Online car-sales platform Fastlane gains $1.5M in seed funding

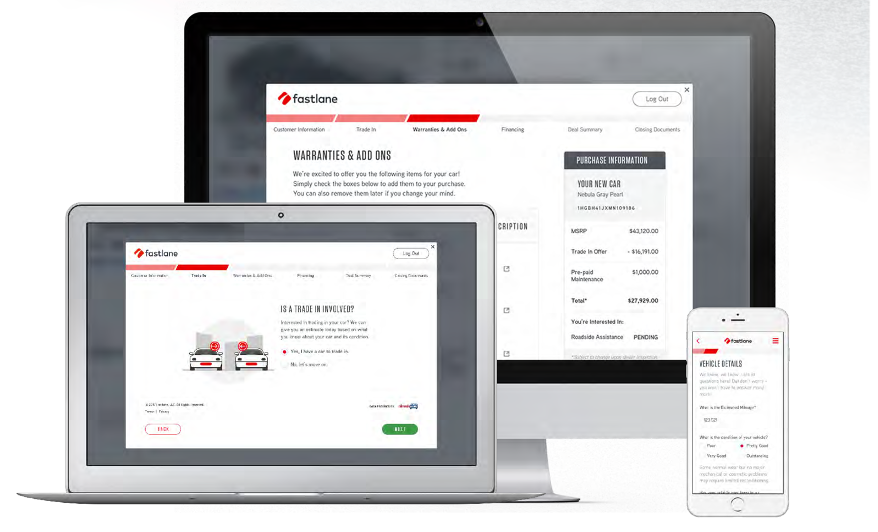

Photo copyright Fastlane.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

DALLAS –

Online car-buying company Fastlane said Friday it has secured $1.5 million in seed funding in an investment round led by Eagle Venture Fund.

Fastlane provides consumers with an ecommerce platform that lets them buy directly from dealer websites or in store, providing what it calls an “Amazon-like checkout experience.”

Based in Dallas, Fastlane provides ecommerce and showroom technology to dealers that allows them to offer online checkout and improve the in-store experience.

When it launched earlier this year, Fastlane focused on franchised dealership groups, but recently announced that it will provide its services to independent and pre-owned dealers next year.

As far as the seed funding, it also included “several prominent angel investors,” the company said in a news release.

Also part of Friday’s announcement, Fastlane will add Eagle Venture Fund general partner Wade Myers to its board of directors.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Fastlane’s offering is well-timed with the rapidly increasing demand for solutions that extend the reach of auto dealers, makes the auto buying experience much faster for consumers, and drives significant business results and a significant impact,” Myers said in a news release.

“We believe the market will continue to see a rapid shift in how cars are purchased and financed as consumers demand an ‘Amazon-like experience’ in all aspects of commerce,” he said. “Fastlane is a powerful solution for the auto industry and we are excited to collaborate with them as they work to build a great company in a massive market.”

Fastlane chief executive officer Brandon Hall added: “The auto industry is ripe for the type of transformation we enable, which saves dealers and car buyers a significant amount of time and streamlines the check-out and financing experience when buying a car.

“Having the financial support and expertise of Eagle Venture Fund will help us execute our vision even more rapidly and broadly — and with the benefit of the experience, perspective and relationships Eagle brings to our firm.”