How AutoGravity’s financing app is giving ‘empowerment’ to dealers & consumers

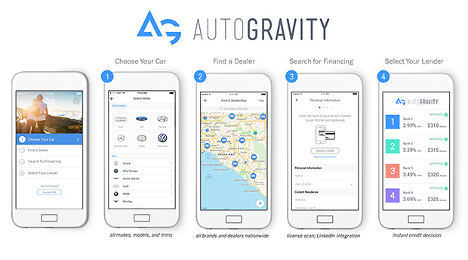

Shoppers can obtain indirect auto finance offers after completing four steps via AutoGravity's mobile app. (Photo courtesy of AutoGravity)

One of the benefits AutoGravity chief marketing officer Serge Vartanov often emphasized during a conversation with Auto Remarketing to discuss the mobile auto financing tool the firm is offering was empowerment.

Vartanov discussed empowerment in context of keeping dealerships in an important place of the vehicle-delivery process, but also while providing consumers with additional information that traditionally they could not obtain until arriving at the F&I office.

“Our belief is if you look at disruptive moments over the past 20 to 25 years, oftentimes when a tech player comes into an industry what they’re innovating is improving on something that lacks convenience or transparency or empowerment of efficiency and choice. We saw that when we talked with dealerships and car shoppers,” Vartanov said.

“No matter how much research you do online, you don’t really know until you go into the dealership and you’re taken into the F&I office what your deal is going to be. There’s an anxiety in that experience insofar as you don’t get to see all of your options as a car shopper. The process really does take quite a bit of time,” he continued.

“Our view is we can innovate against that. We can put car shoppers in a position where they’re able to see their indirect finance options that the dealer can also see because they’re the same lenders the dealer works with,” Vartanov went on to say. “If you can empower the consumer with those options, if you can let them know these are the lenders that have approved you, whether you’re super-prime or subprime, the experience for the car shopper, the dealer and even the lender is a lot better and much more robust.”

Thus far, it appears AutoGravity is gaining some robust momentum as the company recently announced that it has surpassed 200,000 downloads of its native iOS and Android smartphone apps. The platform allows shoppers in 46 states to obtain up to four finance offers on any make, model and trim of new or used vehicle by following four steps. The app can return personalized retail installment contract and lease offers within minutes.

“AutoGravity has brought car finance into the digital age,” said Andy Hinrichs, who became AutoGravity’s founder and chief executive officer after decades as an auto finance executive with captives such as Mercedes-Benz Financial Services.

“Our industry-leading technology has been embraced by top banks and captive auto lenders, as well as leading dealer groups who see customers shopping on their smartphones every day,” Hinrichs continued in a news release. “We’ve re-designed the car finance experience, taking it from hours to minutes for car buyers across the country.”

To arrive at this point has been no small task. Vartanov noted that more than half of AutoGravity’s employees are engineers since it took a coordinated effort to design the platform that can communicate with consumers, dealers and finance companies efficiently and securely.

“Every lender that joins AutoGravity we pass through a vetting process,” Vartanov said. “Our compliance team meets with the lender’s compliance team. Our IT and security teams meet with the lender’s IT and security teams. These lenders hold us up to extremely high standards because many of these lenders are large, publicly traded corporations. We’ve passed through those screens with flying colors."

Vartanov added later, “That’s critical because if you’re going to be partnering with lenders of this magnitude to be able to offer those indirect lending offers in the marketplace, you have to be at least as secure as the lender and you have to be as mindful of compliance and regulatory concerns as the lender is.”

AutoGravity launched its app in California last year. Since that point, Vartanov highlighted the company has developed relationships with finance companies up and down the credit spectrum so it can cater to all consumers, who evidently quickly leverage the technology once downloading it to a device.

“AutoGravity gives you the peace of mind of seeing multiple indirect offers anytime anywhere within minutes,” said Vartanov, who pointed out that the average user obtains offers within 10 minutes of downloading and opening the app for the first time.

And if these shoppers are already on the lot using their smartphones — as recent analysis pointed to that situation happening more often — AutoGravity’s platform could help grease the financing wheels to reduce the time it takes to finalize delivery.

“These are financed deals that the dealership participates in. With these indirect offers, the dealer can put them up very easily in their own systems without requiring an additional application from the customer. They’re deals where dealers have participation in the rate,” Vartanov said.

“What we heard again and again from dealers is you see car shoppers in the showroom looking at the phone, not necessarily talking to a living human being,” he continued. “What dealers have realized, and this is why they’ve embraced AutoGravity, you have to be there on the phone to be relevant and meet those consumer needs. This is true across the credit spectrum.”

Sounds like a situation that’s creating “empowerment.”

View The Latest Edition

View The Latest Edition