‘Pull-forward’ effect pulls used cars to strong performance in first half of 2025

Image courtesy of AutoTrader.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

For all the concerns about political and economic turmoil, the first half of 2025 has been pretty good for used cars in Canada.

AutoTrader’s Q2 Price Index report shows used sales and prices were up in the second quarter and demand remained strong, building on the “pull-forward” effect that began in Q1, with car buyers acting quickly ahead of anticipated market shifts — notably tariffs.

That behavior, AutoTrader said, has driven four consecutive months of price gains, defying seasonal expectations and pushing prices above 2024 levels.

“If you’re a dealership or OEM, I think it’s a good year,” AutoTrader vice president of insights and intelligence Baris Akyurek said. “If you’re a consumer, probably not. It’s good news for dealerships because the demand is there, cars are getting sold and prices are up there, so it should be good for profitability.”

While used-car demand slipped slightly from its tariff-fueled Q1 surge, the report said, sales rose by 1.8% quarter-over-quarter and 2% since the beginning of the year. Combine those trends with tightening supply — used inventory is down 16.8% year-over-year — and the result is Canadian used prices have been rising since March, which AutoTrader said is the opposite of the typical seasonal pattern of beginning the year high and declining as the months go by.

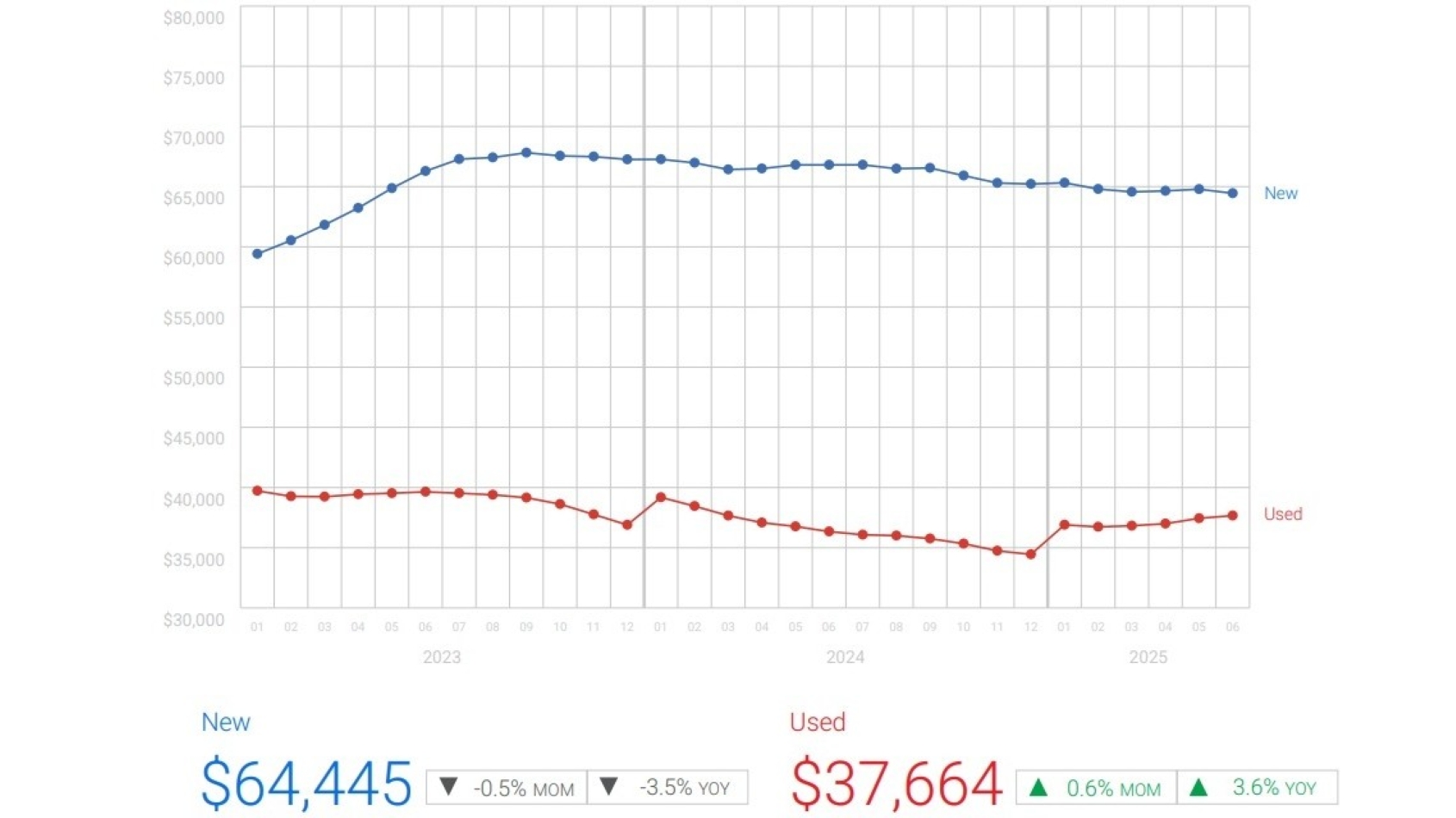

AutoTrader’s numbers showed the average price for used cars listed on its platform jumped 3.6% from Q2 2024 to $37,664, while the new-car average fell 3.5% to $64,445.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The supply shortage will continue to drive used prices up, but it actually improved — barely — in Q2, thanks to trade-ins from the pull-forward new-car sales and the reciprocal tariffs that have reduced used-vehicle exports to the U.S.

But the overall trend is still downward, AutoTrader said, as an estimated 1.5 million fewer vehicles were sold between 2020 and 2023 than originally anticipated, the effect of COVID-era production and supply chain issues, and the reduced number of lease returns.

All of that, Akyurek said, means things should look much the same in the Canadian used-vehicle market for the rest of this year.

“I have just taken my crystal ball out, and what it says is in the second half of the year, used car demand should be there,” he said. “Look, it’s been pretty strong since Q3 of last year, so the demand was there even before the tariff conversation started.

“Now there’s more demand because everybody’s been anticipating there would be an increase in prices, so consumers want to buy used cars instead of new. And in addition to all of this, given the supply crunch, the second half of the year for used markets should be pretty strong, assuming demand stays the same.”

What’s happening in the new-car market plays into that projection, too. Akyurek noted the increased new-car inventory built up before the tariffs took effect in April is now dwindling, which means new prices will likely be increasing soon, further driving used demand.

“There had been some buffer,” Akyurek said. “In the beginning, the days’ supply was sitting around 87 days, which in turn helped with the price and avoided the much anticipated price increases on the new side. But the inventory has come down a bit — the past couple of weeks it came down to 57 days, so we’re just below the quote-unquote ‘healthy’ rate of 60.

“So if things don’t change, if tariffs are still here and the inventory gets depleted, obviously it’s inevitable there’s going to be some sort of a bump in new car prices. And if that happens, there’s going to be more demand on used, period.”

The outlier when it comes to rising used-car prices is electric vehicles. The report said used battery EV prices sank to $44,077, down 7.9% year-over-year, as demand continues to soften since federal purchase incentives were paused in January and with concerns about charging infrastructure persisting.