CULA forges partnership with PSECU, reiterating value propositions to credit unions & dealers

Graphics courtesy of Credit Union Leasing of America (CULA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Expanding its client portfolio among some of the largest institutions in space, Credit Union Leasing of America (CULA) recently announced a partnership with Pennsylvania State Employees Credit Union (PSECU), one of the largest credit unions in Pennsylvania, to offer vehicle leasing to PSECU’s more than 545,000 members.

Through CULA, PSECU members in Pennsylvania will now have access to the benefits of vehicle leasing, including lower monthly payments, flexible terms, and access to a broad network of participating auto dealers.

These benefits will also be available to PSECU members in Ohio as the program is scheduled to expand to its neighboring state in the months to come, according to a news release.

CULA president Ken Sopp cited metrics from Experian Automotive when explaining how important this relationship with PSECU is.

“Our partnership with PSECU reflects the growing demand among credit unions for leasing solutions that help members manage the rising costs of vehicle ownership,” Sopp said in the news release. “With the average cost of a new vehicle at $50,326, and the average monthly loan payment at $760, consumers are increasingly seeking more affordable options, and leasing provides just that.

“PSECU’s member-first culture, and forward-looking approach to auto finance make them an ideal partner as we continue expanding vehicle leasing across key markets. Their commitment to their members is demonstrable in the scale of their business, and we are proud to partner with them,” Sopp continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

According to the latest Cox Automotive Car Buyer Journey Study released in January, affordability pressures are reshaping buyer behavior as record-high vehicle prices drive increased interest in leasing.

That study found that the share of new-vehicle shoppers considering leasing versus buying has reached an all-time high, with consumers saving an average of more than $100 per month on lease payments compared with traditional loan payments.

“This partnership with CULA allows us to expand into a new segment of the auto market while continuing to serve our members’ evolving financial needs, especially in today’s challenging economic environment,” PSECU chief revenue and lending officer Homer Renteria said in the news release.

“And because CULA’s analytics-driven program handles the complexities of leasing – from insurance to compliance – we are able to efficiently and easily diversify our portfolio and increase our members’ access to more affordable auto financing options – all while meeting targeted yields,” Renteria continued as PSECU has more than $9 billion in assets.

CULA currently supports vehicle leasing in 34 states and works with more than 40 credit unions, including nine of the top 10 U.S. credit unions offering vehicle leasing.

