StoneEagle: EV leases surge as front-end profits collapse in July

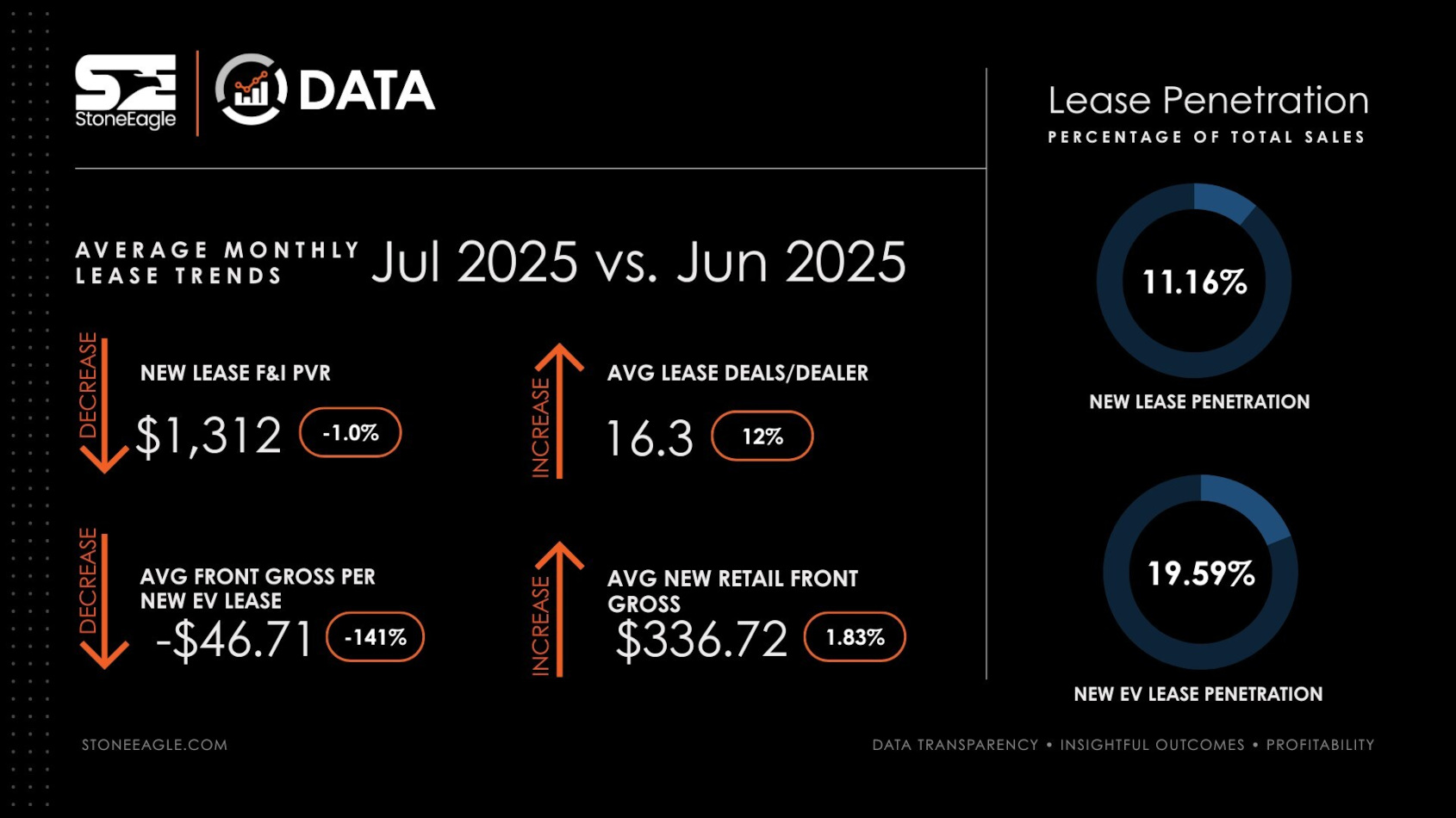

Graphic courtesy of StoneEagle.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Leasing of electric vehicles either got a big recharge or lost a lot of juice in July. It all depends on how you want to consider the data StoneEagle shared on Monday.

The F&I solutions provider reported July’s lease market delivered a sharp rebound led by a surge in EV volume. But the gains came with a steep hit to front-end profitability, according to StoneEagle’s latest StoneEagleDATA benchmark insights, which are drawn from more than 8,900 U.S. dealer rooftops.

The data showed the average dealer booked 16.3 new lease deals in July, up 12% from June. Nearly one in five of those leases were EVs, marking a 31% month-over-month jump in EV lease penetration.

“StoneEagleDATA gives the industry a clear view of the forces shaping dealership performance,” StoneEagle CEO Cindy Allen said in a news release. “In July, the story wasn’t just about a rebound in leasing. It was about front-end gross on leases turning negative for the first time since early 2020.

“While F&I performance helped cushion the impact, our data shows that dealers leaned on aggressive lease strategies, particularly in EVs, to clear aging inventory ahead of expiring EV tax incentives,” Allen continued.

Overall highlights of StoneEagle’s July data included:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Average new lease deals per dealer: 16.3, up 12% month-over-month

—New EV lease penetration: 19.59%, 31% month-over-month

—New lease penetration: 11.16% of all sales, up 13.27% month-over-month

—Front gross per new lease deal: Negative $46.71, down 141% month-over-month

—New retail average front gross: $336.72, down 25.6% month-over-month

—New lease F&I PVR: $1,312, down 1% month-over-month

StoneEagle indicated total EV lease volume jumped 45.6% from June to July, accounting for nearly all the month’s lease growth.

Year-over-year, StoneEagle determined new EV leases rose 51%, tracking closely with the 51% gain in total EV sales.

EV lease penetration has remained steady at just over 55% on a year-over-year basis, according to the new data.

StoneEagle acknowledged profit compression was notable in July.

Average front gross on leases swung from $114 in June to -$47 in July, while F&I PVR held relatively steady, helping to offset front-end losses but not enough to prevent an overall margin squeeze.

“The spike in EV lease penetration was one of the standout trends in July,” said Colin Snyder, general manager of StoneEagle’s Automotive Retail Solutions, including StoneEagleDATA, StoneEagleMETRICS, StoneEagleMENU, and StoneEaglePENCILWRENCH.

“Nearly one in five new leases was electric — a clear sign that leasing is playing a growing role in how EVs reach consumers. StoneEagleDATA captures these shifts across thousands of dealerships, giving the industry the benchmarks it needs to navigate changing market dynamics,” Snyder went on to say.