CBB white paper projects growth in used EV supply, values in a volatile market

Images courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Canada’s electric vehicle future has been a much discussed and debated topic in 2025, with governments pausing and rethinking their policies and consumer demand wavering while the auto industry and the economy as a whole struggle with the impact of a trade war with the U.S.

Such an unpredictable environment makes projecting what’s ahead a difficult task. And Canadian Black Book readily acknowledges that.

“Like the stock market, Canada’s EV progression is hard to predict,” analysts said in CBB’s latest white paper, The Canadian Electric Vehicle Market in 2025. “Though it shouldn’t be, there’s been volatility in the overall car market that has pressured EV development into finding a corner to hide, but hopefully not die.”

Nevertheless, the white paper takes on the challenge, diving into the data to look at the current state of the EV market and where it’s headed down the road. And that outlook, CBB senior manager of industry insights and residual value strategy Daniel Ross said, is generally positive.

“We believe the long-term outlook for electrified mobility in Canada is positive,” he said. “But unlocking that potential will require coordinated effort across public and private sectors.”

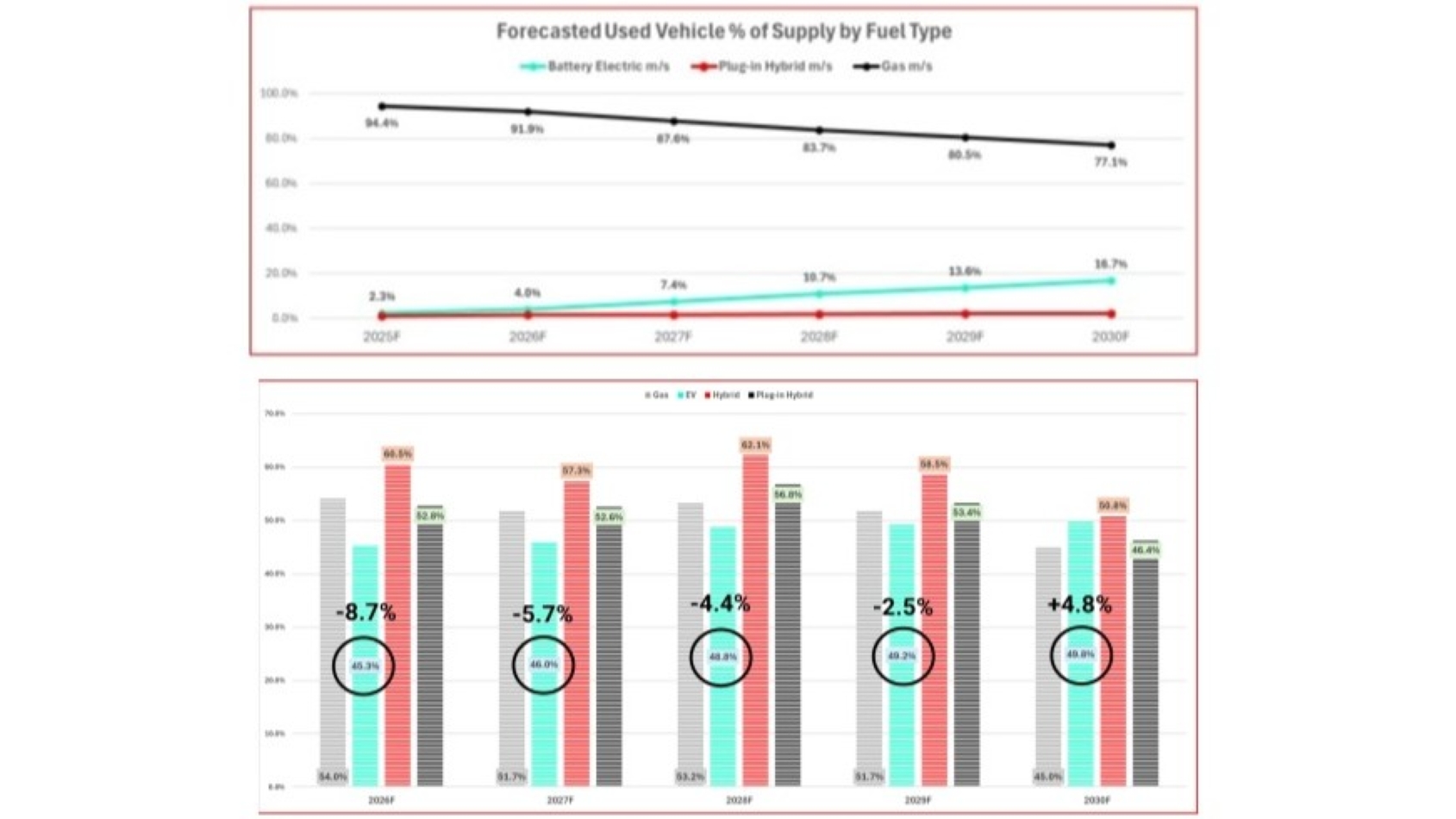

Perhaps the most positive news comes from the used-car sector, in which CBB projects supply to increase rapidly over the next five years — from the current 2.3% of the total used-car market to 16.7% in 2030 — as more and more EVs reach lease maturity and consumers become more educated about battery health and performance.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CBB called that jump in market share “a sure-fire signal that even though product schedules may be delayed as support realigns with other model electrification efforts, the market will be continuing to digest EV supply in multiple ways.”

The report said the influx of those vehicles into the used market should lower the average age of used EVs while driving average retained value up. That will improve forecasted residuals in the wholesale market, which allows dealers to market a lower monthly payment and make used EVs more affordable.

That rise in retained value won’t be as dramatic as the giant leap in supply, but Canadian Black Book’s forecast shows the average value of 4-year-old EVs could surpass that of gas vehicles by 2030. The white paper showed EV values lagging behind by 8.7% this year, but that gap is projected to narrow each year until EVs lead gas cars by almost 5% in 2030.

