From the editor: Tricolor downfall could ripple through industry for some time

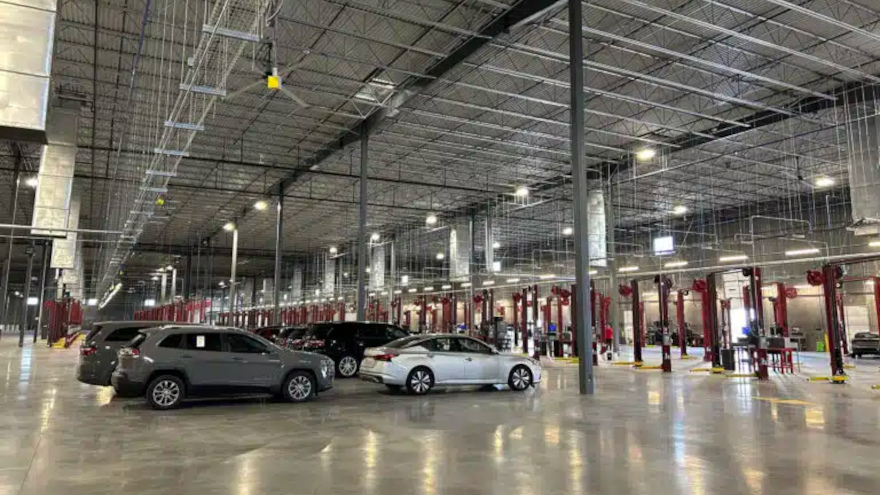

Tricolor intends to employ more than 500 people who will work at the 258,000-square-foot reconditioning facility in Surprise, Ariz. Photo courtesy of the Greater Phoenix Economic Council.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

What a mess.

That’s the summation this scribe arrived at on Thursday morning after combing through the outstanding reporting by outlets such as Bloomberg, The Financial Times and Reuters about the major development in the subprime auto finance industry you might already know. It’s the bankruptcy filing and potential investigation by the Department of Justice of fraud involving Tricolor Holdings.

Depending on who is measuring, Tricolor Holdings was one of the top 10 used-car retailers in the U.S., specializing in the Hispanic and other underserved markets and operating 65 retail centers within 22 cities in Texas, California, Nevada, Arizona, New Mexico, and Illinois.

The Financial Times reported on Wednesday that Tricolor’s bankruptcy filing includes liabilities of as much as $10 billion to 25,000 creditors, with Barclays, J.P. Morgan and Fifth Third having the most potential exposure.

Bloomberg reported on Wednesday the U.S. Attorney’s Office in New York is investigating potential fraud involving Tricolor’s securitizations, as there has been speculation of the underlying collateral being used multiple times to prop up the transactions.

And Reuters reported on Wednesday that the law firm that helped Tricolor make its bankruptcy filing in Dallas would no longer represent the company.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Quite a mess, huh? It’s quite a swift downfall for a retailer that has gone on quite a journey over the past decade.

As recently as June, Tricolor made a move involving securitizations. It announced a $217 million issuance, as Barclays acted as the lead structuring agent with JPMorgan serving as joint bookrunner and Fifth Third Securities as co-manager.

The Class A, Class B, Class C, Class D, Class E and Class F were rated by S&P and Kroll Bond Rating Agency and were placed with a diversified mix of institutional investors in a private offering pursuant to Rule 144A under the Securities Act of 1933, as amended.

According to a news release distributed at the time, Tricolor had completed 17 ABS transactions and was the only issuer of subprime auto ABS to be certified by the U.S. Treasury as a Community Development Financial Institution (CDFI). The company issued its first securitization in July 2013.

“We’re excited to complete our second securitization of the year,” Tricolor founder and CEO Daniel Chu said in that June news release. “Volatility has become the norm in the overall macro-economic environment, and we have conviction that our differentiated approach enables us to deliver consistent, predictable and positive outcomes.

“We’re also pleased to close our inaugural transaction with S&P as a rating agency as we continue to build a robust capital markets platform,” Chu added.

That CDFI designation certainly was key development in Tricolor’s journey.

In November 2019, the company landed that CDFI certification, which provided Tricolor with greater opportunities to partner with banks to expand its affordable, credit building lending strategy. The designation could enable banks to legally invest in Tricolor securities to promote public welfare and fulfill their Community Reinvestment Act (CRA) obligations.

“We are humbled and honored to join this exclusive group of CDFIs as named by the U.S. Department of the Treasury. It truly speaks to the essence of our mission-driven work and will enable us to grow in service to even more deserving individuals,” Tricolor founder and chief executive officer Daniel Chu said in a news release at the time of the November 2019 announcement.

“Since the beginning, our commitment has been to put the customer’s best interests and needs at the center of every interaction, and this certification not only validates this purpose but significantly enhances our ability to scale our lending platform,” Chu added.

And scaling is what Tricolor certainly did.

Last September, the company opened its second major reconditioning facility to support its sales in California and Texas.

That recon site was in Surprise, Ariz., as Tricolor intended to employ more than 500 people who were to work at the 258,000-square-foot facility.

“This facility was designed from the ground-up to set a new standard for operational excellence in the retail automotive industry. It’s been a pleasure and a tremendous advantage to work with a city that is aligned with our vision and expectations, and we look forward to a long and productive relationship,” Chu said at the time.

“We provide superior value to our customers in the form of high-quality vehicles fully backed by a warranty and financed at affordable rates — an integrated value proposition simply unattainable elsewhere,” Chu said. “This new, cutting-edge infrastructure enables us to deliver on our commitment to unrivaled vehicle quality as we expand our presence throughout California and the Western United States.”

In late 2022, Tricolor unveiled a 200,000-square-foot reconditioning center in Wilmer, Texas.

And Tricolor didn’t just expand its physical footprint.

In April 2023, Tricolor announced that it secured U.S. Patent No. 11,574,362 for its artificial intelligence (AI) interactive tool called Automás.

The company highlighted that the new tool leveraged data across its entire integrated platform to give “the power of self-selection” when choosing and financing a vehicle from Tricolor.

Tricolor explained at the time that its Automás application utilized machine learning to generate specific offers on both the vehicle model and the financing terms.

By leveraging information gained in the application process and connecting precise profiles to historical loan performance and proprietary data points, Tricolor said that interactive tool could empower the consumer to customize their own financing terms, such as down payment and payment amount, within the parameters of the system-generated offer.

“From the beginning, we’ve resolved to provide financially underserved customers, a population often subject to extremely limited options and predatory pricing, with an unprecedented premium brand experience that results in both physical and financial mobility,” Chu said in a news release distributed when the patent was secured.

“Developed using 16 years of impactful results and more than 25 million non-traditional customer attributes, this breakthrough AI innovation powers an interactive tool that maximizes customer success, expands financial inclusion and sets customers on a path to a better future,” Chu continued.

But now? The future for Tricolor is perhaps bleak at best. The future of some of its creditors isn’t likely to be rosy, either, with potential loss of revenue or investment funding. Plus, plenty of write-offs are possible, too.

What really happened with Tricolor? Perhaps only Chu really knows. But Tricolor’s fall into bankruptcy to be followed by potential criminal punishment is one of the most complex developments seen by your correspondent since joining Cherokee Media Group 18 years ago.

What a mess, indeed.

Nick Zulovich is senior editor of Cherokee Media Group and can be reached at [email protected].