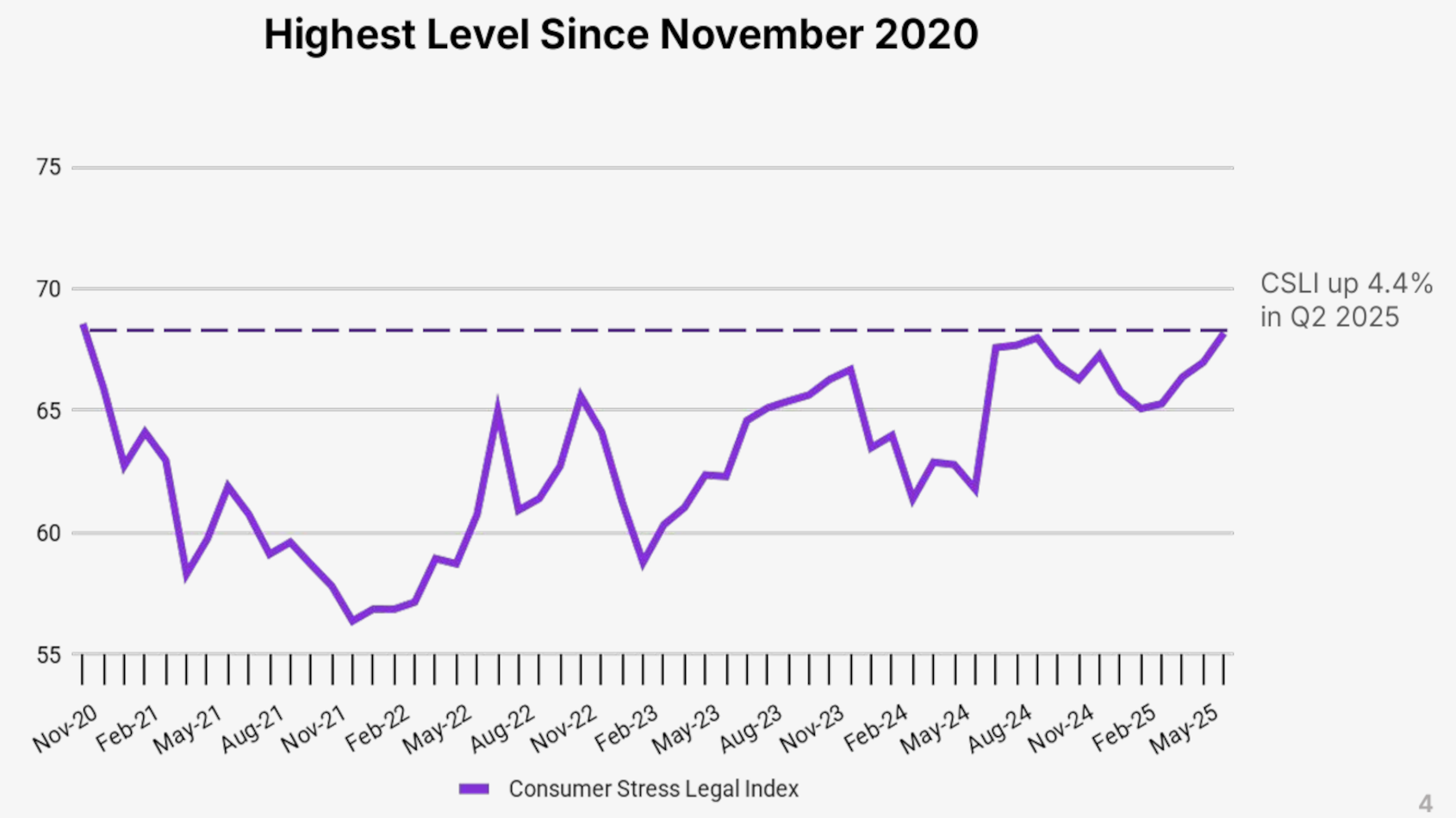

LegalShield’s Consumer Stress Legal Index at highest point in more than 5 years

Chart courtesy of LegalShield.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

LegalShield’s Consumer Stress Legal Index (CSLI) climbed from March to June, and the company said it was driven by surging foreclosure and consumer finance legal inquiries, all rooted in increased debt.

Analysts indicated the CSLI surged to 68.2, which is 4.4% higher quarter-over-quarter and 10.4% year-over-year. The reading now is at its highest point in more than five years.

“Debt is the common thread behind rising consumer stress,” said Matt Layton, senior vice president of consumer analytics at LegalShield. “Whether it’s missed mortgage payments, maxed-out credit cards, or mounting buy-now-pay-later balances, debt-fueled household spending is forcing people to ask a lawyer for help.”

Data analysis showed the Foreclosure Index jumped 13.3% during the quarter and is now nearly 28.9% higher than a year ago, marking the steepest annual increase in three years.

The Consumer Finance Index also climbed 8.7% since March, as more consumers sought legal assistance for debt-related issues such as defaults and loan modifications.

Furthermore, while the company’s Bankruptcy Index softened 11.8% quarter-over-quarter to 32.1, it’s up 8.8% year-over-year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Bankruptcy inquiries eased in the short term but remain significantly elevated compared to last year. The dip may reflect temporary stabilization due to seasonal factors, but high debt levels and consumer delinquencies still loom,” analysts said in a report.

LegalShield’s CSLI report comes ahead of the Federal Reserve Bank of New York’s scheduled release of second quarter household debt numbers in early August. Household debt has steadily increased since 2013 following a period of decline after the 2008 recession.

Analysts pointed out household debt balances stood at a record $18.20 trillion in Q1, a 0.9% rise from the end of 2024. In particular, mortgage balances grew by $199 billion and home equity lines of credit (HELOC) increased by $6 billion.

Layton said that it is more concerning that overall debt delinquencies increased to 4.3% at the end of Q1, the highest level since 2020, including rising delinquencies for mortgages and HELOCs, as well as student loans that began reporting to credit agencies in Q1 following a nearly five-year pause due to the pandemic.

And Cox Automotive reported earlier this week that auto-finance performance deteriorated in June.

“LegalShield data tends to move ahead of official reports, and right now, it’s signaling deeper trouble,” Layton said. “In the coming weeks, we expect the next debt and foreclosure reports to reflect what calls to our provider lawyers are seeing — more households slipping into unsustainable financial territory.”

LegalShield data tracks actions taken by consumers with more than 150,000 calls to provider lawyers each month. The LegalShield dataset is built data based on American households’ real-time legal needs that reflect financial pressures and opportunities.