Experian: Nearly 9 in 10 dealers now concerned about fraud

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

It was probably as sure of a bet as you could find in Las Vegas last week: dealerships are quite concerned about fraud happening at their stores.

In new research released during NADA Show 2026, Experian reported fraud continuing to emerge as a growing operational challenge for the automotive industry, with its latest survey showing nearly 9 in 10 dealers are concerned about fraud.

Survey findings also show 70% of dealers believe fraudulent transactions are on the rise, signaling upward momentum.

A closer look at the study highlighted the financial influence fraudulent transactions can have on a dealership’s bottom line.

On average, over the last 12 months, dealers reported approximately four fraudulent deals were completed prior to detection.

Additionally, 45% reported that a single fraudulent transaction typically results in an estimated financial loss of $10,000 to $20,000, while 31% indicate their losses exceed that range.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experian pointed out dealers are bearing a substantial share of fraud-related losses, with 64% reporting that insurance covers less than half of these costs.

While some receive partial relief from lenders, Experian discovered 67% of survey dealers estimated that finance companies cover less than 50% of the losses and 10% said that credit providers offered no coverage at all.

“When one fraudulent transaction can wipe out tens of thousands of dollars in profit, it’s simply too big to ignore,” Experian’s senior director for automotive Jim Maguire said in a news release. “These losses will eventually cut directly into a dealer’s margin and put serious strain on their operations, making it harder to stay profitable.”

Beyond direct losses, Experian pointed out that fraud is reshaping daily dealership operations and influencing customer experience.

In fact, three in four dealers told researchers that auto-finance fraud affects their business operations.

Furthermore, 53% of survey participants cited balancing fraud prevention with a smooth and fast customer experience as their biggest challenge, while 46% said verification steps slow down the deal and frustrate customers.

Experian’s research also delved into emerging fraud schemes fueling today’s transactions.

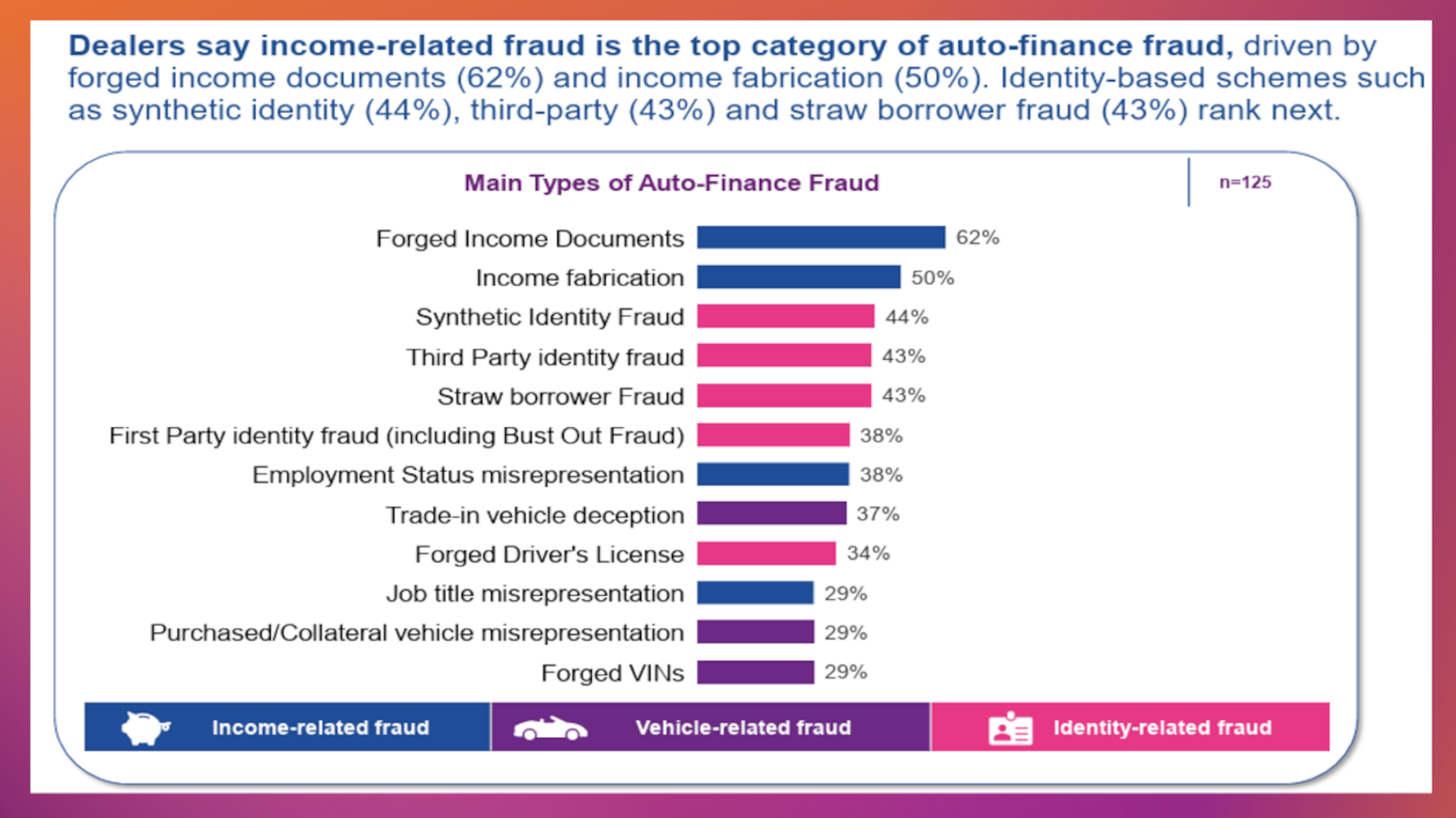

Dealers reported automotive fraud can be classified into three primary categories: income, vehicle, and identity.

The survey indicated the most common fraud schemes fall in the income-related category.

Experian reported 62% of dealers said they encounter forged income documents and 50% see fabricated income claims.

While income-related fraud schemes are the most common, identity-related fraud has become one of the fastest growing risks dealers are facing, according to the Experian survey.

In fact, 44% of dealers expressed having to navigate synthetic identity attempts and 43% have seen both third-party and straw borrower fraud in the last 12 months.

Despite the prevalence of identity- and income-related fraud, Experian found that nearly half (46%) of dealers only validate income when something seems “off.”

Researchers indicated that manual verification remains common, with 67% of dealers capturing ID via driver’s license scanners and 63% via photocopying.

Maguire explained these methods will likely increase friction and create more vulnerabilities to sophisticated document manipulation.

“Fraud is no longer just a risk problem for dealers, it’s a profit leak and a customer experience problem all at once,” Maguire said. “The best defense is simple: confirm identities upfront using multiple data sources, verify income and employment early, validate trade-in vehicle details so clean deals move quickly, and flag anything that doesn’t add up.

“Dealers who take the time to leverage advanced fraud-detection tools to assess shoppers’ incomes and identities are best positioned to avoid major losses and reduce friction during the car-buying process,” he went on to say.

The entire report is now available online.