Associated Bank highlights success with FICO Auto Score 10

Chart courtesy of FICO.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

FICO on Wednesday announced that Associated Bank has successfully upgraded from FICO Auto Score 8 to FICO Auto Score 10, leveraging dual processing to validate predictive benefits, enhance underwriting accuracy, and improve applicant assessment.

According to a news release, Associated Bank has total assets of $41 billion and is the largest bank holding company based in Wisconsin.

Headquartered in Green Bay, Associated Bank offers a full range of financial products and services from nearly 200 banking locations serving more than 100 communities throughout Wisconsin, Illinois and Minnesota and Missouri. The bank also operates loan production offices in Indiana, Kansas, Michigan, Missouri, New York, Ohio and Texas.

And those production facilities have been using FICO’s latest scoring model. Associated Bank implemented a dual processing approach, pulling both FICO Auto Score 10 and FICO Auto Score 8 to compare real-time borrower results with origination and account management strategies.

FICO said this method enabled the bank to cut months off traditional implementation times while validating the score’s predictive power and maintaining operational continuity.

FICO mentioned preliminary analysis from dual processing and account management reviews has already shown:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—A higher percentage of borrowers scoring in top tiers

—Stronger predictive separation for underserved profiles, including thin-file applicants and bankruptcy-prone segments

—Early indicators of increased approval rates, with full delinquency validation expected within 18 months

“The implementation of FICO Auto Score 10 is a game-changer for our risk and sales teams,” said Steven Zandpour, executive vice president and head of consumer and business banking at Associated Bank. “It empowers us to make faster, more predictive credit decisions and has already accelerated our loan approval rates.

“FICO Auto Score 10 gives us the agility to assess borrower terms with greater precision, without sacrificing loan volume. We’re especially excited by the early improvements in predicting future delinquency, particularly for thin-file and bankruptcy-prone segments,” Zandpour continued in the news release from FICO.

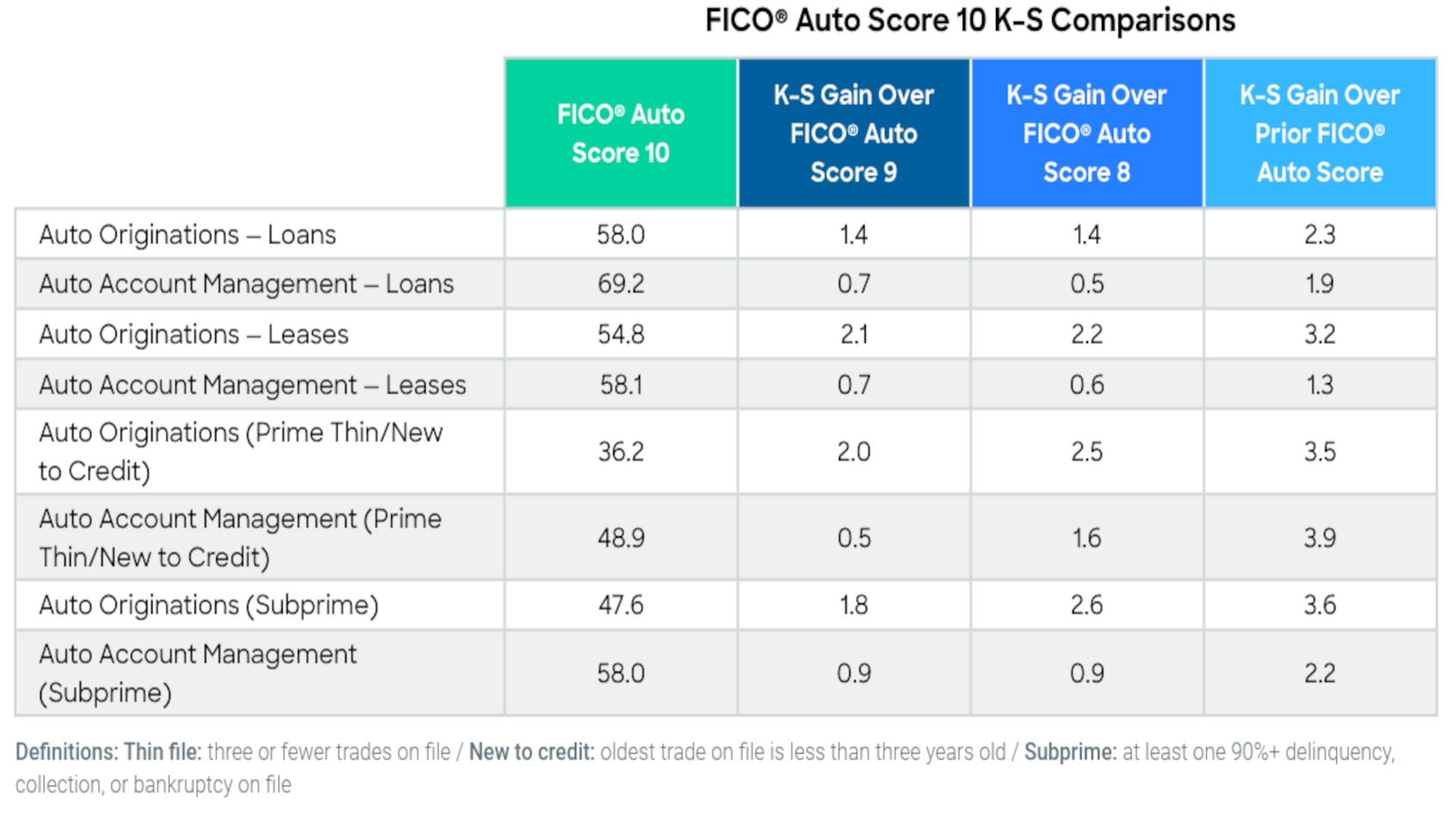

The company said FICO Auto Score 10 is the most powerful FICO auto-specific score yet, built on recent credit data to deliver sharper risk separation where auto lenders need it most: mid-band and thin-file borrowers.

FICO said the new version outperforms prior ones in predicting defaults, especially for prime thin/new-to-credit and subprime segments, helping lenders approve more loans while avoiding costly charge-offs.

Designed for seamless adoption, FICO Auto Score 10 keeps the 250–900 range, reason codes, and compliance readiness lenders demand.

“Associated Bank’s rapid adoption of FICO Auto Score 10 is a powerful example of how financial institutions can lead with agility and innovation,” said Shams Blanc, vice president of auto scores at FICO. “By leveraging dual processing, lenders can accelerate implementation timelines and validate predictive improvements in real time, without disrupting operations.

“This kind of forward-thinking approach is exactly what today’s credit landscape demands, and we’re proud to support Associated Bank in delivering smarter and faster lending decisions,” Blanc added in the news release.

Dealers and lenders can learn more about FICO Auto Score 10 and its predictive power by visiting https://www.fico.com/en/latest-thinking/solution-sheet/fico-auto-score-10.