Edmunds spots multiple new all-time highs for new-car financing in Q2

Chart courtesy of Edmunds.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Used-car financing might be even more appealing for lenders and consumers, especially since Edmunds reported this week that the number of individuals committing to monthly payments of $1,000 or more hit an all-time high during the second quarter.

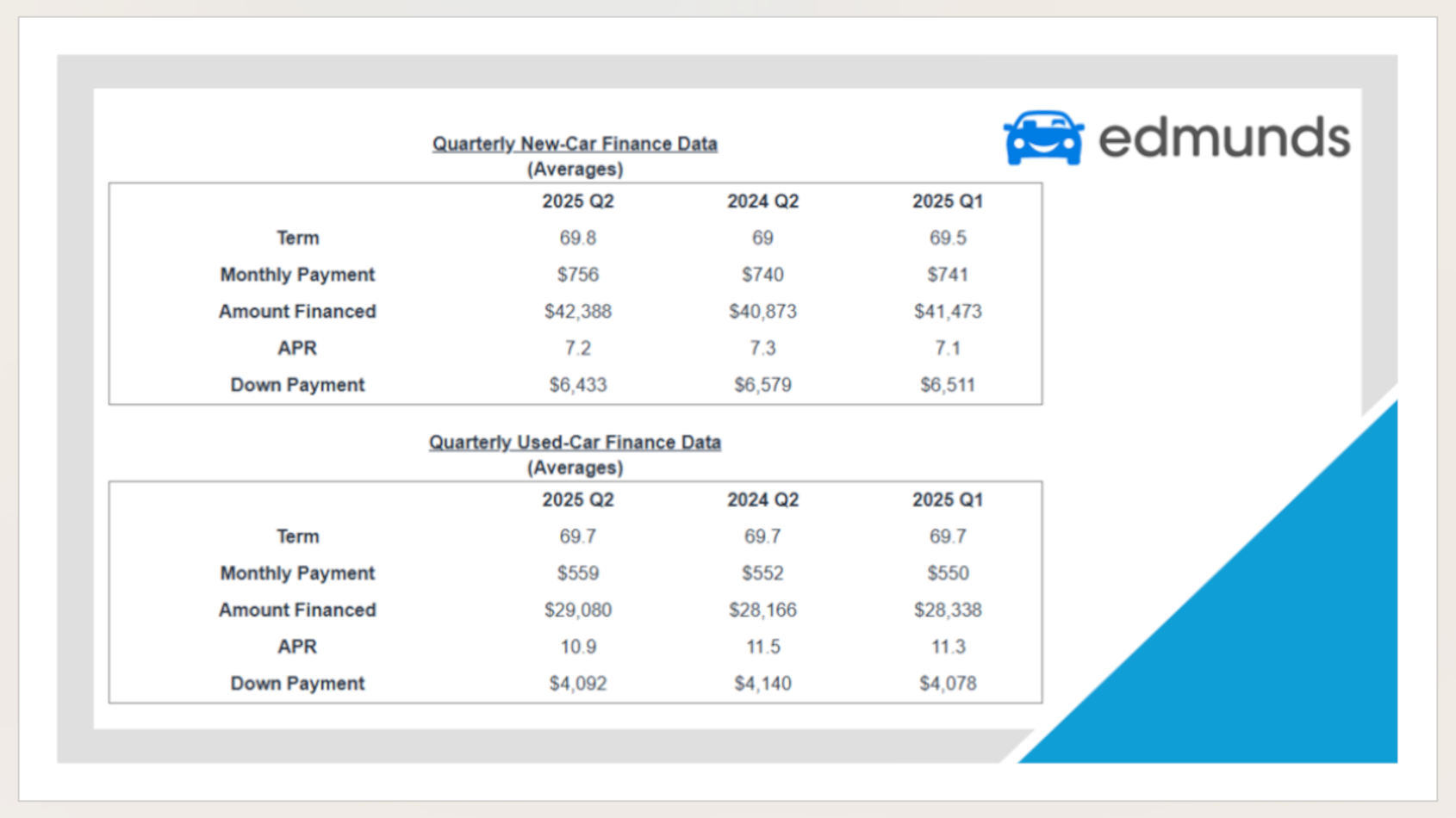

Edmunds noticed consistency in used-car financing in Q2, with average monthly payments ticking up just $7 quarter-over-quarter and $9 year-over-year to $559.

Meanwhile, analysts indicated the share of these new-car buyers committing to monthly payments of $1,000 or more hit an all-time high of 19.3% in Q2, compared to 17.7% in Q1 of last year and 17.8% in Q2 2024.

And these new-model contracts are not short. Edmunds analysts reported that 84-month contracts set a new record in Q2, accounting for 22.4% of new-vehicle financing — up from 20.4% in Q1 2025 and 17.6% a year ago.

The average amount financed for new vehicles climbed to $42,388 in Q2 2025, an all-time high, up from $41,473 in Q1 and $40,873 in Q2 2024.

And interest rates remain historically high for new-car financing. The average new-vehicle annual percentage rate (APR) in Q2 was 7.2%, compared to 7.1% in Q1 and 7.3% in Q2 2024.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Furthermore, Edmunds noticed that 0% finance deals sink below 1% for the first time ever.

In Q2, 0% finance deals accounted for 0.9% of new-vehicle loans — the lowest share Edmunds has on record since 2004 and down from 1% in Q1 and 2.9% in Q2 2024.

Getting back to the used-car side, average terms have remained at 69.7 months while the average amount financed climbed to $29,080, which is $742 higher year-over-year.

“It would be easy to assume that tariffs are already reshaping the market, but the reality is that the record-breaking trends we saw in the second quarter are reflective of more consumers opting for maxed-out term lengths despite vehicle prices remaining steady,” Edmunds’ director of insights Ivan Drury said in a news release. “It’s clear that buyers are pulling the few levers they can control to manage affordability, whether that’s by taking on longer loans, financing more, or putting less money down — even if some of those decisions increase their total costs.

“Consumers are continuously stretching to afford new vehicles in this market, and while tariffs haven’t directly driven these Q2 numbers, they’re certainly not going to make things any easier for shoppers moving forward,” Drury continued.

As more buyers lean on extended contract terms, Edmunds analysts caution that this strategy could carry consequences down the road.

“While extended loan terms may make a monthly payment more palatable, consumers need to keep in mind the risks associated with a loan extended that far into the future, including increased costs for upkeep down the line and the risk of being underwater on the loan if the car is traded in before it’s paid off,” said Joseph Yoon, Edmunds’ consumer insights analyst.

“If payments on a more standard 60- or 72-month loan don’t fit your budget, you might consider leasing. While you won’t be building equity in your vehicle the way you do with a purchase, leases afford time to get your finances in better shape with lower monthly payments in the meantime,” Yoon went on to say.