PODCAST: TransUnion explains auto-refinancing opportunities with 18M consumers

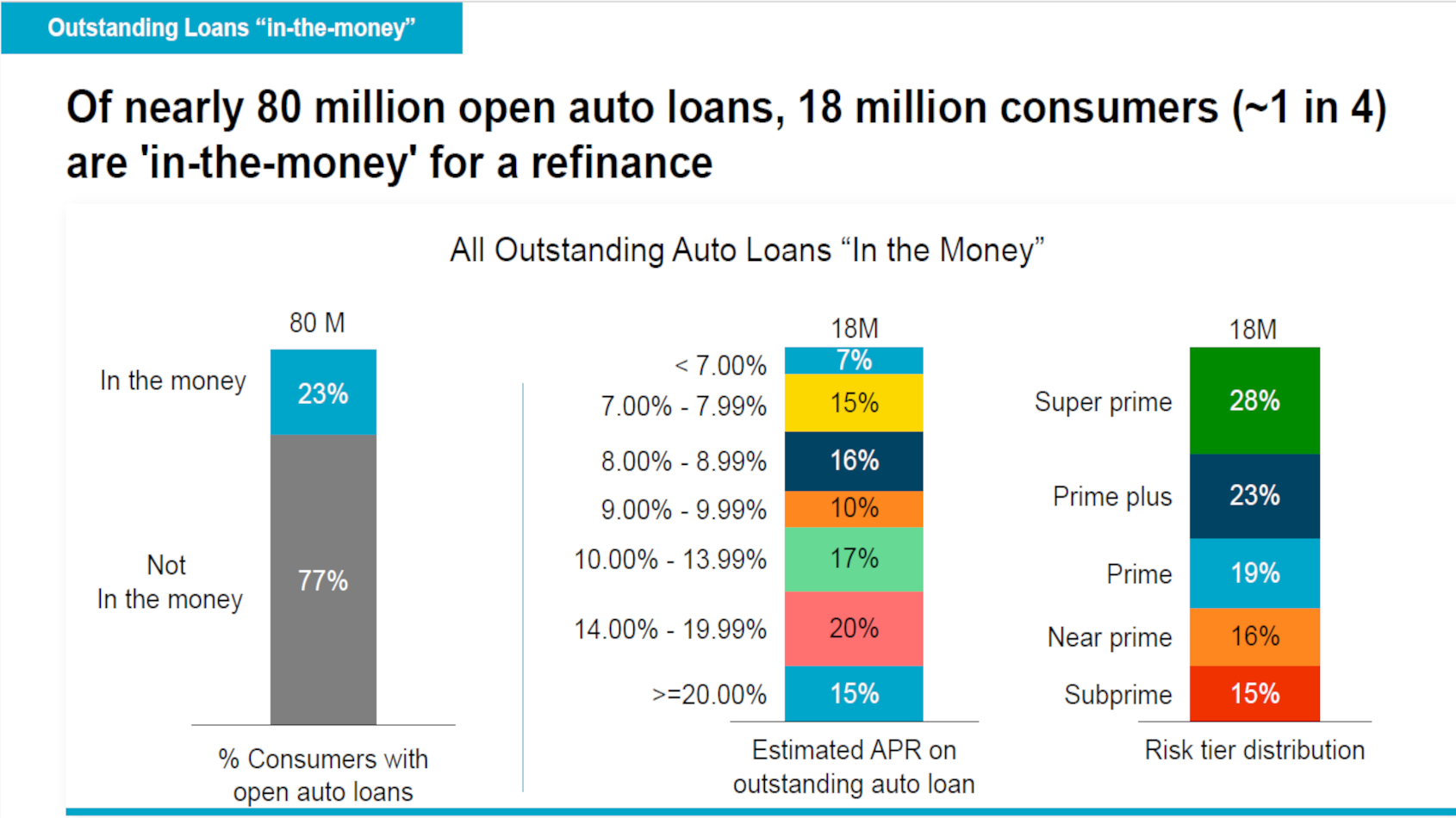

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Even without the aid of an interest rate cut from the Federal Reserve that’s displaying some dissension, TransUnion is bullish about the prospects from auto refinancing.

Analysts acknowledged many consumers continue to face pressure on their household budgets, prompting a growing search for ways to improve monthly cash flow. New research from TransUnion showed that auto loan refinancing may offer a meaningful path to savings for millions of consumers, while also presenting a valuable opportunity for lenders.

Of the nearly 80 million open auto loans in the U.S., TransUnion indicated approximately 18 million are considered “in-the-money” for refinancing. Analysts explained the term refers to consumers whose current contract rates exceed the prevailing average APR, making them strong candidates to benefit financially from a refinance.

TransUnion’s analysis also found that while rising interest rates have reduced the average monthly savings from auto loan refinancing — from $1071 in 2021 to $90 in 2024 — these savings remain meaningful for many consumers.

According to TransUnion research, more than half of consumers surveyed indicated they would be motivated to refinance if they could save between $50 and $149 per month.

“At a time when we are still feeling the effects of inflation on budgets and spending, consumers are exploring every opportunity to save money,” said Jason Laky, executive vice president and head of financial services at TransUnion. “Refinancing an auto loan can reduce monthly payments substantially and bring much needed financial relief to millions of Americans.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TransUnion went on to mention the number of consumers who are “in-the-money” for an auto refinancing is poised to grow substantially if the Federal Reserve lowers interest rates.

Currently, approximately 18 million consumers meet the criteria and can lower their APR. However, TransUnion computed that even a modest 25-basis point rate cut would increase that number to nearly 20 million.

Furthermore, analysts estimated that a whole percentage point (100 basis points) reduction could expand the pool by an additional 6.5 million consumers.

Refinanced auto loans continue to outperform purchase loans across credit tiers

And here’s some encouraging signs for finance companies concerned about risk. TransUnion said a consistent trend has emerged.

Analysts found that auto refinance loans are demonstrating stronger performance compared to original purchase loans originated during the same period. They pointed out this pattern holds true across all credit tiers, with particularly notable results among near prime borrowers.

TransUnion went on to mention that an analysis of Q4 2023 vintage loans revealed that consumers who refinanced their auto loans were significantly less likely to be 60 or more days past due at the 12-month mark. And that’s by a margin of 170 basis points.

Analysts added the performance gap was even more pronounced within the near prime segment, where refinance borrowers outperformed purchase loan borrowers by 320 basis points.

“Many auto loan borrowers may not realize that refinancing is an option,” said Satyan Merchant, who is senior vice president and auto and mortgage business leader at TransUnion. “As a result, those who do refinance tend to be more financially savvy and proactive about managing their credit.

“At a time when other segments of the auto loan market are facing performance challenges, lenders should consider targeting qualified borrowers for refinance opportunities, which have historically shown stronger repayment behavior,” Merchant went on to say.

Merchant elaborated further about auto refinancing during a conversation with Cherokee Media Group’s Nick Zulovich for the Auto Remarketing Podcast. The episode is available in the window below.