Benchmarks Reveal A Challenging 2013

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“I think the big thing is they took a number of our customers. They reduced the sales volume for a lot of operators by taking that business and putting them into vehicles so we had to give up market share,” NABD founder Ken Shilson said.

“Based on Experian’s numbers, we lost over 20 percent of the market share during 2013, and the special finance industry in the short term grew by a corresponding amount,” he continued. “I won’t blame it all on the special finance industry because some of that market share was lost to credit unions, some of which are being very aggressive right now. And also some was lost to new-car franchise dealers who on their used-car operations are being very aggressive themselves.

“The combination took those customers out of play,” Shilson added.

Why did all of a sudden these special finance companies start booking contracts with deep subprime customers? During the worst of the recent recession, reportedly consumers with credit scores approaching 700 had difficulty in securing financing. Now in the past 12 to 18 months, Shilson recollected conversations with BHPH operators who heard about consumers who had credit scores in the low-500 range being able to secure a late-model or even a new car.

“All of the special finance activity was driven by a search for higher yield investments. They were borrowing the money at 2 percent and loaning it out to subprime customers at over 19 percent. The spread there was the attractive part for investors to pour money in, and they securitized a lot of these loans,” Shilson said.

How Successful Operators Managed

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Brent Carmichael is the BHPH specialist for NCM and helps to construct the benchmarks. Throughout the year, he moderates 20 Groups that collect stores of similar size for semiannual gatherings of brainstorming and more. Carmichael shared with BHPH Report what successful operators did to stay in business.

“Subprime was back and very aggressive,” Carmichael said. “We’ve also had dealers manage their growth for a cash flow and capital standpoint. We have some dealers who are intentionally selling three less cars a month because they’re focused more on the quality of the portfolio, not necessarily the quantity. Some dealers just wanted to maintain their portfolios, bringing in enough cash to do what they wanted to do. Some aren’t out to be DriveTime or Car-Mart, just wanting the business to pay them back a little bit.”

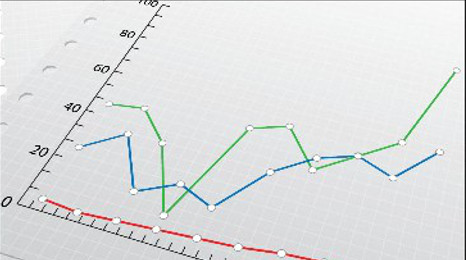

Carmichael pointed to the benchmarks, numbers to support why some operators chose that path. He mentioned profitability on a per-vehicle sold basis softened to nearly $2,100, representing about a $100 decline per unit.

“A $100 per car doesn’t sound like much, but when you’re talking 600 units per year, now we’re talking about a $60,000 loss in profitability year-over-year,” Carmichael said.

While operators tried to tighten their budgets in many areas, Shilson mentioned how BHPH stores looked to overcome a dwindling customer base by advertising more. The benchmarks showed the average operating expense for advertising ticked up to 3.8 percent in 2013, up from 2.8 percent a year earlier.

“They definitely tried to advertise more as they started to lose market share,” Shilson said. “The only thing that seemed to work successfully was online marketing. Online marketing seemed to be giving them the most bang for their buck. If they just did more radio or television, we didn’t see as much traction there.

“The online marketing in terms of a website and in term of other online marketing is more focused on reconnecting with particular customers or prospective customers,” he continued. “I think that’s where they had the great success. The competitive environment, like we’re seeing with special finance, is every man for himself out there. If you just advertise on TV, so is everyone else. But if you do a more focused thing with your website and your online marketing, maybe you’ll have a better chance of attracting that particular customer.”

Cautionary Signs

Beyond the raw sales numbers, both Shilson and Carmichael spotted trends that caught their attention and reflected just how challenging the BHPH business can be.

“The continuing increase in cash in deal is really one the most telling things,” Shilson said. “For the time since we’ve been doing the benchmarks, the cash in deal averaged more than $5,000.”

To be exact, the average cash in deal at BHPH stores last year climbed to $5,294. A year earlier, the figure stood at $4,672. Back in 2009, it was just below $4,000 at $3,990.

“That’s very significant. Our down payments and our repayments are not moving commiserate with the cost in the industry, so that’s a real challenge for us. We’re spending more, but we’re not taking in more,” Shilson said.

And just one area where BHPH operators are spending more money is on reconditioning. For the fifth year in a row, reconditioning spend increased by at least $100. The 2013 amount broke the $1,000 threshold, settling at $1,026, up from $962 back in 2011.

