Service visits rising as Canadians keep vehicles longer in face of high car prices

Image courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As car prices rise, so do trips to the repair shop.

That correlation was illustrated neatly by J.D Power’s latest research, which showed dealership service department visits at their highest level in four years.

The J.D. Power 2025 Canada Customer Service Index — Long-Term Study found the average number of dealership service visits for 4-to-12-year-old vehicles is now 1.8 per year, up from 1.5 in 2022, while the average for aftermarket facilities rose to 1.5 from 1.3 a year ago.

The research firm said those numbers are a result of Canada’s economic uncertainty fueled by trade tensions, inflationary pressure and rising new-vehicle prices, causing Canadian car owners to hold on to aging vehicles longer, which in turn leads to increased maintenance and repairs.

According to the study, based on responses from 9,999 vehicle owners in March and June, service visits for repairs reached 46% of all service visits for dealerships, a jump of six percentage points year over year, and 27% for aftermarket shops, up three percentage points.

In part as a result of that difference, the average cost of a dealership visit — $539, up from $465 in 2024 — is nearly 80% higher than aftermarket visits ($302). But the type of work isn’t the only factor involved, as 65% of vehicle owners who chose an aftermarket facility cited the high cost of dealership service as the top reason for their decision.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The auto service market in Canada is experiencing unprecedented growth,” J.D. Power Canada automotive practice lead J.D. Ney said, “with revenue estimated at $18.8 billion, thanks to a combination of macroeconomic factors that are leading to stagnation in new light‑vehicle sales and driving up maintenance and repair costs.

“That presents a unique opportunity for dealerships to offset softer new‑vehicle sales and for aftermarket facilities to capture a larger share of the revenue stream in a market in which used‑vehicle owners are more price‑conscious.”

Indeed, the study found the aftermarket segment accounts for just 38% of total auto service revenue, with independent shops and aftermarket chains taking 19%, while dealerships have the lion’s share at 62%. Nor surprisingly, dealerships lead in market share as well, claiming 48% of all auto service and repair visits, followed by independent shops (26%) and quick lube locations (11%).

J.D. Power also said vehicle owners who have taken their vehicle in for service indicated greater trust in dealerships for complex repairs on aging vehicles. The average trust ranking for dealerships according to the study was 5.94 on a 7-point scale for complex maintenance and 5.76 for complex repair is higher, significantly higher than the 5.68 and 5.64 for aftermarket providers.

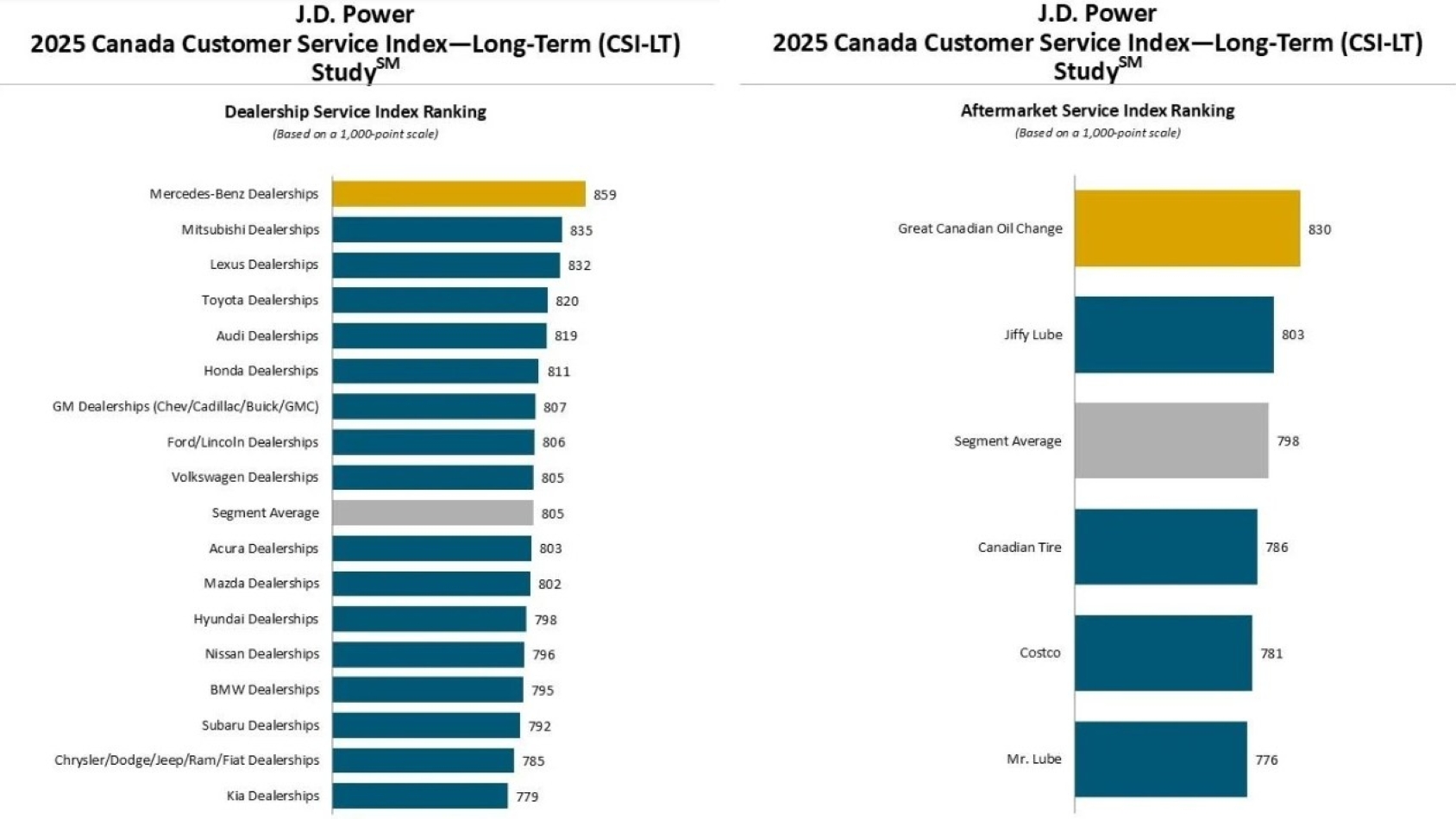

The study ranked Mercedes-Benz as the top brand for dealership service with a score of 859 on a 1,000-point scale, followed by Mitsubishi (835) and Lexus (832). Great Canadian Oil Change was number 1 among aftermarket facilities at 830, ahead of Jiffy Lube (803). The rankings are based on five factors rated by study respondents: service quality (32%), vehicle pick-up (20%), service facility (17%), service initiation (16%) and service advisor (15%).