VantageScore: Early-stage delinquencies at highest point in 5 years

Charts courtesy of VantageScore.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

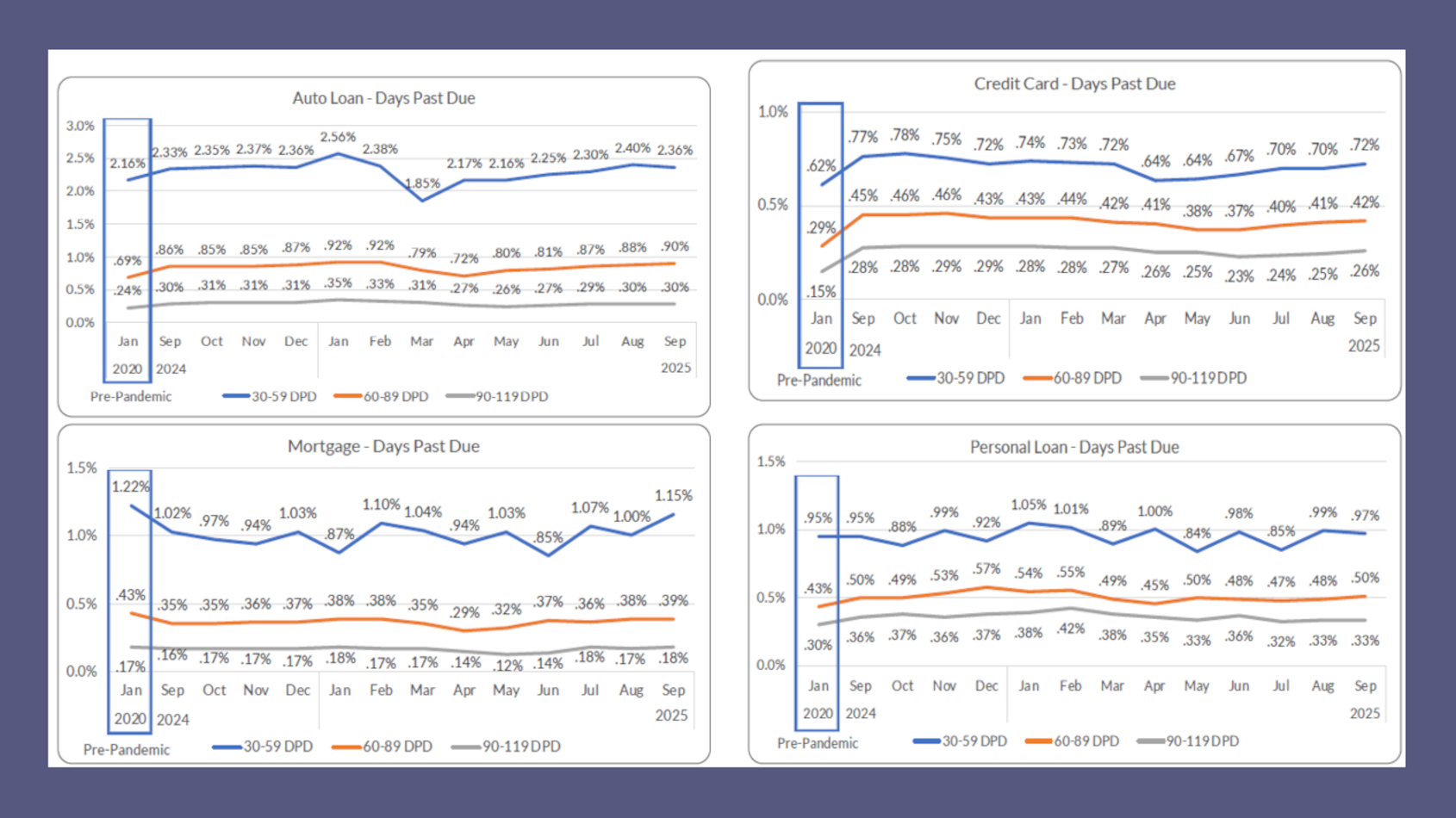

Along with slowing originations, the latest edition of CreditGauge by VantageScore showed delinquencies throughout the credit market are on the rise.

Analysts reported on Tuesday that overall credit delinquencies edged higher in September, with delinquencies 30 to 59 days past due moving to 1.13%. That’s up from 1.02% in August.

VantageScore said these early-stage delinquencies are approaching the pre-pandemic threshold of 1.15% for the first time in five years. Atif Mirza is senior vice president of digital at VantageScore.

“Consumers are facing high burdens, interest-rate fatigue, as well as the reality is earnings are not going up, and that’s squeezing the borrowers,” Mirza said in the October online video episode of CreditGauge LIVE when VantageScore elaborated about the latest findings.

Analysts indicated the average VantageScore 4.0 credit score remained stable at 701 in September. But that didn’t necessarily trigger a big volume wave flowing into portfolios.

The overall credit mix has been stable over the past two years, but since early 2025, there has been a gradual shift toward lower credit tiers, reflecting subtle pressure on borrower credit health amid persistent inflation and higher borrowing costs,” analysts said in the report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts indicated the share of VantageScore subprime (300–600) and near-prime (601–660) consumers edged higher, while the prime (661–780) segment continued to narrow, declining from 34.0% in September 2023 to 32.7% by September of this year.

VantageScore mentioned the number super-prime (781–850) borrowers also softened, easing to 30.8% of the credit market after peaking in the middle of this year, “indicating that more consumers are gradually moving out of premium credit segments into lower VantageScore tiers.”

With more consumers falling into lower credit tiers, VantangeScore pointed out originations In September declined across all products month-over-month, led by personal loans, followed by credit cards, auto loans and mortgages. Notably, new auto loans and mortgages have remained relatively subdued since the beginning of the year, likely constrained by high interest rates, affordability and macroeconomic headwinds.

“Banks are reining in new lending, suggesting that banks are taking a more cautious posture after a strong summer and leading to originations softening across most credit products,” VantageScore executive vice president and chief digital officer Susan Fahy said in a news release. “Early-stage delinquencies are near levels last seen before the COVID pandemic.”

The latest edition of CreditGauge also included more details about what’s happening in auto finance.

In September, VantageScore found that the average auto loan balance increased by $32 to $24,700, which is up by 1.7% year-over-year.

Analysts added the balance-to-loan ratio edged up to 63.99%, “staying relatively stable but indicating that borrowers are gradually taking on more debt as vehicle costs remain elevated.”

Month-over-month, VantageScore noticed auto loan originations declined slightly for Gen Z and Boomers, while holding steady for the rest of the generations compared to August.