AFSA again addresses burden CFPB places on small operations

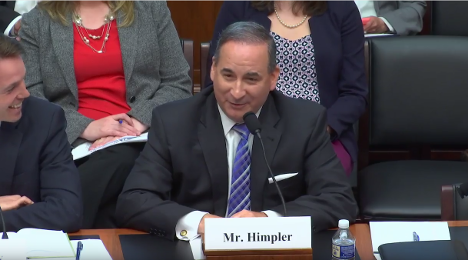

AFSA executive vice president Bill Himpler joined three other experts in testifying to the House Financial Services subcommittee on Financial Institutions and Consumer Credit.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

WASHINGTON, D.C. –

While a former Department of the Treasury official insisted the Dodd-Frank Act resulted in an economy “far stronger and more resilient today than it was preceding the crisis,” American Financial Services Association executive vice president Bill Himpler addressed the Consumer Financial Protection Bureau’s regulatory overreach of the state-regulated consumer credit industry and the need for Congress to reform the bureau’s practices, approve its budget and amend its structure.

The points of view came a day after the CFPB’s semiannual visit to the U.S. House, as Himpler joined three other experts in testifying to the House Financial Services subcommittee on Financial Institutions and Consumer Credit in a session entitled, “Examination of the Federal Financial Regulatory System and Opportunities for Reform.”

In a memo leading up to hearing, the subcommittee indicated providers of financial services are generally subject to a variety of regulatory and supervisory requirements. This hearing was geared to examine the impact the rules and processes from federal financial agencies, specifically the Federal Reserve, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Consumer Financial Protection Bureau and the National Credit Union Administration, have had on financial companies and their customers.

Lawmakers noted the hearing was also set to examine opportunities for reform of these federal financial agencies, with the aim of improving transparency, accountability and due process for regulated persons and entities and their customers.

The hearing took place last week, a day after CFPB director Richard Cordray delivered his semi-annual report to the full House Financial Services Committee and sparred back and forth with lawmakers, especially from the GOP. AFSA pointed out that Himpler’s testimony and responses filled in critical context about the difficulty financial services providers are facing complying with the unbalanced regulations and enforcement actions put forth by the CFPB.

Himpler noted that while many are focused on financial institutions being too big to fail, AFSA is concerned about those that are “too small to succeed” under the weight of CFPB overregulation.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“AFSA strongly believes that credit should be available to everyone who can manage it, not just to the wealthy or those with perfect credit scores,” Himpler said in written testimony. “It is not apparent that the CFPB shares this philosophy. The CFPB seems to believe that credit should only be extended to those borrowers who do not present any risk.”

The committee addressed a variety of issues with regard to the CFPB, including the bureau’s faulty use of disparate impact theory in vehicle finance, issues with the construction and use of the consumer complaint database and a general lack of balance between consumer protection and credit availability.

“We believe in the CFPB’s mission to protect consumers, but that has to be balanced with ensuring the availability of credit and all too often … it seems that the bureau does not have that balance in mind,” Himpler said in response to questions from the committee.

In prepared testimony, Amias Moore Gerety, former acting assistant secretary for financial institutions at the Treasury Department, applauded the ramifications of the Dodd-Frank Act, the law that led to the creation of the CFPB.

“A broad, diverse and dynamic financial system is a benefit to the U.S. economy and to our citizens. But this strength can only be realized on the foundation of clear rules, appropriate oversight, and independent expertise. Here in Washington, the pain of the financial crisis may be receding from memory, but throughout the country the cost of lost jobs, lost homes and the immeasurable cost of lost opportunities persist. This cost, above all, to the United States, our citizens and taxpayers, must be the central consideration when evaluating changes to our regulatory system,” Gerety said in his prepared testimony.

“In writing the Dodd-Frank Act, Congress sought to make our financial regulations both more protective and more responsive to changes in our economy and in finance. Since the passage of Dodd-Frank, the regulatory agencies and their staff have demonstrated immense capacity to listen to the concerns of industry, advocates and citizens — both to design and revise regulations and guidance that increase the stability and the fairness of our economy,” he continued.

“The result is that our financial firms, our financial system, and most importantly, our economy, is far stronger and more resilient today than it was preceding the crisis. Investors and counterparties have more faith in their financial transactions and investments, and the U.S. has continued to distinguish itself as the safest and most dynamic place to invest capital in the world,” Gerety went on to say.

The entire subcommittee hearing can be viewed here or through the window at the top of this page.