Sumsub report on global fraud explains ‘sophistication shift’

Graphic courtesy of Sumsub.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

A global examination of fraud by Sumsub showed how much of a worldwide problem it really is.

Sumsub recently released its Identity Fraud Report 2025-2026, analyzing millions of verification checks and more than 4 million fraud attempts between 2024-2025. The study blends global and regional dynamics from internal data with findings from Sumsub’s Fraud Exposure Survey 2025, featuring responses from more than 300 risk professionals and over 1,200 end users.

In 2024, Sumsub explained the rise of fraud-as-a-service platforms and ready-made toolkits “democratized” identity crime, making it widely accessible to non-tech-savvy fraudsters.

In 2025, Sumsub indicated that trend matured into what the verification and fraud prevention company called a “sophistication shift,” with fewer but more professionalized operations designed for higher-impact damage.

“The sophistication shift marks a turning point, as businesses now face challenges tied to their velocity: the speed at which they can detect threats and adapt,” Sumsub co-founder and CEO Andrew Sever said in a news release.

Key findings from the report included:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—180% year-over-year growth in ‘sophisticated’ fraud: the share of multi-step attacks rose from 10% (2024) to 28% (2025) of all identity fraud.

—In 2025, 40% of surveyed companies and 52% of end users reported being victims of fraud; 75% of respondents believed fraud to become increasingly AI-driven.

—Over 2024-2025, the overall identity fraud rate decreased from 2.6% to 2.2%, but still remained above the 2.0% level of 2023.

