5 changes toward the Consumer Financial Opportunity Agency

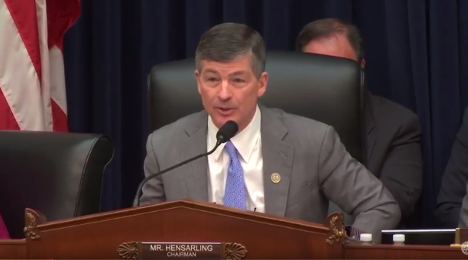

U.S. House Financial Services Committee chairman Jeb Hensarling poses a question to CFPB director Richard Cordray during a hearing on April 5.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

WASHINGTON, D.C. –

Last summer, Rep. Jeb Hensarling, the Texas Republican who also is the U.S. House Financial Services Committee chairman, introduced a plan he described as a way to replace the Dodd-Frank Act and promote economic growth.

This spring, the outspoken critic of the Consumer Financial Protection Bureau is circulating an update to his proposal, which includes renaming the bureau as the Consumer Financial Opportunity Agency.

Among the eight pages of modifications now being dubbed the Financial CHOICE Act 2.0, the American Financial Services Association highlighted some of the most noteworthy, including:

—Allowing the sole director to be removed at will by the president

—Removing the bureau’s supervisory authority

—Limiting the CFPB’s enforcement authority to enumerated statutes

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Removing its unfair, deceptive, and abusive acts or practices (UDAAP) authority

—Repealing mandatory advisory boards and market monitoring authority.

In its latest update via Newsbriefs, AFSA not only shared a copy of these proposed plan changes, the organization noted that Hensarling’s outline also mentioned how the president could appoint and remove the deputy director of this new agency while establishing what the Financial Services Committee chair called an Office of Economics to review rulemaking and enforcement.

Hensarling is also looking for the prohibition of the consumer complaint database from being published and reforming joint investigations and enforcement actions, according to the document available here.

As likely expected, the ranking member of the Financial Services Committee staunchly pushed back against Hensarling’s latest proposal. Rep. Maxine Waters, a California Democrat, outlined 11 different qualms she had with the Financial CHOICE Act 2.0, including repeal of the Volcker Rule, among other objections.

“The so-called Financial Choice Act is a piece of legislation that will essentially kill the most important aspects of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was designed to prevent another financial crisis. Republicans and Donald Trump have once again prioritized the needs of Wall Street over the needs of hard-working Americans, with a proposal that would take away much-needed protections and put our economic security at risk,” Waters said.

“Simply put, the Wrong Choice Act bows down shamefully to Wall Street’s worst impulses, and would lead us back down the road to economic catastrophe,” she continued.

“The new version, which is even worse than chairman Hensarling’s first draft, cannot be allowed to become law. There is too much at stake for consumers and for our economy at large,” Waters went on to say.