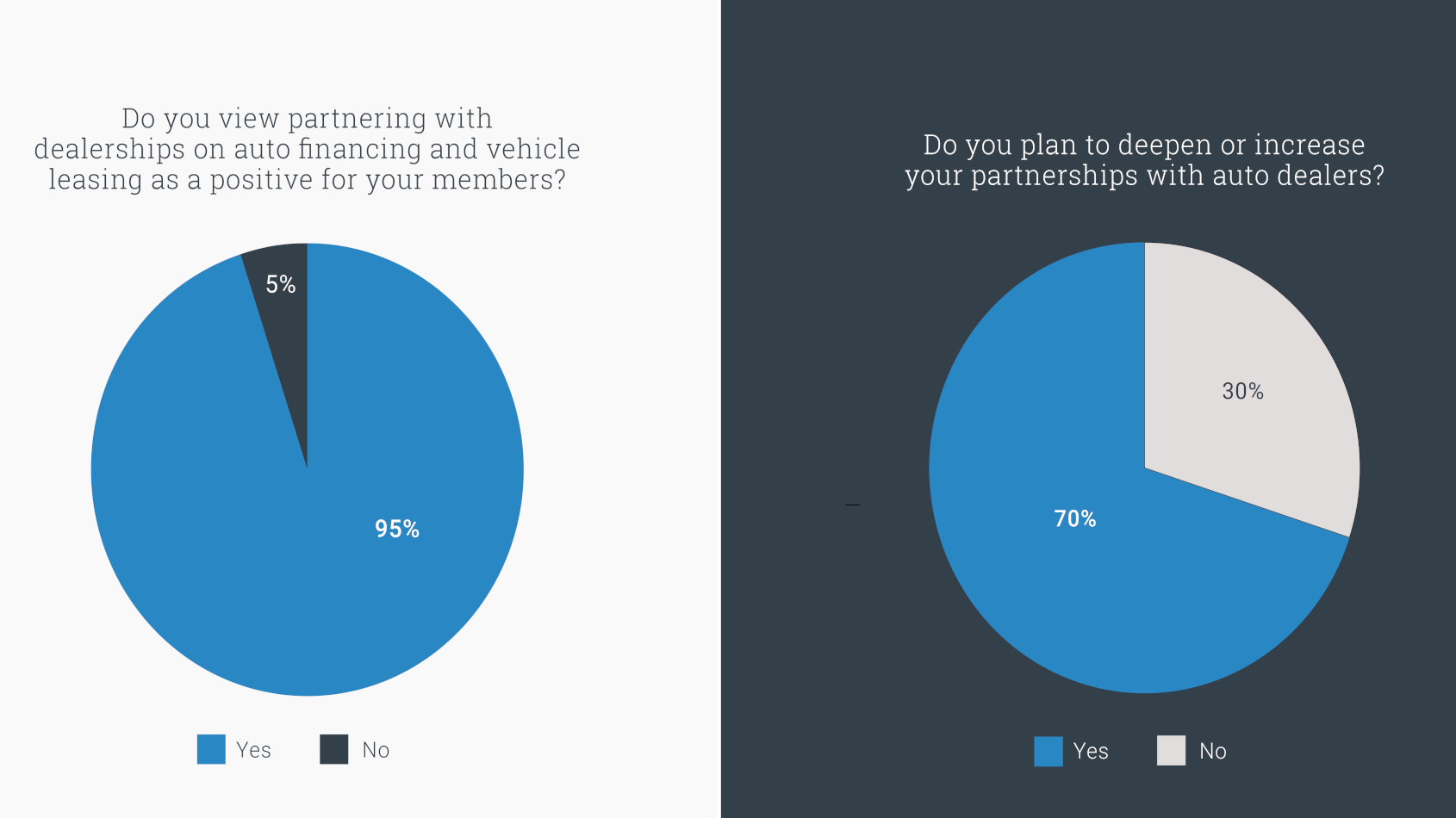

In another industry message, CULA reiterated why it’s uniquely positioned to bring credit unions and dealerships together.

Among the possible credit union benefits CULA highlighted, they included:

—Localization: Partnering with dealers can help credit unions better understand local market demands, so they can develop tailored, affordable financing packages that align with consumer needs.

—Streamlined approval processes: Closer partnerships with dealers can enhance the streamlining of the financing approval processes, while providing quicker access and reducing time-related costs and complexities.

—Balancing risk and profitability: By leveraging insights they can only get from dealers, credit unions can identify viable lending opportunities that mitigate over-extension risks while ensuring reasonable returns.

—Long-term customer relationships: Offering financing in concert with dealer partners can help credit unions build stronger, long-term relationships with members, foster member loyalty and strengthen the credit union’s reputation in the community.

Meanwhile, CULA said dealers can benefit by working closer with credit unions for multiple reasons, including:

—Affordability: Being able to offer customers the lowest monthly lease payments (versus installment contracts) on many makes and models, benefits the customer and helps the dealer move the vehicle

—Flexibility: The option of greater term flexibility, (such as a 36-month lease versus an 84-month financing contract) at a similar payment, can increase an unsure customer’s likelihood to close.

— Insurance: Turnkey with GAP and $1,000 wear and tear coverage included

—Remarketing: As used-vehicle inventory increases, having used vehicle leasing options can help move more vehicles.

—Inventory: With some vehicle inventory continuing to be constrained, the ability to purchase the vehicle at lease-end is a significant value.

“With few alternatives for dealers to their own captives, credit unions can help auto dealers find more flexible finance and mileage terms, as well as more products like used and new vehicle leasing, often with higher residual values, lower money factors, and larger reserve payouts,” CULA said.

“And, because CULA’s credit union leasing program is easy to use, this combination provides dealers with an alternative to the captive financing that is both efficient, practical, and lucrative,” the company went on to say.

Visit cula.com for more details.