StoneEagle Q3 data shows steady times in dealer F&I departments

Graphic courtesy of StoneEagle.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

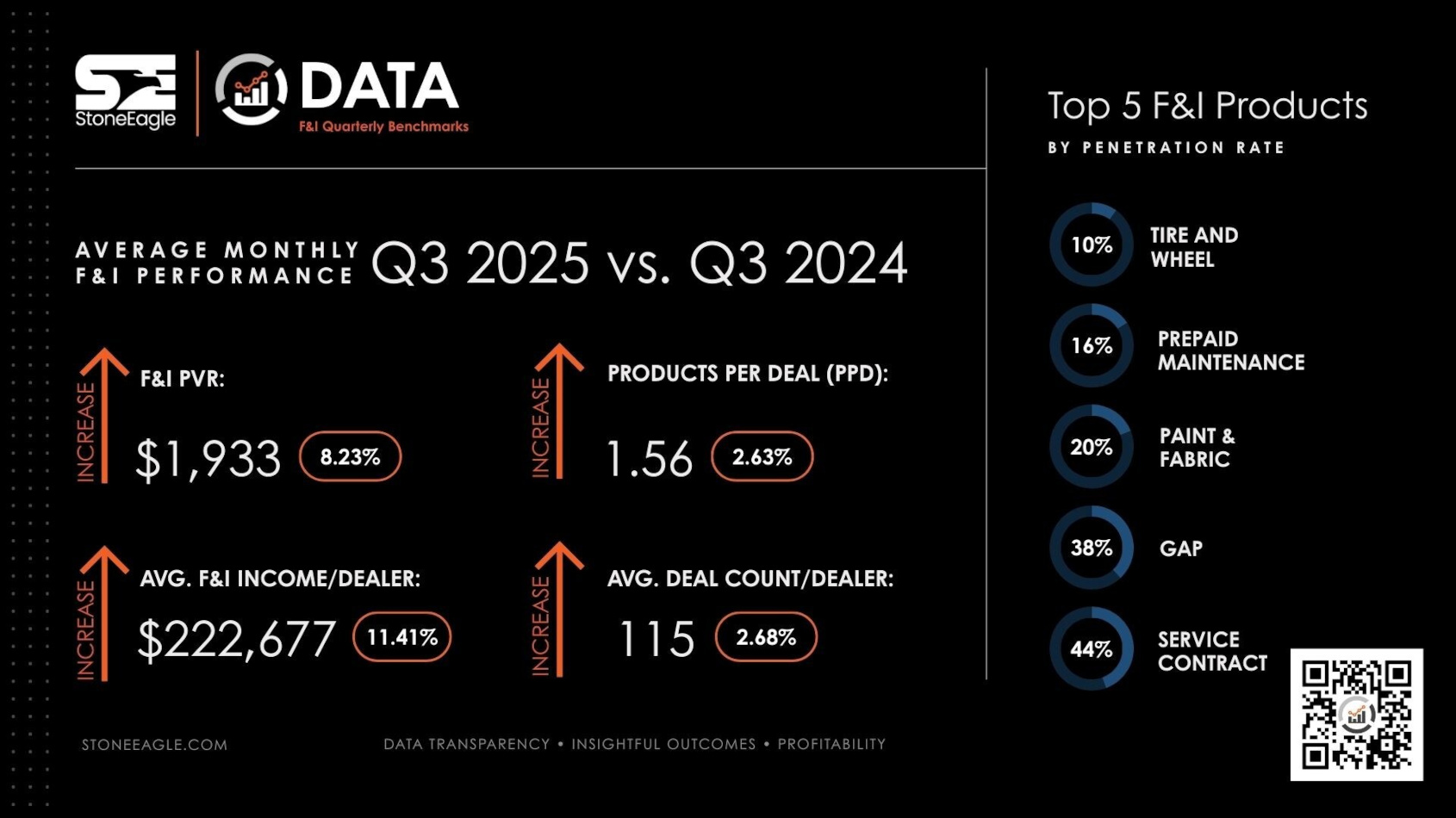

StoneEagle on Tuesday highlighted how it was a steady quarter in dealership F&I departments amid some gross-profit turbulence seen in July, August and September.

