Gas Prices Fall; Wholesale Compact Car Prices Follow Suit

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

McLEAN, Va. –

As gas prices have fallen by almost 10 cents since last week, it seems the compact car segment wholesale prices will continue to follow fuel rates down.

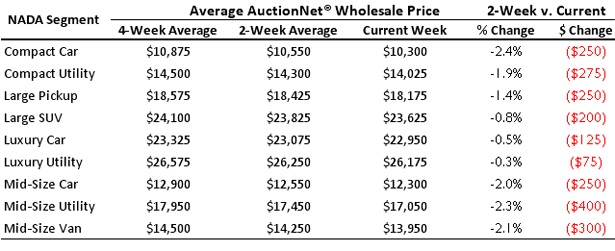

According to NADA Used Car Guide, this segment is expected to see slightly bigger drops than last week and prices are still expected to decline the most of any segment — 2.4 percent or $255.

And the as fuel rates spiral downward, demand for fuel-efficient vehicles continues to lessen; the Energy Information Administration revealed this week the average price of regular grade gasoline (all formulations) fell eight cents from $3.44 to $3.36.

Next up for the segments, NADA UCG tracks, midsize cars are expected to see declines of 2.0 percent or $250. Luxury cars are also expected to depreciate 0.5 percent or $125.

And moving on to highlight the light duty truck side of the market, the midsize utility segment is expected to see the biggest declines, dropping 2.3 percent or $400.

Moreover, the midsize van (2.1 percent), compact utility (1.9 percent), and luxury utility (.3 percent) segments are all expected to drop over the course of the current week.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Though they are still seeing declines, the larger family vehicles and pickups seem to be retaining wholesale value a bit better than their smaller counterparts.

The large pickup and large SUV segments are expected to see declines of 1.4 percent and 0.8 percent, respectively.

Wrapping up its commentary for the week, NADA UCG officials reported, not surprisingly, the two-week average rate of depreciation for the compact car segment saw the biggest drop off at 3.0 percent followed by the midsize utility segment at 2.8 percent and midsize car segments at 2.7 percent.

Four- and two-week AuctionNet wholesale average prices are created by collecting all AuctionNet records for vehicles up to five years of age for a specified period of time. Prices are then adjusted for changes in mileage and mix.

Current week prices are based on NADA’s proprietary used vehicle value model which includes assumptions for new vehicle prices, used vehicle supply, gasoline prices, and other economic factors.