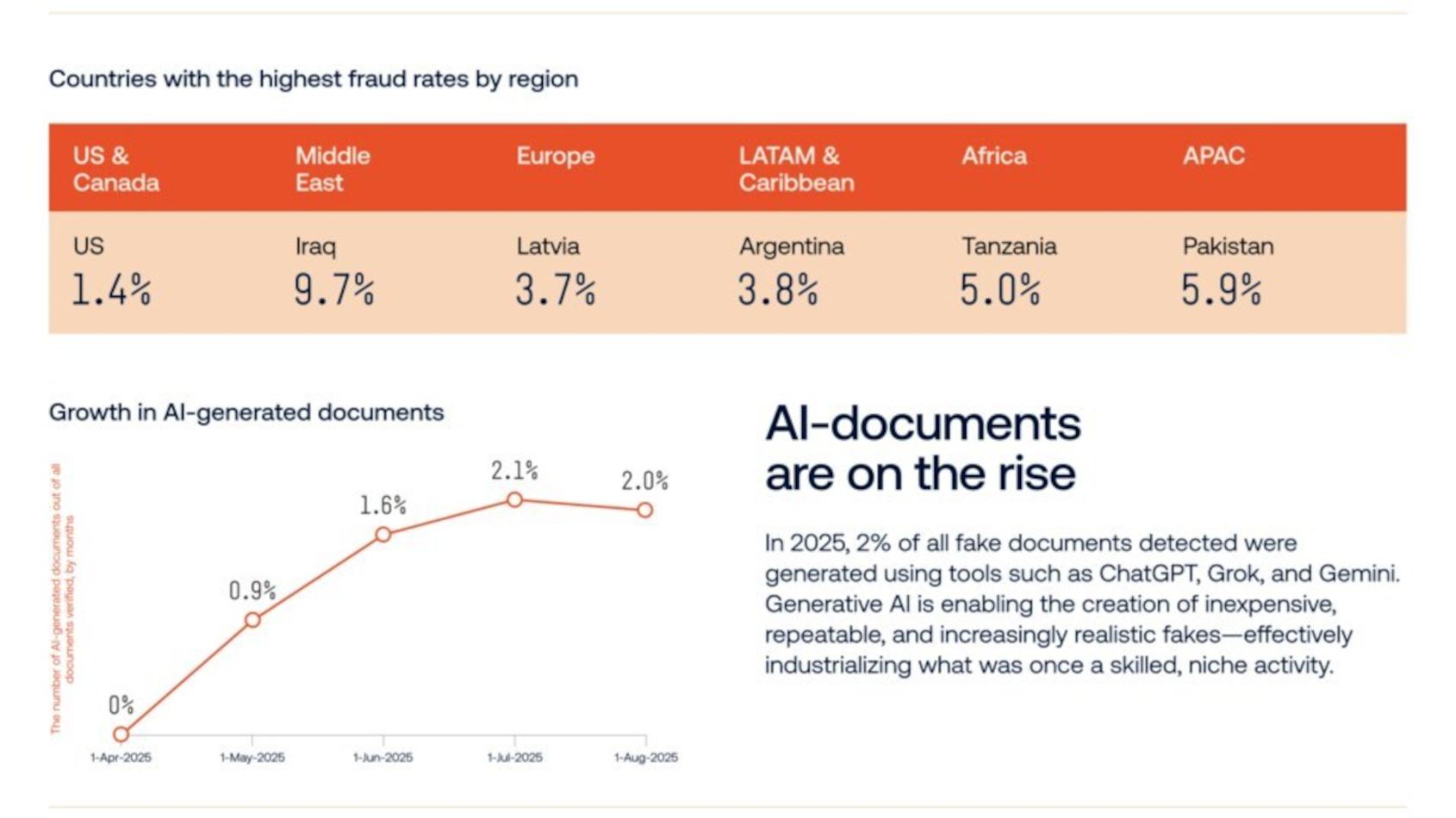

—A new trend for fake documents: AI-assisted forgery rose from 0% to 2% in 2025, driven by tools such as ChatGPT, Grok, and Gemini.

—Sectors most affected by fraud in 2025 included online media & dating (6.3%), financial services (2.7%), crypto (2.2%), professional services – consulting, legal, accounting, marketing, and freelance platforms (1.6%), video gaming (1.6%).

—Top first-party fraud schemes (the individual behind the verification is the fraud actor): synthetic identity (21%), chargeback abuse (16%), application fraud (14%), deepfakes (11%), money mules (11%).

—Top third-party fraud schemes (external attackers exploit or impersonate genuine users): identity theft (28%), account takeover (19%), card testing (17%), social engineering (16%), bot attacks (12%).

Sumsub also indicated a new risk is the emergence of artificial intelligence fraud agents, autonomous, self-learning systems capable of executing entire fraud operations with minimal human intervention.

In some cases, experts said a single agent can orchestrate a comprehensive attack chain, mixing fake-ID document generation, deepfake video submission, and human-like interaction at high speed.

“Protection mechanisms must evolve faster to block such attempts,” Sumsub said.

Experts added that fraud production is also becoming industrialized by mixing automation, cross-channel manipulation, and orchestration.

With roughly one in 50 forged documents now AI-generated, Sumsub explained visual checks are among the most exposed layers.

“As big tech innovations such as Google Veo 3.1 and OpenAI’s Sora 2 push the limits of hyper-realistic content, even protective measures like watermarks are proving increasingly easy for professional scammers to bypass,” Sumsub said.

Sumsub head of artificial intelligence and machine learning Pavel Goldman-Kalaydin pointed out that attackers are shifting from content to context, targeting the telemetry layer of verification — SDKs, APIs, data pipelines, and device/environment signals — to mask origins and behavior.

“AI reshapes both offense and defense,” Goldman-Kalaydin said in the news release. “Attackers gain deepfakes, synthetic IDs, and autonomous fraud agents; defenders gain behavior modeling, millisecond anomaly detection, and self-learning systems. The next frontier is verifying AI agents themselves, confirming not just who you are, but who acts on your behalf.”

Sumsub experts closed by higlighting effective measures for the future should include:

—Compliance teams turning into consolidated risk intelligence units that blend compliance, fraud detection, reporting, and case management

—Verification moving from single checks to continuous assessment—combining device telemetry, behavioral analytics, and contextual intelligence into one adaptive layer

—AI tech providing the backbone for efficiency, integration, and transparency

“As AI agents increasingly transact on behalf of users, verification systems will involve their secure and traceable verification–potentially, by other AI agents,” Sumsub said.

To explore the report in full detail, go to https://sumsub.com/fraud-report-2025/.