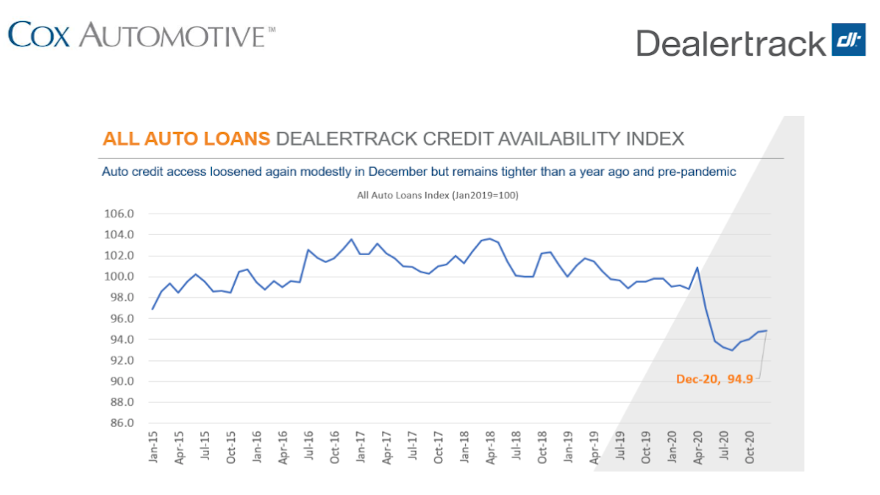

Dealertrack: Credit availability down year-over-year

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ATLANTA –

While Cox Automotive discovered a bit of improvement in vehicle affordability, one of its divisions determined that credit availability is tightening when compared to a year ago as well as before the pandemic intensified.

According to the Dealertrack Auto Credit Availability Index for all types of auto financing, access to credit expanded only modestly in December on a sequential basis with the reading improving by 0.1% to land at 94.9.

“Across all auto lending in December approval rates increased from November, subprime share declined, negative equity share declined, yield spreads narrowed and the share of terms longer than 72 months increased,” Dealertrack said in its latest index report.

However, analysts added access remains tighter by 5.0% year-over-year or by 4.4% compared to February just prior to the pandemic spreading.

Dealertrack expanded upon those year-over-year credit access comparisons with these metrics based on what kind of vehicle and retailer:

— All new: down 5.4%

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

— All used: down 4.5%

— Non-captive new: down 4.9%

— Franchised used: down 4.9%

— Used certified pre-owned: down 6.7%

— Independent used: 1.5%

When looking at the provider category, Dealertrack discovered that credit availability offered by finance companies that specialize in auto actually improved year-over-year, rising 1.4%.

Meanwhile, the other three categories included in the report showed year-over-year softening, with auto credit availability at credit unions sliding most in December at 8.8%, followed by banks (down 6.7%) and captives (down 6.5%).

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads, and contract details including term length, negative equity and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.