“That’s one area that concerns me because of what inventory is. I don’t think dealers are doing more to the cars. It’s just costing more to fix the cars,” Carmichael said. “That’s one thing many dealers haven’t thought about. BHPH dealers often look at cars that are about 6 or 7 years old. They’re decent enough with some reconditioning that they can sell, and they are affordable to the customer from a down payment and sale price standpoint.

“There were little to no cars made in 2007 and 2008. That 7-year-old car just isn’t out there. It’s either a 2009 or it’s a 2006. Obviously, 2009 is more expensive, maybe with an (actual cash value) of $7,000 to $8,000. A 2006 is a cheaper car, but they’re also higher mileage and have a little bit more worn off, so to speak. They need a little bit more love to get them ready to make them sellable and safe for a customer,” he continued.

Shilson also shared a theory about why reconditioning costs jumped so much last year.

“What I think is happening in the reconditioning cost area as you recycle more repossessions, your cost to make them ready and to recondition them increases. I think that’s part of what’s happening,” he said.

How Dealers Can Leverage Benchmark Data

Both Carmichael and Shilson explained that operators should use the benchmark data as a reference point, not necessarily as the objectives for how their particular store should be.

“I never want a dealer to set up his business according to a benchmark. Our benchmarks are compiled from hundreds of dealers,” Carmichael said. “You’ve got guys out there who are single-point owner operators who are very involved in the business and run very lean. So there are some areas of the benchmarks that the average dealer selling 50 cars a month and 600 cars a year cannot get to some of the benchmarks.

“I think they’re a great goal to take a look at to see if I can get close as you can to some measure. Some have to be taken with a grain of salt. Some are very attainable for the average dealer. Some aren’t,” he continued.

Shilson emphasized that working each day is crucial, no matter when the benchmarks indicated.

“The big thing to say is a very challenging year in 2013, but are you going to make 2014 better? It’s not going to happen by itself. You can’t sit back and hope that it’s going to get better. You have to get out there and see what’s going to make it better,” Shilson said.

LAS VEGAS –

2013 YEAR IN REVIEW

The financial benchmarks for 2013 reflect a higher level of competition within the deep subprime marketplace. The more significant factors that impacted profitability were:

1 Unit sales for most operators were fat or declined (some by up to 25 percent) from 2012, due primarily to increased market competition from special finance sources that extended credit to BHPH customers. Individual operators were affected by varying levels of special finance competition in their local markets. Some operators expanded their facilities (added lots) to increase market share. Market data indicated that the BHPH deep subprime financing market share declined by more than 20 percent in 2013, while the market share for subprime finance companies grew by a corresponding percentage.

2 Subprime finance lenders (including franchise operators) were particularly aggressive in financing deep subprime customers (with credit scores below 550) who purchased new and late-model vehicles (less than three years old) with low down payments, high repayments and terms of more than 60 months. Finance companies originated these “silly loans” in an attempt to “buy” market share quickly.

3 Capital poured into the subprime auto markets making special finance lenders overly aggressive in their underwriting policies and practices in search of high yields.

4 History indicates that higher default rates occur on deals with “too much vehicle and too little customer”. Recent Experian Automotive Data shows that quarterly repossession rates for the second half of 2013 increased dramatically over the corresponding period in 2012 for special finance lenders. Charge-offs for special finance lenders in the fourth quarter were the highest since 2006 and averaged $8,772.

5 BHPH operators again found inventory acquisition to be challenging. Lower new-car sales from 2008-2012 provided a limited supply of BHPH vehicles (usually more than 4 years old), which kept auction prices high. Operators reduced inventory levels commensurate with a limited supply and reduced customer demand.

6 Technology played an important role in 2013 BHPH operating efficiency. Most customers now have smartphones. This cellular link has become an important way for BHPH operators to “connect and collect” with their customers and prospects. In addition, the integration of Internet-based marketing tools, payment device technology, electronic pay portals and other technology into BHPH operations continued. Operators who proactively utilized online marketing fared better than those who did not.

7 New regulatory challenges surfaced in 2013 when the FTC, Consumer Financial Protection Bureau, and various state attorney generals’ offces monitored compliance and investigated alleged deceptive practices. The IRS increased tax audits of used-car operations, focusing on compliance issues. Even the Department of Justice joined in by policing discriminatory lending practices using their “disparate impact theory”. We should expect more compliance scrutiny in 2014 and beyond.

8 Operators with greater financial flexibility (more equity and/or available lines of credit) fared best. Increased competition, the limited liquidity of their customers and a higher cost environment were the major reasons why.

9 Given this overall environment, operators who managed risk successfully and opted to pass on making “silly loans” to maintain market share will beneft by avoiding defaults when these customers don’t perform.