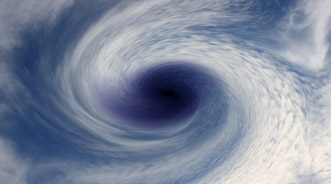

Hurricane Sandy Disrupts Both Supply & Demand for Northeast Dealers

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

McLEAN, Va. –

In the aftermath of Hurricane Sandy, the physical damage caused by the storm to dealerships all along the East Coast is being assessed. And in many cases, dealers are still waiting to have power and communication service restored.

But it is the disruptions that aren't visible to the naked eye that could have the biggest impact on sales in the next few months.

The fallout from the storm is bound to rock the boat for both the supply and demand side of the new- and used-car markets, according to Jonathan Banks, executive automotive analyst with the NADA Used Car Guide.

In fact, sales have already begun to falter as many victims of the storm had to wait to buy a new ride and instead repair their damaged homes.

For the used side of the market, in particular, CNW Research has stated that approximately 225,000 used-vehicle sales were deferred as a result of the storm.

Meanwhile, Banks said that the new-vehicle sales seasonally adjusted annual rate for October was projected to be somewhere in the area of 14.7 million units. However, citing WardsAuto.com, Banks noted that the month’s SAAR ended up at 14.22 million units, largely due to Sandy’s impact.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The total (new-unit) sales figure (for October) of 1.09 million units was 5 to 6 percent below the 1.15 million figure that Wards had predicted prior to the storm,” Banks said.

Moving on to highlight the supply side, it can be expected that both new- and used-vehicle inventory will be depleted as a result of the storm, but Banks warns “as of right now, it is difficult to ascertain just how much supply will be removed.

“Although the damage wrought by Sandy impacted twelve states and Washington, D.C., flooding appears to have been most severe in low-lying or coastal areas of New York and New Jersey, both of which rank in the top 15 states in terms of overall vehicles in operation ( No. 4 and No. 10, respectively) and new-vehicle dealerships (No. 4 and No. 8, respectively),” Banks said.

And since both New York and New Jersey have large populations and high population-density ratios, “supply and demand disruptions will be more significant in these states,” he added.

Picking Up Deferred Sales

The question on many dealers minds: When are customers going to get back into the lots and turn their focus back to a new vehicle?

According to Banks, in terms of deferred new- and used-vehicle sales, NADA expects that the bulk of purchases postponed by the storm will be recouped towards the end of November and through December after damage has been fully assessed and insurance settlements have been made.

And demand may be more evident in some segments than others.

Since the Mid-Atlantic and Northeastern states have a much larger population of cars than trucks (by a score of 58 percent to 42 percent, respectively) and import brands comprise a significant share of overall vehicle sales in these regions, pent-up and replacement demand should be more acute for cars than for trucks, particularly for import brands, NADA explained.

That said, there may still be a surge of interest in the pickup segments, as well.

“Large pickup and domestic fleet sales will also benefit as contractors and fleet/taxi operators will also need to replace vehicles damaged by the storm,” Banks added.

Lastly, Banks explained some potential long-term effects of the storm and a few things dealers should be prepared for in the coming months when looking for inventory that may prove tight.

“In addition to slightly higher used-vehicle prices, dealers will be even more challenged in sourcing inventory in hardest hit areas as used trade-ins and off-lease volume will be down,” he said. “Dealers will most likely have to rely more on upstream channels, e.g. online buying, account for higher than normal transportation costs given increased distances, and devise other creative means to meet short-term inventory needs."

President of the American International Automobile Dealers Association Cody Lusk also offered Auto Remarketing his take on the aftermath of the storm:

"Our dealers in impacted areas are just beginning the process of evaluating damage and determining loss. While they will feel the impact from Sandy for some time, their biggest concern at the moment is the human element. They want to know that their families, employees and customers are safe, and they want to know how they can help begin to re-build their communities. Until that happens, all other concerns are secondary," Lusk said.