Currently, EVs rank last in retention behind hybrids, the market leader at 60.5%, gas vehicles and plug-in hybrids.

The white paper offers two scenarios for overall adoption of ZEVs — which include EVs and plug-in hybrids — in the second half of 2025, based on the fate of the federal government’s ZEV mandates and its iZEV rebate program, which has been paused due to funding issues.

If the rebates and mandate are restored, CBB projects adoption to rise to 16.8% of the market, but if the mandate is removed that number will drop to 11.7%. The takeaway, the report said, is “the fact that Canada’s market for zero-emission vehicles will progress no matter the outcome.”

That progress shows up in the number of EV models and trims available, which have shot up 336% — from 55 to 240 — since 2021, while the market as a whole has shrunk, pushing EVs up to 12% of available options for new vehicles.

Price trends, which were initially guided toward luxury markets earlier on in EV history have opened, significantly accelerating EV options. Back in 2021MY the average price disparity to gas models was over 36% or $22,600. Now as we close out 2025MY, that gap has been reduced to 23% or $17,800.

Yes, still a sizeable financial gap, but this is outside of the federal and provincial iZEV rebates that up until lately were available to many mainstream models, effectively reducing that price gap to 29% in 2021MY and 17% in 2025MY, for those eligible models.

Meanwhile, as high-volume crossover segments and mainstream brands took over the average equipped retail price of new EVs has risen just 13%, well below the 27% market average increase as high-volume crossover segments and mainstream brands have offset the luxury models that first entered the market. And while the EV average of $95,439 is still more than $17,000 above that of gas vehicles, that gap is down from the $22,000-plus difference in 2021.

Still, the rate of EV progress hasn’t always been a smooth road.

“Canada has also inflicted wounds on its own EV market development,” the white paper said. “Through ZEV mandates and provincial rebates, government has encouraged consumers and forced manufacturers into buying and selling vehicles there is a limited market for. … Currently EVs are too expensive, too inefficient and lack reasonable refueling times to adopt into most households.”

But that doesn’t mean the future is bleak. On the contrary, CBB said, consumer interest in EVs has remained relatively strong compared to that in the U.S.

“This means when EVs come down in price, become more efficient, with vastly developed charging infrastructure, we’ll have customers in Canada who demand EVs and want to buy them by the masses,” the report said.

The complete white paper is available for download here.