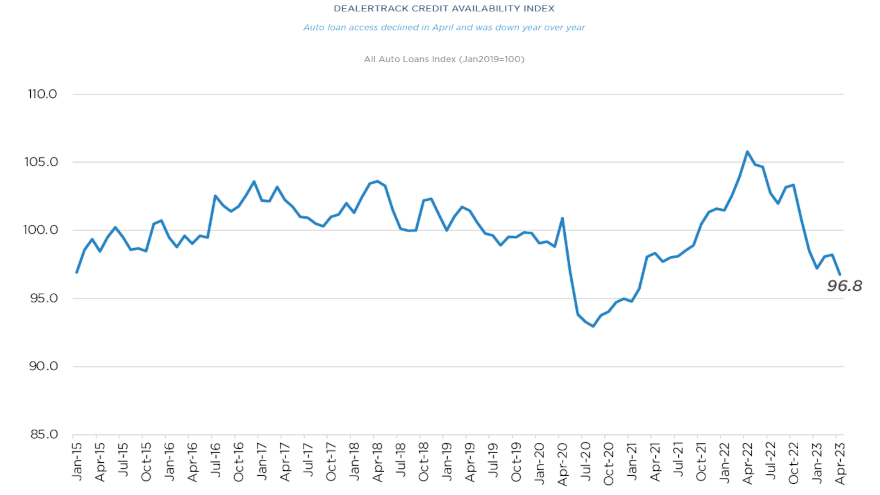

Dealertrack Credit Availability Index drops to lowest point in 2 years

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Three ingredients that analysts put in the headwind category had more impact than the trio of trends in the helpful category, resulting in access to auto finance credit tightening in April to the lowest point in more than two years.

That’s all according to the newest Dealertrack Credit Availability Index released this week.

Following varied moves by vehicle type and credit provider in March, Cox Automotive reported that credit access tightened across all channels and finance company types in April. The index declined 1.5% to 96.8 in April, the lowest reading since February 2021 and reflected that auto credit was harder to get.

With the decline in April, analysts indicated access was tighter by 8.5% year-over-year. And compared to February 2020, they said access was tighter by 2.4%.

“Movement in credit availability factors was mixed in April,” Cox Automotive said in a Data Point that accompanied the new index.

“Yield spreads narrowed, average terms lengthened, and down payments declined, and those moves improved credit access for consumers. However, decreases in the approval rate, subprime share, and negative equity share hurt consumer credit access,” analysts continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive explained that the average yield spread on auto financing booked in April narrowed by 20 basis points, so rates consumers received on their installment contracts ended up being more attractive in April relative to bond yields.

Analysts noted the average rate for paper booked in April declined by 49 basis points compared to March, while the five-year U.S. Treasury declined by 30 basis points, resulting in a narrower average observed yield spread.

Cox Automotive mentioned the approval rate declined 0.4 percentage points in April and 2.4 percentage points year-over-year. Analysts said the subprime share dropped to 11.7% from 13.4% in March and softened 1.5 percentage points year-over-year.

Analysts went on to state the share of contracts signed in April with terms longer than 72 months increased 0.8 percentage points on a sequential basis, but dropped 0.4 percentage points year-over-year.

And when it comes to financing for used vehicles versus new models, Cox Automotive said credit availability in April declined for both kinds of cars. It was different in March when analysts said tightening in used market but loosening in the new space.

Finally, when it comes to underwriting choices by provider category, Cox Automotive added credit unions tightened the most, while auto-focused finance companies tightened the least.

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments. The index is baselined to January 2019 to show how credit access shifts over time.