Third-quarter information included in the StoneEagleDATA F&I Benchmark Report showed stable F&I performance across key metrics. Analysts found that deal counts rose nearly 3% year-over-year, and total F&I income per dealer increased almost 12%.

StoneEagle indicated F&I profit per vehicle retailed (F&I PVR) climbed 8% year-over-year, while average products per deal generated a 2.5% lift.

Analysts computed these gains helped limit total gross per deal to a modest 2.1% decline despite a sharp 26% drop in front gross versus the third quarter of last year.

Here’s a breakdown of the overall F&I trends that StoneEagle reported for Q3:

—F&I profit per vehicle retailed (F&I PVR): Averaged $1,933 per deal in the third quarter, up from $1,923 in the second quarter and $1,786 in the third quarter of 2024.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Products per deal (PPD): Averaged 1.56 products per deal, compared with 1.57 in the second quarter and 1.52 in the third quarter of 2024.

—Average monthly F&I income per dealer: Averaged $222,677, up from $219,266 in the second quarter and $199,876 in the third quarter of 2024.

—Average front gross: Averaged $560 per vehicle, down from $839 in the second quarter and $761 in the third quarter of 2024, but still roughly 30% above pre-COVID levels.

—Total gross per vehicle: Averaged $2,493, down from $2,762 in the second quarter and $2,547 in the third quarter of 2024.

Next, StoneEagle examined how various F&I product performed during Q3.

Analysts said product performance this period remained solid, with service contracts and GAP continuing to anchor F&I revenue.

StoneEagle added ancillary offerings also held steady, accounting for roughly one-third of product-driven F&I revenue.

Overall, analysts determined product sales represented just over 60% of total F&I revenue this past quarter, “reinforcing the balanced mix that supported performance.”

Here’s a further breakdown of the StoneEagle data:

—Vehicle service contracts (VSC): Held steady at 44% penetration in the third quarter, compared with 45% in the second quarter and 44% a year earlier.

—Guaranteed asset protection (GAP): Reached 38%, consistent with the second quarter and up from 36% in the third quarter of 2024.

—Paint-and-fabric protection: Averaged 20%, up from 19% in the third quarter of 2024.

—Prepaid maintenance: Held at 16%, unchanged from both the second quarter and the third quarter of 2024.

—Tire-and-wheel protection: Averaged 10%, matching both the second quarter and the third quarter of 2024.

“F&I product providers continue to innovate, and we’re seeing the impact in the data,” said Colin Snyder, general manager of StoneEagle’s Automotive Retail Solutions, including StoneEagleDATA, StoneEagleMETRICS, StoneEagleMENU, and StoneEaglePENCILWRENCH.

“StoneEagleDATA shows a clear shift toward well-built product bundles and appearance packages that consumers continue to see value in, and F&I offices are doing an exceptional job presenting these protections in ways that support overall profitability,” Snyder continued in a news release.

The report also mentioned electric vehicles represented only 5.5% of franchised dealer transactions in the third quarter, according to StoneEagleDATA.

Analysts pointed out nearly 60% of those EV deals were leases, “reflecting how dealers used leasing as a bridge of affordability during the final months of the federal EV tax credit.”

StoneEagle added total gross per deal also trended lower, driven by a sharp drop in front gross as dealers stretched to put vehicles over the curb.

“EVs drew a lot of attention this period, but they were only a small slice of what we measured,” StoneEagle CEO Cindy Allen said in the news release. “StoneEagleDATA shows that dealers doubled down from a front-gross perspective and leaned on leasing to help consumers into EVs, and that consistent F&I revenue is what gives them the ability to make those adjustments.”