TransUnion ponders if auto-loan delinquency is at or near peak

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TransUnion acknowledged the percentage of consumers 60 days or more past due on their auto loan climbed to a rate in the second quarter that exceeded what analysts recorded in 2009.

But TransUnion also said the pace of increases in delinquency spotted at a year’s midpoint is slowing.

According to TransUnion’s Q2 2025 Credit Industry Insights Report (CIIR), the 60-day delinquency rate for auto financing ticked up another 4 basis points year-over-year to 1.31%.

While that reading might be alarming, especially when viewed in comparison to the time of the Great Recession, analysts also pointed out the latest year-over-year increase was considerably smaller than what they saw at the halfway point of 2023 and 2024. Those increases were 23 basis points and 14 basis points, respectively, suggesting that delinquencies may be nearing a peak, according to TransUnion.

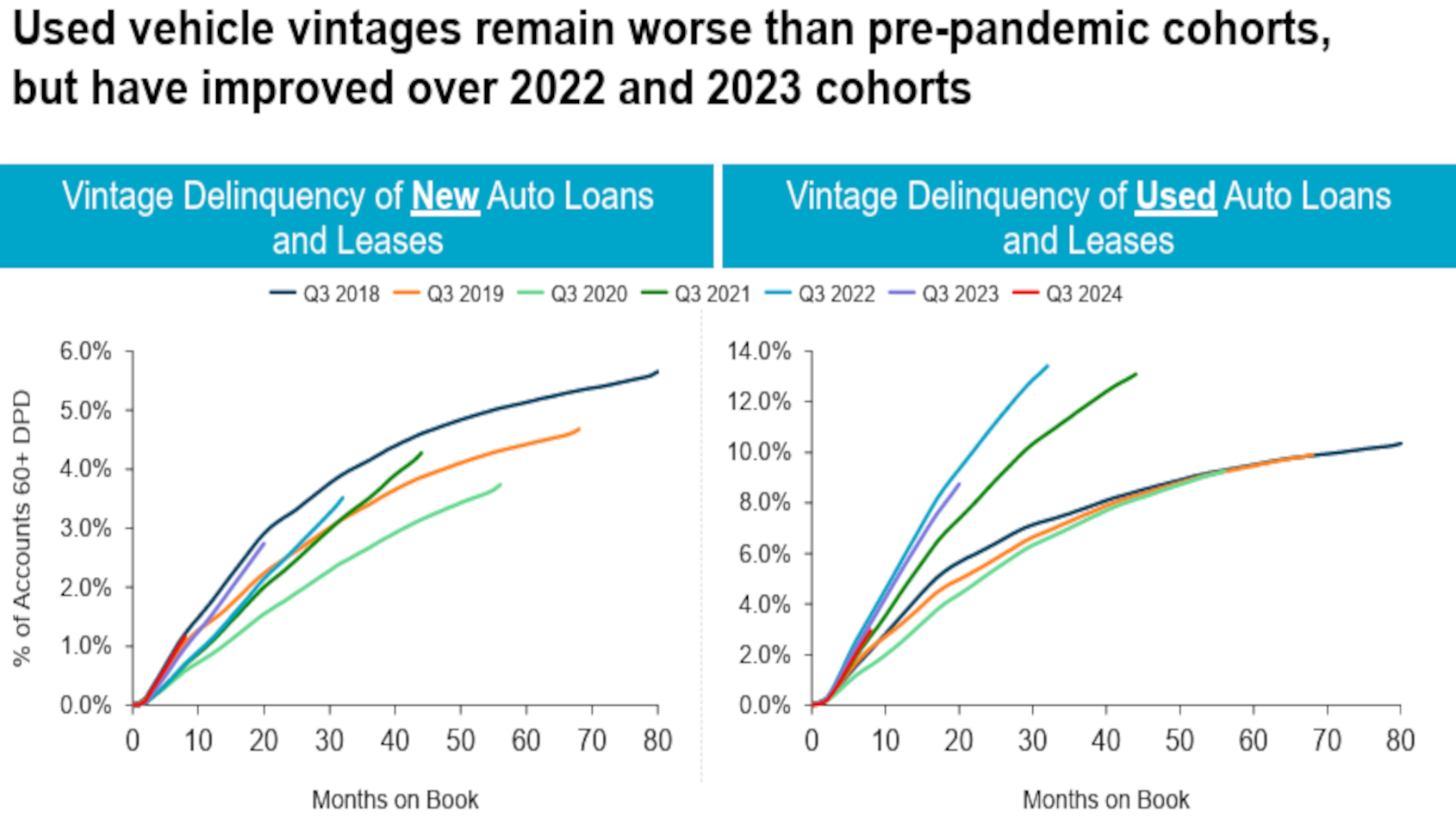

The report showed new-vehicle accounts from the 2024 vintage have elevated delinquency levels compared to 2019, particularly among prime and below-prime tiers.

