December auto-credit availability climbs to best level in more than 3 years

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

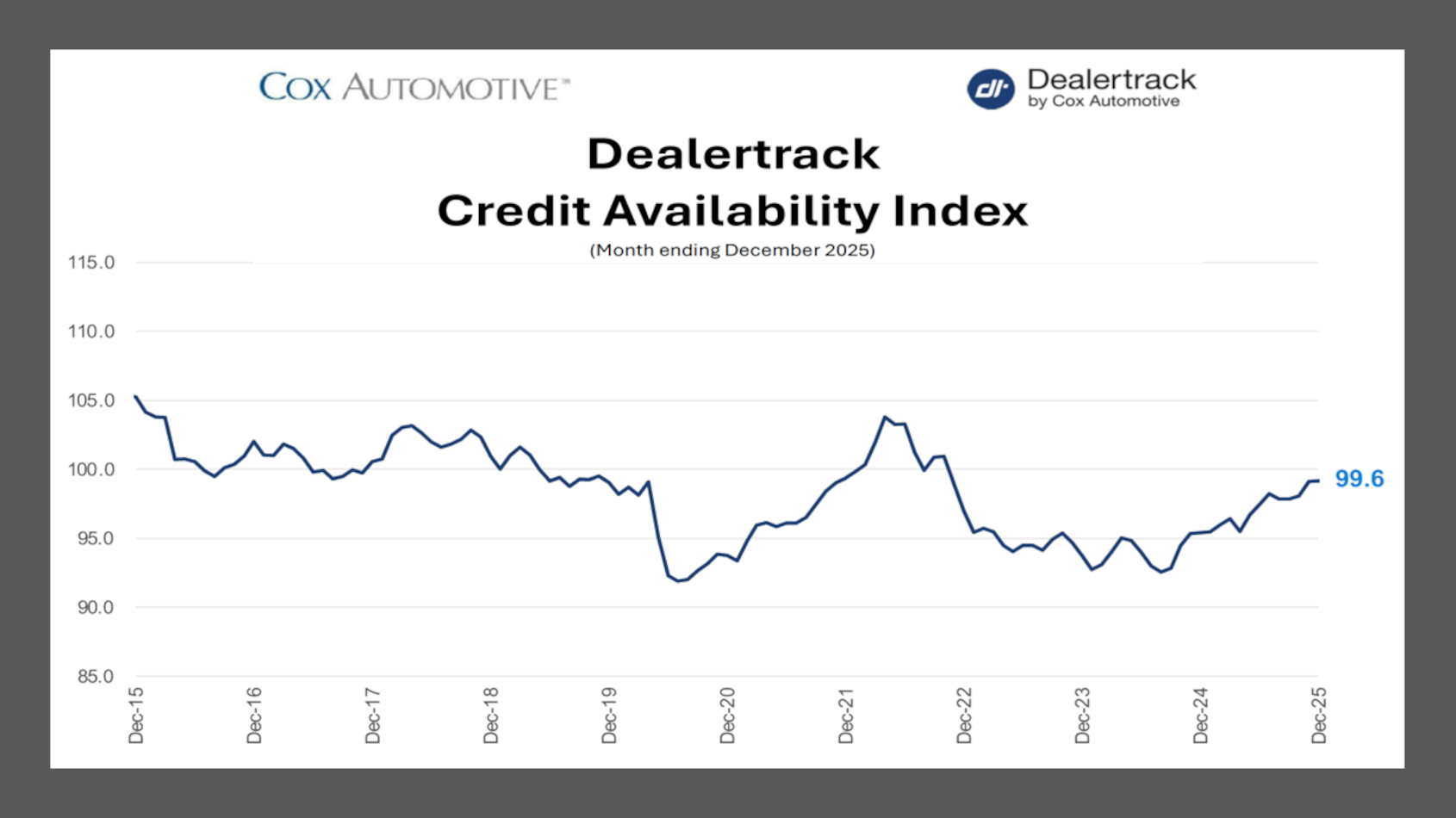

Jonathan Gregory recapped 2025 from the credit-granting perspective since the December Dealertrack Credit Availability Index reached its highest point of year and reflected the best level since October 2022.

The Cox Automotive senior manager of economic and industry insights on Monday explained that for all of 2025, the Dealertrack Credit Availability Index averaged 97.3, a 3.4-point improvement from 2024’s average of 93.9, representing a 3.6% year-over-year gain. Gregory pointed out in an analysis that this reading marked a “notable reversal” from 2024, which saw the index decline slightly from 2023 levels, “as lenders remained cautious amid elevated rates and affordability pressures.”

Gregory indicated that the improvement accelerated throughout the year, with the second half of 2025 averaging an index reading of 98.4 compared to 96.3 in the first half. He said December’s reading of 99.6 also brought the index back near its January 2019 baseline of 100 for the first time in more than two years, “signaling that credit conditions have largely normalized following the tightening cycle that began in late 2022.”

Gregory continued in the online analysis, “The full-year improvement was driven primarily by increased subprime lending, which accounted for over half of the index gain as lenders expanded their risk appetite after a cautious 2024. Greater accommodation of longer loan terms — with the share of loans exceeding 72 months rising nearly 2 percentage points — contributed roughly a quarter of the improvement, reflecting lender flexibility in addressing ongoing affordability pressures.

“Yield spread compression added another 18% of the gain through more favorable consumer pricing. Notably, overall approval rates edged slightly lower year-over-year, a modest headwind that was more than offset by the loosening in other components,” he went on to say.

Cox Automotive reiterated that its Dealertrack Credit Availability Index tracks six factors that affect auto credit access, including:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Loan approval rates

—Subprime share

—Yield spreads

—Term length

—Negative equity

—Down payments

Reported monthly, Cox Automotive said the index indicates whether access to auto credit is improving or declining. “This typically means that it is cheaper and easier for consumers to obtain a loan or more expensive and harder,” the company said, adding that the index is published on about the 10th day of each month.

As mentioned previously, Gregory reported the December index reading hit its highest point of 2022, landing at 99.6. A few ingredients that helped the year finish strong on the availability front included:

—The contract approval rate for rose to 73.7% in December, representing the second straight months of increases after two months in a row of declines

—Subprime share finished 230 points higher year-over-year

—December also marked the lowest level of negative equity Cox Automotive saw in 2025

Also of note, Gregory acknowledged the average down payment percentage decreased by 10 basis points in December from 13.4% to 13.3% and softened 100 basis points year-over-year.

“This may reflect increased consumer demand or lenders’ greater flexibility as credit conditions ease,” he said.

Gregory wrapped up his December observations with these comments.

“Ongoing improvement in credit access, especially in both the new and used markets, continues to offer financing opportunities. While approval rates increased, the slight decline in down payments combined with longer loan terms may indicate stretched affordability. Consumers should remain mindful of the total cost of ownership when evaluating loan offers,” he said.

“The performance across lender types reflects a shift in strategic priorities. Finance companies, captives, banks and credit unions all appear to be expanding access but are more cautious about risk. As credit conditions evolve, lenders must balance growth with prudent risk management, especially amid shifting rate environments and consumer behavior,” Gregory went on to say.