AutoTrader report: Canadian used-car market steadies, but uncertainty ahead

Image courtesy of AutoTrader.ca.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Three quarters through a year of uncertainty, the Canadian used-vehicle market has finally reached … well, OK, there’s still uncertainty.

But according to the latest analysis from AutoTrader, the market is steadier than it’s been since the beginning of 2025.

AutoTrader’s Q3 2025 Price Index report found the “tariff-rush” that drove consumers to accelerate their vehicle purchases to beat the effects of tariffs imposed by the U.S. and Canada is over, leaving a landscape of increasing inventory (though only slightly) and prices stabilizing into what the report called “the new normal” (though still higher than pre-pandemic levels).

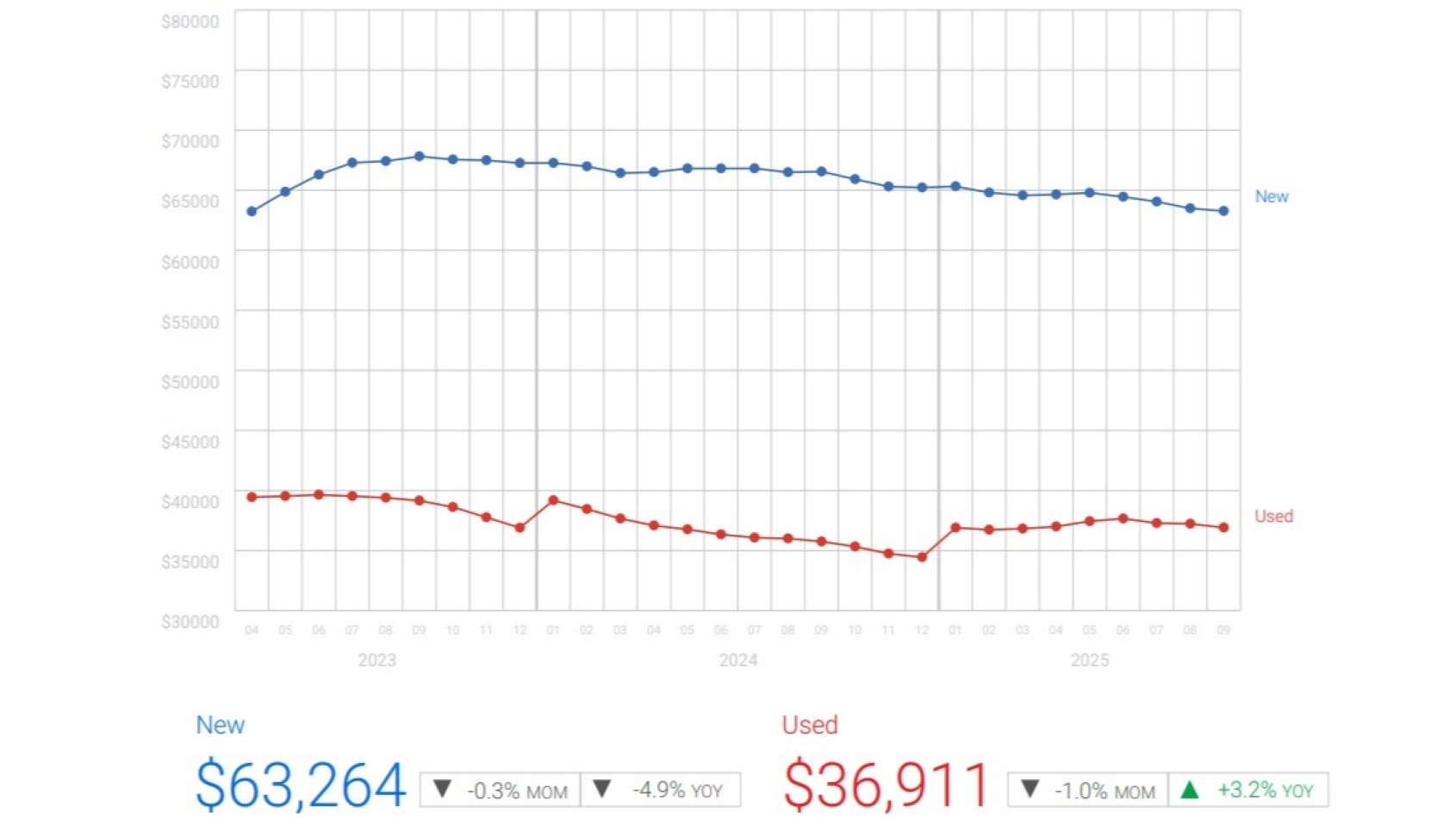

As the artificially strong sales of the spring and early summer tariff rush faded, Q3 settled into a more typical seasonal pattern. While new-car sales were up 2.5% over Q3 2024, according to Desrosiers Automotive Consultants data, AutoTrader’s estimates of used-vehicle sales showed a 1.4% year-over-year drop, and with that decrease in demand, used prices declined from the previous month in July, August and September, to an average of $36,911 by quarter’s end.

Still, that was 3.2% higher than the average price the previous year.

In addition to softening demand, the price decrease is also a product of an increase in used supply, caused in part by the rise in new-car sales resulting in more trade-ins, which the report said has not only boosted the overall number of used vehicles entering the market but has also shifted their makeup by creating a larger share of 1- to 4-year-old vehicles.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The stronger sales on the new side have been largely driven by lower new-car prices, which ended Q3 at an average $63,264. That’s more than $1,000 less than Q2 and down 4.9% year-over-year. In addition, the average interest rate for new vehicles is now at its lowest since July 2022.

Other factors boosting used inventory include the reciprocal tariffs, which AutoTrader said have reduced used car exports, thereby keeping more inventory in Canada, and the decline in used sales, keeping inventory levels higher.

But the effect of all that has not been large, and inventory is still tight as the reduction in new-vehicle in production, sales and leasing of the COVID era continues ripple through the used-car market.

Barring “significant changes” to those factors, the report said the inventory situation is unlikely to change much through 2026.

Where all this leads down the road is where the uncertainty comes in — again.

AutoTrader’s report said used-car prices may have peaked for now, but noted new-car prices could begin to rise again if manufacturers find they can’t handle tariff-driven costs, and that could make consumers turns to more affordable used options.

But it might not be that simple. Rising used demand combined with tighter inventory could drive used prices up. But AutoTrader pointed out the broader trend has been for used-car prices to fall as supply conditions improve and seasonal demand slows, so it’s possible the trajectory could continue downward for the next few months.

Which direction sales, prices and supply go depends on too many unpredictable elements to make an accurate forecast.

“Much will depend on the availability of both new and used vehicles, ongoing trade policy developments, and broader economic conditions,” the report said, “so visibility remains limited.”

The full report can be downloaded here.