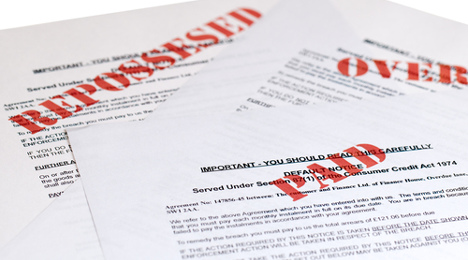

April Auto Defaults at Lowest Point in 10 Months

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

S&P Dow Jones Indices and Experian discovered auto loan defaults dropped 9 basis points in April to settle at its lowest level since June of last year.

Analysts reported as a part of the S&P/Experian Consumer Credit Default Indices that the auto loan reading came in at 0.94 percent.

The composite index — a comprehensive measure of changes in consumer credit defaults — continued its downward trend, posting a historical low of 0.97 percent in April and marking a decrease of 8 basis points, and its lowest level since July of last year.

The second mortgage default rate also reported a historical low, decreasing 7 basis points to 0.43 percent.

The first mortgage default rate decreased for a third consecutive month, dropping 9 basis points to 0.83 percent, its largest reported decrease since May of last year.

Meanwhile, the bank card default rate continued to rise, climbing to a rate of 3.18 percent and representing an increase of 19 basis points to jump to its highest reported rate since July 2013.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Looking at four of the five major cities included in the monthly updated, analysts reported declining month-over-month default rate results in April.

Miami led the way reporting a rate of 1.20 percent, down 19 basis points from the previous month.

Dallas reported a second consecutive decrease, down 15 basis points to 0.90 percent.

Chicago reported a default rate of 1.05 percent, a decrease of 10 basis points and the Windy City’s lowest reported rate since July 2006.

New York posted its first decrease since November of last year with a reported rate of 1.10 percent, down 10 basis points.

Los Angeles reported the only rate increase, a modest 1-basis point increase to 0.90 percent.

“Continued improvements in the economy and the labor markets seen in the April unemployment rate and job growth suggest consumers have reasons to be optimistic,” said David Blitzer, managing director and chairman of the index committee for S&P Dow Jones Indices.

“Apparently, that optimism has a darker side in rising defaults among bank card users. However, the current default rates are lower than those experienced before the financial crisis and should not present any significant economic concerns,” Blitzer continued. “Moreover, default experience in the mortgage series continues to improve. Overall, consumer credit conditions support further economic activity.”

Blitzer closed his reaction to the latest data by circling back to the geographic metrics.

“Among the cities, the notable trend is that the default rates for all five continue to move closer and closer together. This is markedly different from the financial crisis when the default rates for Miami and Los Angeles were substantially higher than the other cities, especially compared to low rates in Dallas,” he said.

“City composite default rates are driven by first mortgage default rates and reflect the extent to which home prices fell after 2006. These patterns are another sign that housing is returning to more normal conditions,” Blitzer went on to say.