Canadian wholesale market’s gentle slide becomes a plummet as February begins

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As the calendar turned to February, the gentle decline of Canadian used-vehicle wholesale values turned to a steep dive.

Canadian Black Book’s weekly Market Insights report found the market down 0.71% for the week ending Feb. 7, a sharp contrast from decreases of 0.32% and 0.28% the previous two weeks.

The feathery downward drift of January, which caused CBB’s Used Vehicle Retention Index to actually rise for the month gave way to a drop that better reflects what CBB senior manager of industry insights and residual value strategy Daniel Ross called an “overall negative Q1 trajectory” fueled by “the general lack of consumer demand expected in 2026.”

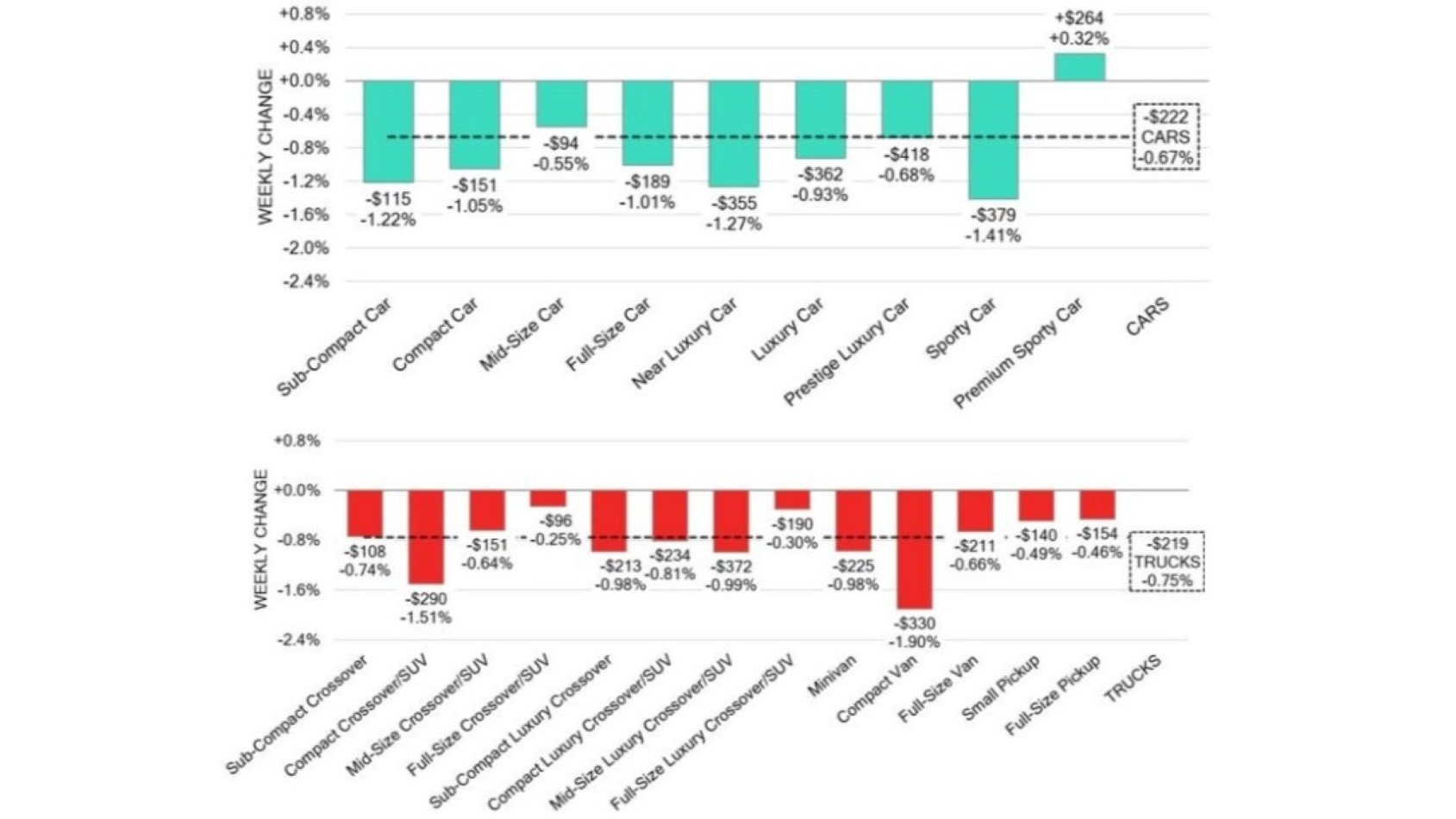

February opened with just one segment on the positive side of break-even, though it was a considerable gain of 0.32% ($264) for premium sporty cars. On the downside, every other segment but two lost more than $100 in value and 17 of the 22 segments sank more than 0.50%.

The average car segment was down 0.67% ($222) and five of them dropped more than 1% for the week, led by sporty cars (1.41%, $379) and near luxury cars (1.27%, $355).

Among truck/SUV segments, which declined 0.75%, just one lost less than $100, and that one — full-size crossovers/SUVs (0.25%) — was down $96. Compact vans (1.90%, $330), compact crossovers/SUVs (1.51%, $290) and mid-size luxury crossovers/SUVs (0.99%, $372) took the biggest fall.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The average auction conversion rate dipped below 50%, coming in at 44.4% for the week with a range from 17.6% to 88.1%. Retail prices inched barely upward to $36,850.

The situation in the U.S. is markedly different, with wholesale prices rising by 0.09% and conversion rates up as the market continues to show signs of an early spring market.