October data from Cox Automotive & VantageScore shows expanded credit access but growing delinquency

Chart courtesy of VantageScore.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

You can make your own judgements about the state of the credit market based on October data from Cox Automotive and VantageScore.

In October, Cox Automotive reported, the Dealertrack Credit Availability Index resumed its upward trend of improved credit access after a slight tightening in the previous month. The index edged up to 98.3 in October from 97.9 in September.

The index also improved 4.1% from last October.

“Even though some key metrics varied, this continues the broader run of loosening credit conditions that began in late summer 2024,” Cox Automotive senior manager of economic and industry insights Jonathan Gregory wrote in an analysis that accompanied the index.

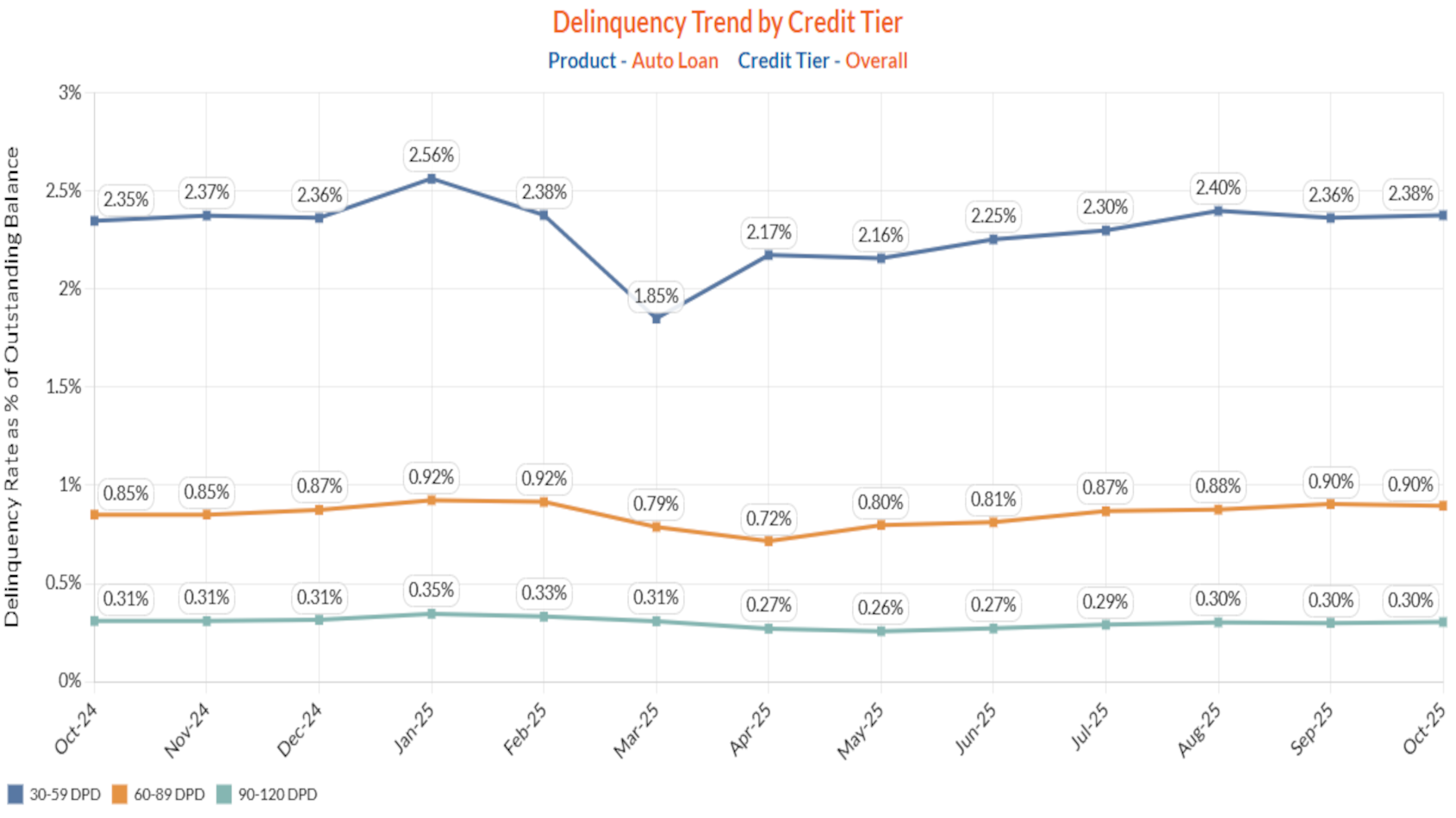

Meanwhile, according to the latest edition of CreditGauge by VantageScore, lower-income borrowers have led year-over-year increases in delinquencies of 60 days past due, a trend that continued in October.

Since July, VantageScore indicated delinquencies have risen more sharply among lower-income consumers, suggesting a disproportionate impact of persistent inflation, labor market softening and reduced access to credit on financially vulnerable households.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Since mid-2025, lower-income households are seeing increased delinquency rates year-over-year compared to middle- and high-income groups,” said Susan Fahy, executive vice president and chief digital officer at VantageScore. “Overall credit balances have continued to increase throughout 2025, reaching a five-year high, while credit utilization rates have risen month-over-month since September 2025.

“As consumers enter the holiday spending season, many are relying more on available credit to contend with a persistently higher cost of living,” Fahy continued in a news release, which also mentioned the average VantageScore 4.0 credit score remained stable at 701 in October.

VantageScore added the average credit balance edged up to $106,700 in October, an increase of $153 from the previous month, reaching a new five-year peak.

Perhaps that credit utilization impacted the auto-finance data that Cox Automotive’s Gregory recapped for the monthly Dealertrack index update.

Gregory noted the approval rate for auto financing rose 50 basis points year-over-year in October to 72.6% in October, but that’s also down 1.4 percentage points from September.

