TransUnion sees auto delinquency rising for fifth straight year

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TransUnion acknowledged its 2026 Consumer Credit Forecast originated through a “complex backdrop,” with unemployment being one of the primary ingredients in analysts’ prediction of auto-finance delinquency rising for the fifth year in a row.

And perhaps that “complex backdrop” got even more complicated when the Bureau of Labor Statistics reported on Friday that employers hired only about 50,000 workers in December.

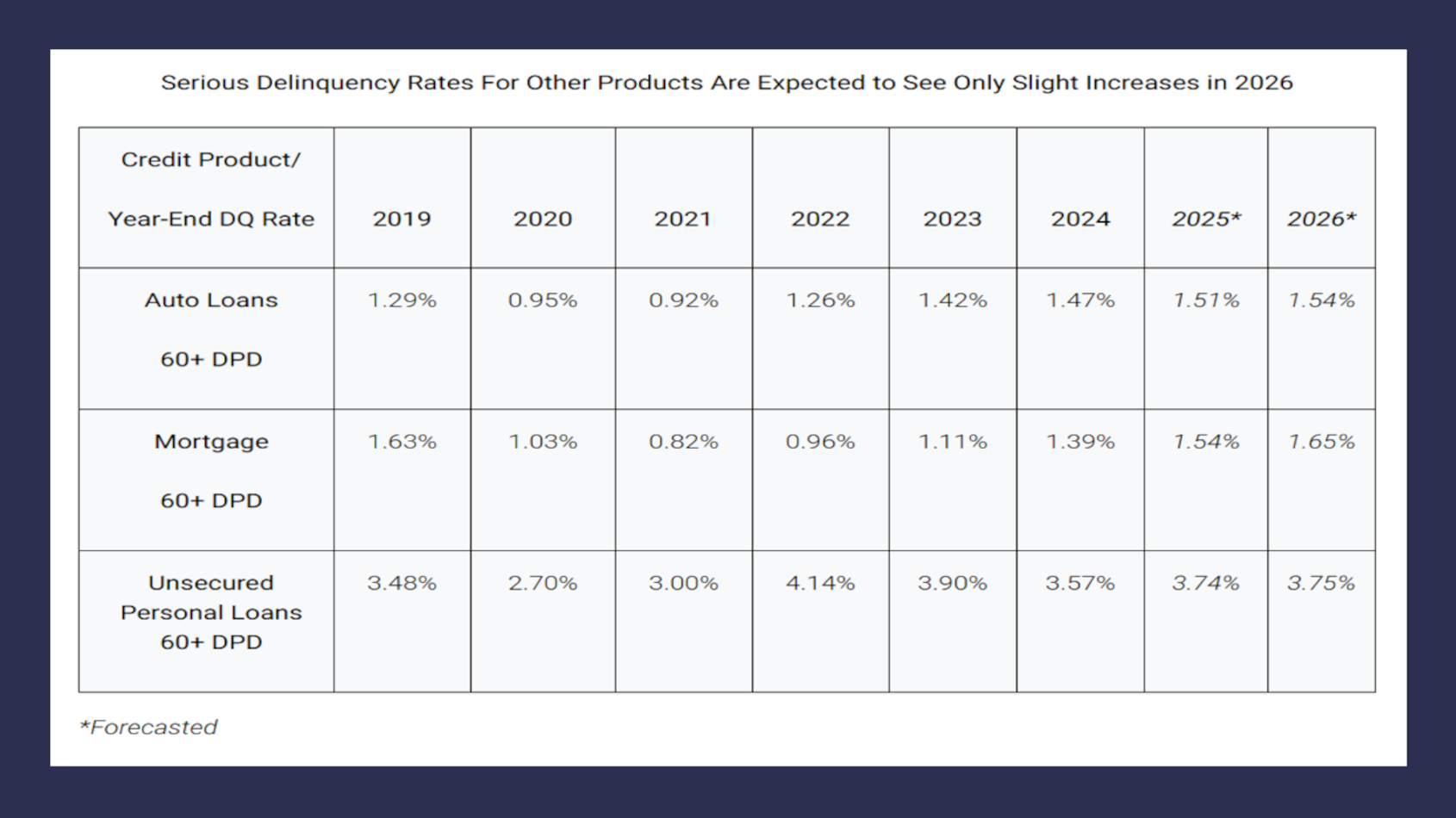

TransUnion projected that auto-finance accounts 60 days or more past due are expected to reach a rate of 1.54% in 2026. That would represent a lift of 3 basis points year-over-year, marking the fifth straight year of higher delinquencies, “though each increase has become progressively smaller,” according to TransUnion.

Analysts continued, “The forecast reflects a complex backdrop: inflation remains above target at 2.45%, and unemployment is expected to rise slightly to 4.5% by late 2026, which could put strain on household budgets for certain borrowers.

“At the same time, multiple anticipated Federal Reserve rate cuts over the next year should ease borrowing costs and provide some relief to consumers,” TransUnion added.

Analysts also shared delinquency expectations across other credit products

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Mortgages: Accounts landing 60 days past due are projected to hit 1.65% in December 2026. That would be a year-over-year increase of 11 basis points, “influenced by a modest rise in unemployment.”

—Unsecured personal loans: Consumers falling 60 days or more past due are forecasted to edge up 1 basis point year-over-year to 3.75%, “driven partly by macroeconomic pressures and increased non-prime originations.”

TransUnion reiterated its forecasts are based on various economic assumptions, such as expected consumer spending, disposable personal income, home prices, inflation, interest rates, real GDP growth rates and unemployment rates, among other metrics. The forecasts could change if there are unanticipated shocks to the economy.

Analysts added better-than-expected improvements in the economy, such as increases in GDP and disposable income, could also impact these forecasts.

Michele Raneri is vice president and head of U.S. research and consulting at TransUnion.

“Delinquency rates across most credit products are expected to see slight increases, which is not surprising given the unsettled economic environment,” Raneri said. “The growth in serious delinquency rates remains measured, and consumers appear to be managing their finances reasonably well. We’ll continue to monitor these trends closely to determine whether this signals a broader improvement in consumer credit health.”