Auto snippets from TransUnion’s October 2025 Credit Industry Snapshot

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

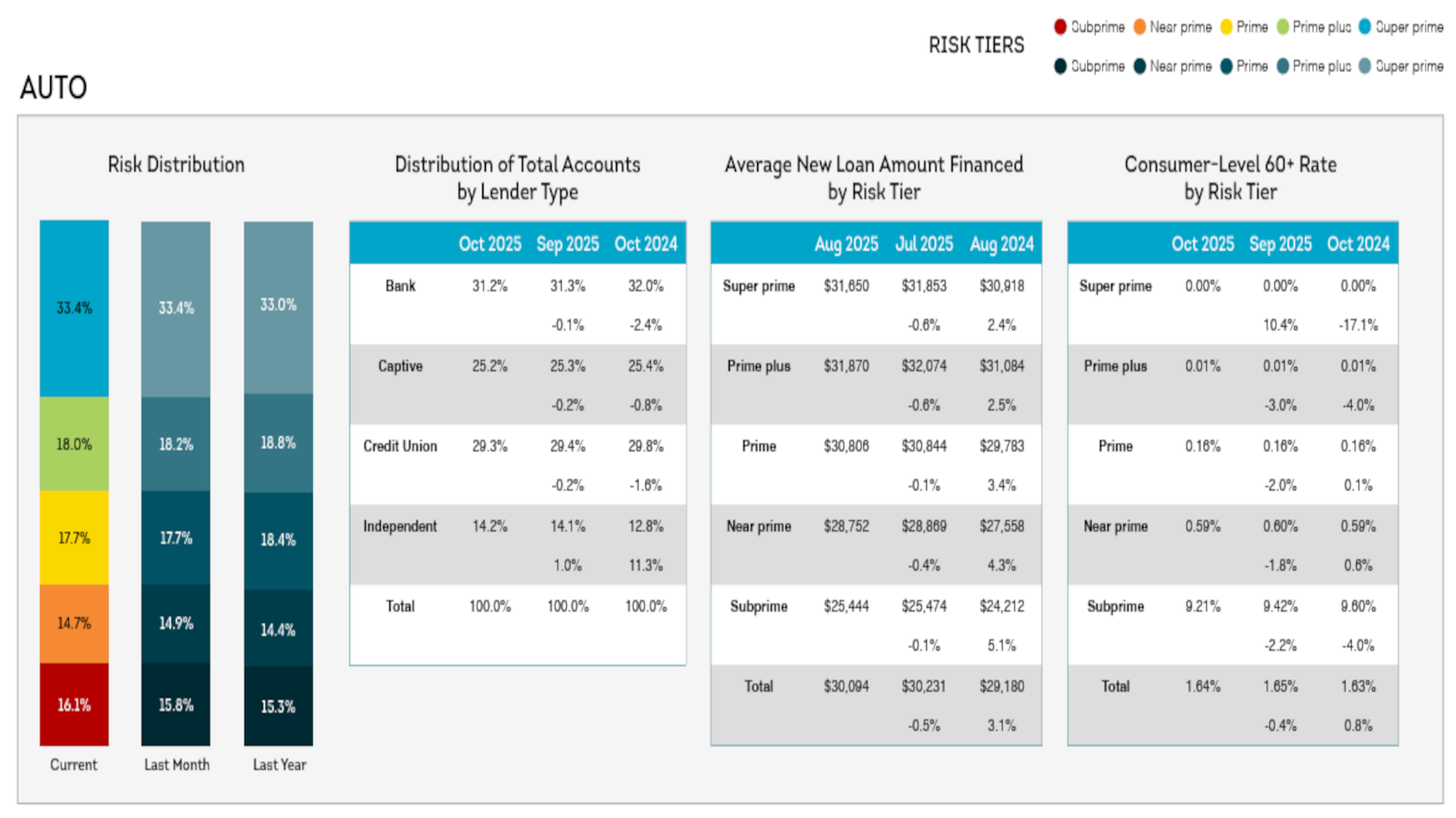

As Cox Automotive’s information showed credit access improved a bit in October, TransUnion’s October 2025 Credit Industry Snapshot showed 16.1% of the current, industry-wide auto portfolio falls into subprime, which covers individuals with a VantageScore 4.0 reading between 300 and 600.

That new reading on subprime is up from 15.8% in September and 15.3% a year earlier, according to TransUnion tracking.

And by the way, TransUnion reported consumers who fell into near-prime — holding scores between 601 and 660 — constituted 14.7% of the current auto portfolio.

Analysts mentioned a couple of other month-over-month movements from their October data generated in the auto space, including:

—Delinquencies at 30 days past due remained unchanged at 4.34%, while delinquencies at 60 days past due decreased to 1.64%

—Average amount financed for contracts booked in October decreased to $30,094 from $30,231

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Consumer credit conditions are likely to remain mixed for the remainder of 2025,” TransUnion said in an analysis that accompanied the snapshot. “Lower interest rates should ease borrowing costs for consumers, potentially supporting holiday spending.

“However, persistent labor market weakness, subdued sentiment and lingering uncertainty from the shutdown may temper demand for new credit,” analysts continued. “Overall, credit growth will likely continue at a modest pace, with risks tilted toward slower originations and rising delinquencies if job losses accelerate.”