“While approval rates declined in October, this was offset by increases in subprime lending, longer loan terms, and reduced down payment requirements, which collectively expanded access for borrowers,” Gregory wrote.

And despite the delinquency in the market mentioned by VantageScore, Cox Automotive pointed out that lenders still were not risk averse.

Gregory found that the share of loans to subprime borrowers in October increased by 90 basis points month-over-month and 240 basis points year-over-year.

“This change suggests lenders are expanding access to higher-risk borrowers as overall credit loosens,” Gregory wrote.

Furthermore, Cox Automotive data showed contract terms continued to stretch in October. The share of contracts longer than 72 months jumped another 70 basis points on a sequential basis to 27.5%. It’s also up by a whopping 300 basis points year-over-year.

“This may reflect greater affordability pressures or lender flexibility on term length,” Gregory wrote.

Perhaps time will tell if the paper coming into portfolios will perform well or delinquency will continue to deteriorate. Here’s how Gregory summarized the scene.

“The continued improvement in credit access, especially in franchise used and non-captive new vehicle segments, continues to offer financing opportunities,” Gregory wrote. “While approval rates declined, the drop in down payments and more flexible loan terms may enhance affordability. However, consumers should remain mindful of longer loan terms and slightly higher negative equity levels when evaluating loan offers.

“The performance across lender types reflects the increased risk appetites and strategic priorities,” he continued. “Finance companies, captives, banks and credit unions all appear to be expanding access. As credit conditions evolve, lenders must balance growth with prudent risk management, especially amid shifting rate environments and consumer behavior.

“Overall, the October Dealertrack Credit Availability Index reflected a continuation in the loosening of auto credit conditions. The improvement was driven primarily by lenders’ increased willingness to extend credit to subprime borrowers through longer terms and lower down payments, even as overall approval rates declined,” Gregory went on to write. “However, this expanded access came with higher yield spreads, meaning consumers paid more for financing compared to prevailing market rates.”