Two dealers already impressed with Octane’s Captive-as-a-Service

Image courtesy of the company.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Octane is accelerating its presence in automotive.

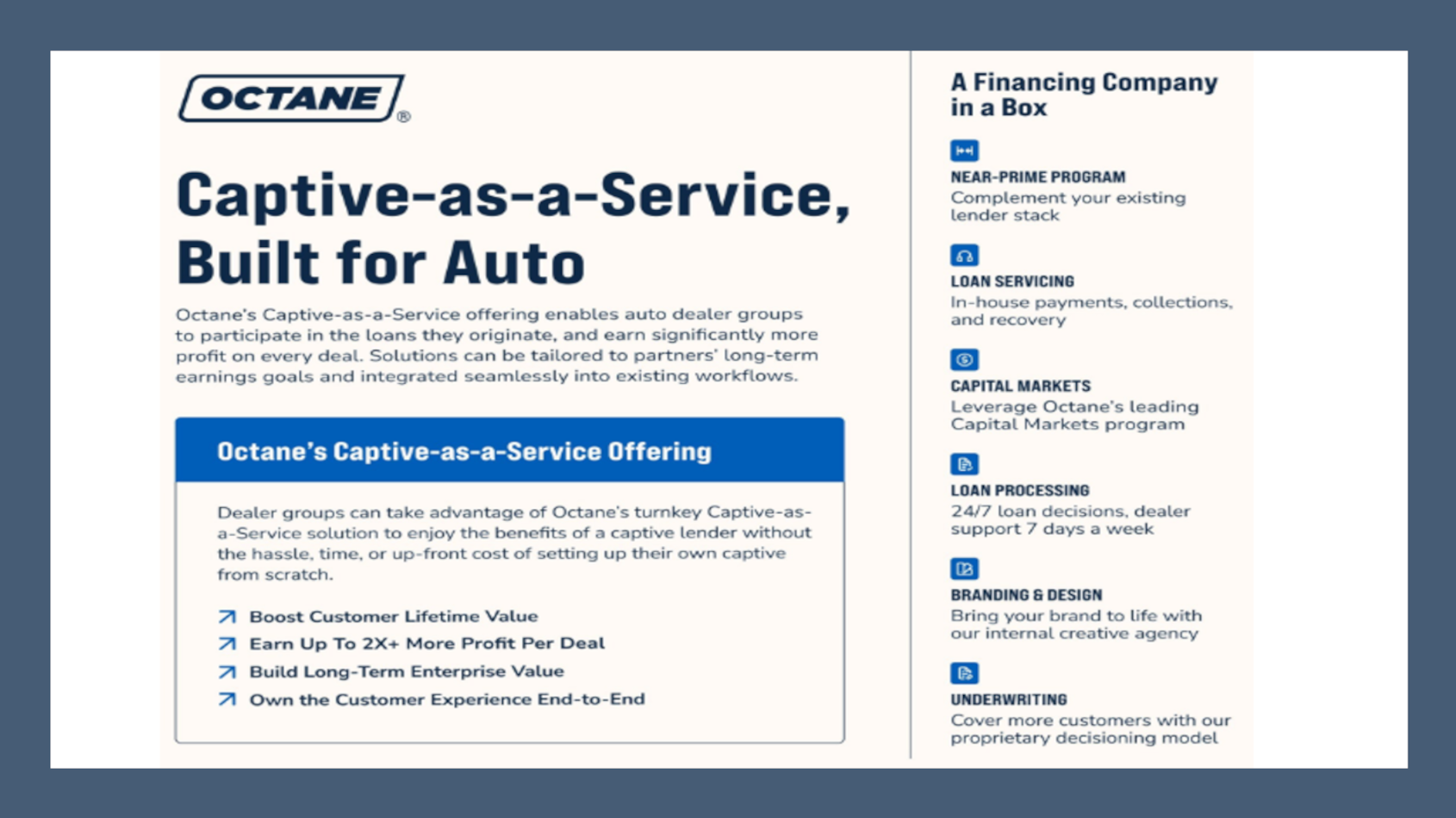

The fintech company founded in 2014 that already has more than 60 OEM partner brands, 4,000 dealer partners, and a team of more than 600 professionals is now offering what’s positioned as Octane’s Captive-as-a-Service.

