Car segments take a steep dive in Canadian wholesale used market

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

If there’s one thing that can be said about the trend in the Canadian wholesale used-car market for the week ending June 28, it’s that it was consistent.

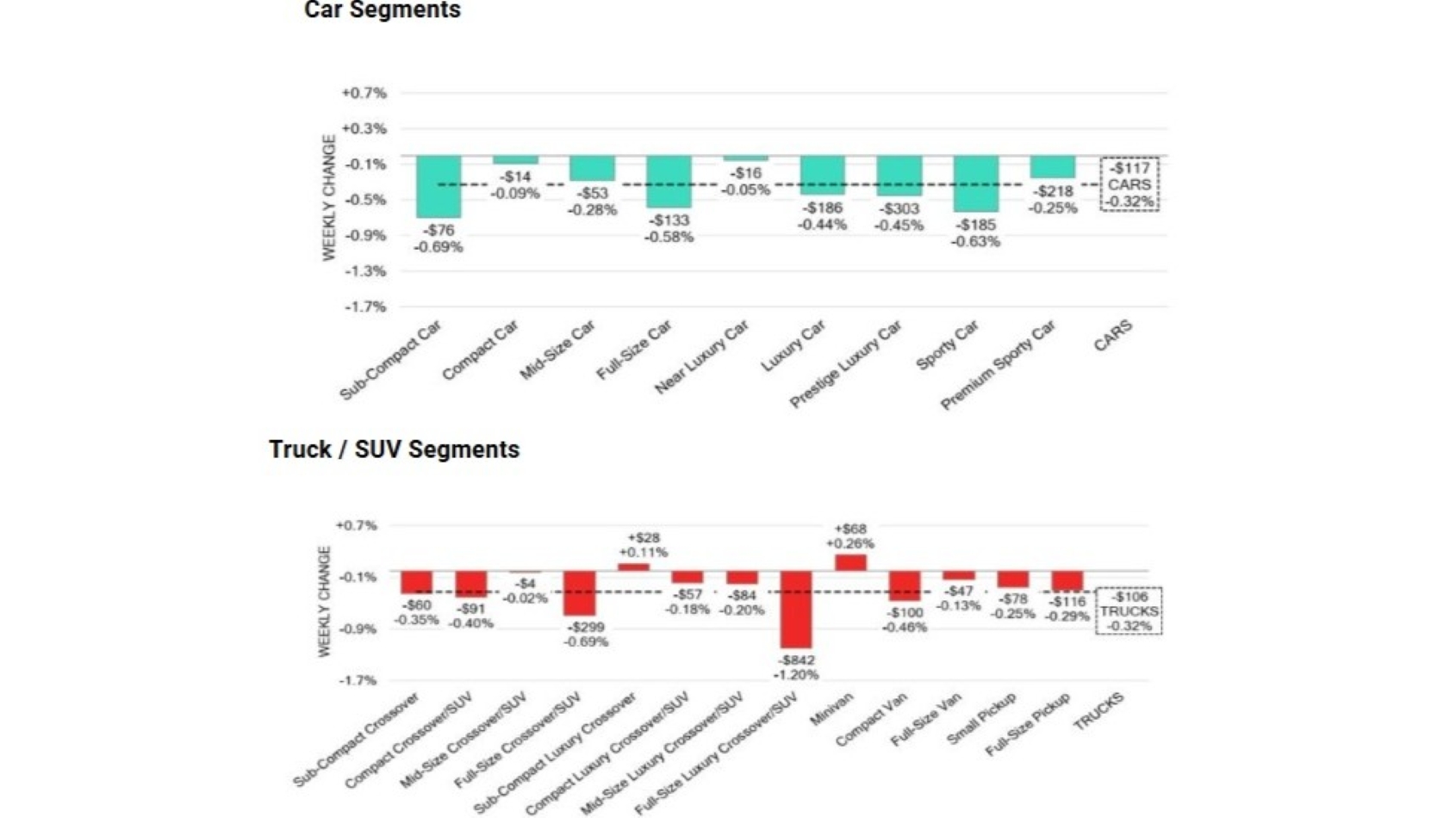

According to Canadian Black Book’s weekly Market Insights report, car values were down 0.32%. Truck/SUV segments were down 0.32%.

And overall? You guessed it: 0.32%.

The decline was only slightly greater than the previous week’s 0.29% for trucks and SUVs, but it was a sharp acceleration for cars, which were coming off a gentle 0.6% fall. Five of the nine car segments lost more than $100 in value, led by prestige luxury cars (down $303, 0.45%) and premium sporty cars ($218, 0.25%), and none gained.

Sub-compact cars had the largest percentage drop at 0.69% ($76), followed by sporty cars (0.63%, $185) and full-size cars (0.58%, $133).

Just two segments showed positive values among trucks/SUVs, with minivans up 0.26% ($68) and sub-compact luxury crossovers rising 0.11% ($28). Meanwhile, full-size luxury crossover/SUV values took a massive dive, sinking $842 (1.20% during the week, and full-size crossovers/SUVs fell 0.69% ($299).

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The average auction sale rates remained low at 35.8%, but showed a wide range, from as low as 18.7% to a high of 72.4%. Retail prices held steady, with a 14-day moving average listing price of $37,500 — identical to the previous week.

In the U.S., analysts spent the week trying to figure out where the “new normal” is. As in Canada, U.S. truck/SUV depreciation was stable at 0.42% (compared to 0.40% the previous week), but car depreciation accelerated beyond typical seasonal patterns, from 0.30% to 0.57%. Overall, values were down 0.46%.