The analysis also indicated used-vehicle accounts from the 2024 vintage have performed better than those from 2022 and 2023, though they still lag behind the benchmarks set in 2018 and 2019.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TransUnion also examined risk exposure through the lens of federal student loans, which are impacting the credit market significantly since government changes associated with delinquency and collections.

Analysts determined $169.5 billion in outstanding auto financing is held by consumers who also have federal student loans to pay. Of that auto amount, TransUnion calculated 47% of it is connected with individuals who are not current on their student loans.

Nonetheless, the auto-finance market is still growing.

TransUnion reported auto originations grew 5.9% year-over-year to 6.4 million in Q1 2025, marking the strongest Q1 performance since 2022, supported in part by rising new-vehicle inventory levels. Analysts explained this growth occurred despite increasing vehicle prices, which may have been driven in part by anticipation of tariffs.

TransUnion reiterated originations are viewed one quarter in arrears to account for reporting lag

Analysts indicated total amounts financed rose in Q2. They were up 2.5% year-over-year for new vehicles to an average of $42,459 and 2.8% higher year-over-year for used vehicles to an average of $26,583.

TransUnion mentioned Q2 vehicle financing mirrored pre-pandemic trends, with 59% of loans for used vehicles and 41% for new vehicles. Analysts noted this metric represents a 6-percentage-point shift toward used vehicles compared to Q2 of last year, likely driven by affordability challenges in the new-vehicle market.

“We have observed a modest upward trend in pricing,” said Satyan Merchant, senior vice president and automotive and mortgage business leader at TransUnion. “This development may contribute to growing affordability challenges for a broad segment of consumers. As a result, we could see a shift in market composition, with a higher concentration of super-prime consumers, who tend to be more resilient and adaptable to price fluctuations.

“Meanwhile, point-in-time delinquency rates — specifically accounts that are 60 or more days past due — continue to rise,” Merchant continued. “Nevertheless, the pace of this growth is beginning to decelerate. We are closely monitoring this trend to determine whether it will stabilize in the near term.”

Looking at unsecured personal loans

Turning to another part of the report, TransUnion found the unsecured personal loan market continued its recent growth trend in Q1, with both super prime and subprime borrower segments contributing to the increase in originations.

Overall, analysts said originations rose 18% year-over-year. Super prime originations increased nearly 20% year-over-year, while subprime originations climbed almost 23%.

TransUnion indicated this sustained growth in originations led to a new record in total unsecured loan balances, which reached $257 billion in Q2. That’s an increase of 4% year-over-year.

Furthermore, analysts found that delinquency rates also showed modest improvement, with the 60-day delinquency rate edging slightly lower from 3.38% in Q2 of last year to 3.37% of this year.

Delinquency among personal loans now have declined for three consecutive quarters, according to TransUnion tracking. This improvement was led by the subprime segment, where the consumer-level delinquency rate dropped from 14.4% to 13.6% year-over-year.

“Lenders are driving growth through refined risk assessment and targeted acquisition strategies, despite ongoing uncertainty from trade policies and federal student loan repayment pressures,” said Josh Turnbull, senior vice president and consumer lending business leader at TransUnion. “Improving delinquency rates among subprime borrowers signals effective risk management and broader economic stability, reinforcing lender confidence in this segment.

“Meanwhile, rising demand from super prime consumers across a wider range of lenders highlights both the utility of unsecured personal loans and a strategic shift toward this risk segment as the market matures,” Turnbull continued. “If these trends persist, the unsecured personal loan market is well-positioned to maintain its positive growth trajectory.”

Overall credit observations

TransUnion said American consumers are generally exhibiting steady and disciplined credit behavior, with signs of stabilization and measured growth across key lending categories, even as they continue to navigate a complex economic landscape.

While credit card and unsecured personal loan originations have risen, analysts said their balance growth remains controlled, and delinquencies have continued to decline.

TransUnion explained this combination of tempered balance growth and reduced delinquency rates suggests a stabilizing — if not gradually improving — consumer credit environment, even as many households continue to navigate economic challenges.

“Consumers appear to be increasingly successful at adapting to today’s economic realities,” said Michele Raneri, vice president and head of U.S. research and consulting at TransUnion. “While many are still relying on credit to manage everyday expenses, the data suggests they’re doing so in a controlled manner.

“The continued decline in delinquencies and charge-offs reflects a level of financial discipline that speaks to consumers’ flexibility and determination to stay on track,” Raneri went on to say.

To learn more about the latest consumer credit trends, register for the Q2 2025 Quarterly Credit Industry Insights Report webinar.