CU Direct Unveils Next Generation of AutoSMART Program

CU Direct launched the next generation of its online auto shopping program, CUDL AutoSMART. a platform with more than 1.5 million vehicles in dealer inventory and aimed at reaching credit union members.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ONTARIO, Calif. –

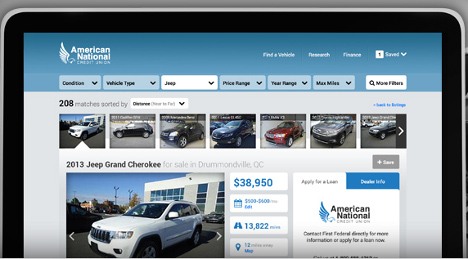

On Tuesday, CU Direct launched the next generation of its online auto shopping program, CUDL AutoSMART. With more than 1.5 million vehicles in dealer inventory, officials highlighted the program offers a host of new features designed to dramatically transform members’ experience and engagement with credit unions.

The new CUDL AutoSMART can enable credit unions to create top-of-mind awareness with their members by providing dynamic features, such as white-label branding, and customizable homepage images and content.

The vehicle shopping platform’s new design also includes robust ad space and custom content capabilities, providing additional opportunities for credit unions to market and promote products and services to members.

Members have the ability to shop online and across multiple devices, including smartphones and tablets, through the new, mobile optimized/responsive design experience.

Furthermore, the site can provide members a streamlined user experience with a “walk the lot” feel, the ability to apply for a credit union loan, a dynamic research hub and a soft touch log-in that allows members to save search results and connect with the credit unions.

Currently more than 1,000 credit unions are using AutoSMART to drive member engagement and loyalty, and to help grow auto loans.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CU Direct vice president of automotive marketing and business development Marci Francisco acknowledged that credit unions face an increasingly more competitive landscape for the acquisition of auto loans. Francisco noted credit unions captured 23 percent of all auto loan originations in the first quarter of this year and continue to increase market share, with auto loans comprising 31 percent of their total portfolio.

Competitively, leasing and other finance segments threaten to capture market share, and CU Direct insisted credit unions need a vehicle research program that helps retain member financing.

“Credit unions need a consolidated, best of breed auto shopping site which promotes their brand, enhances the value of membership, harnesses that power to aggregate influence on behalf of the consumer, and builds and protects auto loan volume,” Francisco said.

“AutoSMART successfully fills this need for credit unions looking to advance their auto lending programs,” she went to say.