Tariff-related demand pushes Canadian wholesale values up in April

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

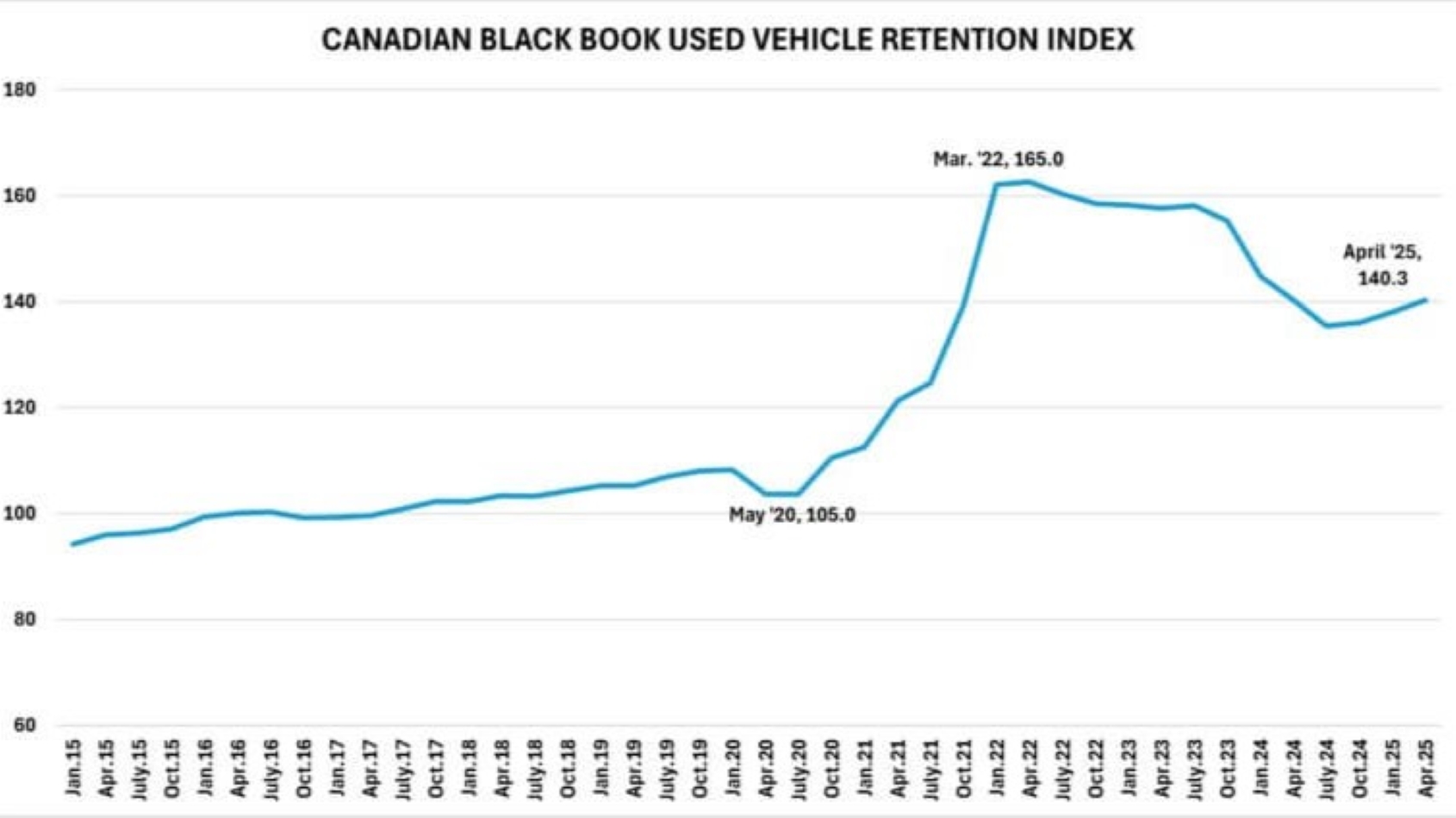

The effects of tariffs drove Canada’s wholesale used-vehicle market up again in April, according to Canadian Black Book’s latest Used Vehicle Retention Index.

The April index climbed to 140.3 points, up 0.5 points from March and even with the index of April 2024, when it was nearing the end of 27 months of consecutive declines.

“Existing and proposed tariffs continue to affect the demand for used Canadian inventory, resulting in an increase in CBB’s Used Vehicle Retention Index,” CBB senior manager and head of Canadian vehicle valuations David Robins said. “Uncertainty has been driving increased activity this spring at both the wholesale and retail levels.”

The index measures the wholesale average value of 2-6-year-old used vehicles as a percentage of original typically equipped MSRP and weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

The index rose slowly in the second half of last year but jumped 2.3 points in January, when U.S. President Donald Trump took office and began talking about imposing tariffs on Canadian cars and other goods. It has continued to rise each month since.

Wholesale market dips in first week of May

CBB’s weekly Market Insights report showed Canadian wholesale values down 0.15% for the week ending May 6.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The dip followed four weeks of little to no change in the market, with rises and falls of 0.03% or less ending with 0% change in the last week of April.

Car segments took the biggest dive, dropping 0.21%. Prestige luxury cars were down 0.47% ($320) to lead the downward trend (-0.47%), followed by compact cars (0.31%. $51), premium sporty cars (0.22%, $196) and near luxury cars (0.22, $67).

Two car segments gained value — midsize and full-size cars were both up just 0.05%.

Trucks/SUVs declined 0.09%, with four gainers led by midsize crossover/SUVs (0.31%, $87). Full-size vans had the largest drop at 0.56% ($201).

The average auction sales rate rose 2.6 percentage points to 41.2%. ranging from 14.9% to 60.6%, and retail prices inched up $50 to $37,950

The report noted some of the impact of the tariffs on the Canadian auto industry, including a decrease in production at the General Motors assembly plant in Oshawa, Ont. The plant is dropping from three shifts to two and is expecting to drop its output by 48,000 vehicles annually. The plant built 144,000 vehicles in 2024.

CBB also reported the Trump’s Administration’s announcement that Canadian-made auto parts will not face a tariff if they’re compliant with the USMCA.

In the U.S., the market’s uncharacteristic jump beyond the “spring bounce” slowed, with values up 0.24% after shooting up 0.63% in back-to-back weeks to end April. CBB analysts noted the typical seasonal trend is downward this time of year.