The product is designed to enable dealerships to enjoy the benefits of owning a captive finance company without the significant up-front costs, time, effort, and investment required to establish such a business.

Octane’s turnkey solution is supposed to bring together core captive business elements, including credit underwriting, loan processing, loan servicing, funding and capital markets execution, under a brand name of the partner’s choice.

The company said its dealer partners and their customers can benefit from a seamless technology-forward experience.

Additionally, tailored programs can include access to digital soft-pull tools, Octane Prequal and Prequal Flex, to drive qualified leads; a customized lending platform to support dealership-level promotions; and monthly customer touchpoints enabling dealer marketing for the duration of a consumer’s loan.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As a result, Octane’s Captive-as-a-Service solution can allow dealers to earn more money on each sale, grow and diversify their earning streams, strengthen customer loyalty, and build long-term enterprise value.

Two dealers are already using the offering.

Roger Holler III is president and CEO at Holler-Classic Family of Dealerships.

“We’re extremely impressed with Octane’s efficient and seamless process, providing an integrated financing experience that directly benefits our customers,” Holler said in a news release from Octane. “Our buyers across the credit spectrum can move confidently through the loan process, while giving us more control as we continue to scale our business.

“Partnering with Octane’s team has been fantastic; a smart business move for the Holler-Classic Family of Dealerships,” Holler added.

Matt Greenblatt is owner and dealer principal at Matt Blatt Dealerships.

“The Octane Captive program makes an incredibly powerful tool — captive financing — approachable and deployable for us as a dealer group,” Greenblatt said in the news release. “We are able to serve our customers better, see a fantastic return on our portfolio, and leverage the Octane team to implement solutions that save us money and bring in new customers.

“This is a new area of growth and profit for us and we are excited to be leading the industry and embracing it,” Greenblatt went on to say.

Octane co-founder and chief executive officer Jason Guss explained how the company got to this juncture of its automotive journey.

“At Octane, we are constantly looking for ways to help our partners grow their businesses. With Captive-as-a-Service, we give dealer groups the flexibility to create a program to meet their specific needs, like supplementing their existing lender mix, connecting their in-store and digital strategy, or turning their loan portfolio into a profit center,” Guss said in the news release.

“After seeing success with captive and private label partnerships in the powersports and RV markets, we are excited to bring our Captive-as-a-Service solution to the auto market,” Guss continued.

Through its in-house lender, Roadrunner Financial, Octane has surpassed $7 billion in aggregate originations since its founding a dozen years ago.

Dealers can benefit from Octane’s in-house loan processing team, which offers support seven days a week, and its award-winning loan servicing team, which handles in-house payments, collections, and recovery.

Dealers can also leverage Octane’s significant capital markets experience; the company has issued more than $4.7 billion of asset-backed securities (ABS) since establishing its ABS program in December 2019, has cumulatively sold or secured commitments to sell $3.3 billion in loans through whole loan sale and forward flow transactions, and maintains strong relationships with institutional investors, banks, rating agencies, and warehouse capital providers.

Furthermore, Octane’s leadership team, which includes president and CFO Steven Fernald, chief risk officer Mark Molnar, and senior vice president of credit strategy, auto, David Bertoncini has more than 50 years of combined experience in capital markets, financial services, compliance, and credit risk, and more than 25 years of combined experience in auto lending.

“Our Captive-as-a-Service solution also unlocks countless marketing opportunities to drive value across the dealership, like coupons for servicing and maintenance or remarketing messages to drive the next sale,” Octane co-founder and chief growth officer Mark Davidson said.

“At the same time, we help dealers deliver a fast, seamless financing experience to their customers through our digital tools and instant credit decisioning, and responsibly extend credit to a wide range of customers through our proprietary underwriting model,” Davidson went on to say.

Learn more at octane.co/o/captive-lending.