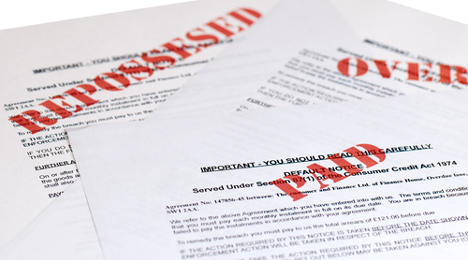

2014 Repossessions Climb 8%

According to the 2015 Manheim Used Car Market Report, total repossessions increased by 8 percent in 2014 to an estimated figure of 1.48 million.

In the coming years, Manheim projects that the increases will likely be more substantial, but not necessarily because finance company portfolios will be worth less than the paper on which their performance reports are printed.

“(Repossessions) will be driven primarily by the higher number of contracts outstanding and the mix shift toward lower credit tiers — not any major, or unexpected, deterioration in portfolio performance,” Manheim said in its report released this past weekend during the National Automobile Dealers Association Convention in San Francisco.

“In fact, on a credit-adjusted basis, default rates should remain below historic norms,” the report continued. “In addition to a secular shift wherein households have placed a high priority on auto debt relative to other obligations (witness the S&P default indices), there are also current short-term economic forces that will better enable customers to make their monthly car payment.”

What Manheim found to be most notable is the higher level of job security enjoyed by workers. Report orchestrators mentioned initial jobless claims adjusted for employment growth show that the likelihood of an employee’s being laid off is now the lowest in history.

“And, of course, job loss is a primary cause of loan default,” Manheim said. “In addition, the rapid fall in gas prices in the second half of 2014 will provide households with more discretionary income and will help them keep up with monthly obligations.”

The report also touched on what Manheim considers to be of longer-term importance. Analysts focused on the “significant” deleveraging in the household sector.

Manheim explained the Financial Obligation Ratio — the sum of mortgage, rent, auto lease and loan, and property tax payments as a percent of disposable personal income — is currently running at 30-year lows.

“This clearly indicates that most households are operating from a very solid financial base,” the report said.

Update on Repossession Remarketing

Moving along to what happens when those repossessed vehicles move through wholesale channels, Manheim reiterated that finance companies are “naturally” focused on converting this units into cash as quickly as possible.

“Various laws and regulations dealing with the processes of collateral collection and liquidation often present a stumbling block to that quick conversion, but lenders and their auction partners have been successful in streamlining the processes that they do control,” the report said.

Manheim acknowledged that “pure” upstream selling is sometimes hampered by various obstacles to the efficient production of quality condition reports for repossessed units.

“But, after crossing that hurdle, repo remarketers can easily avail themselves of many opportunities to offer units 24/7 while in transit to, or awaiting sale day at, the auction,” the report said.

Given the finance company’s strong focus on time to sale, Manheim maintained they generally strive for and achieve high conversion rates.

“That, coupled with little or no reconditioning, means that wholesalers are often the buyers of repo units,” the report said. “Sometimes they will do some light cosmetic work and then re-wholesale the unit.

“That arbitrage should not be regarded as a lost opportunity, but rather simply the wholesale market’s efficiently getting vehicles to the ultimate end dealer in the condition desired,” the report went on to say.

View The Latest Edition

View The Latest Edition