Canadian used wholesale market continues downward trend

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

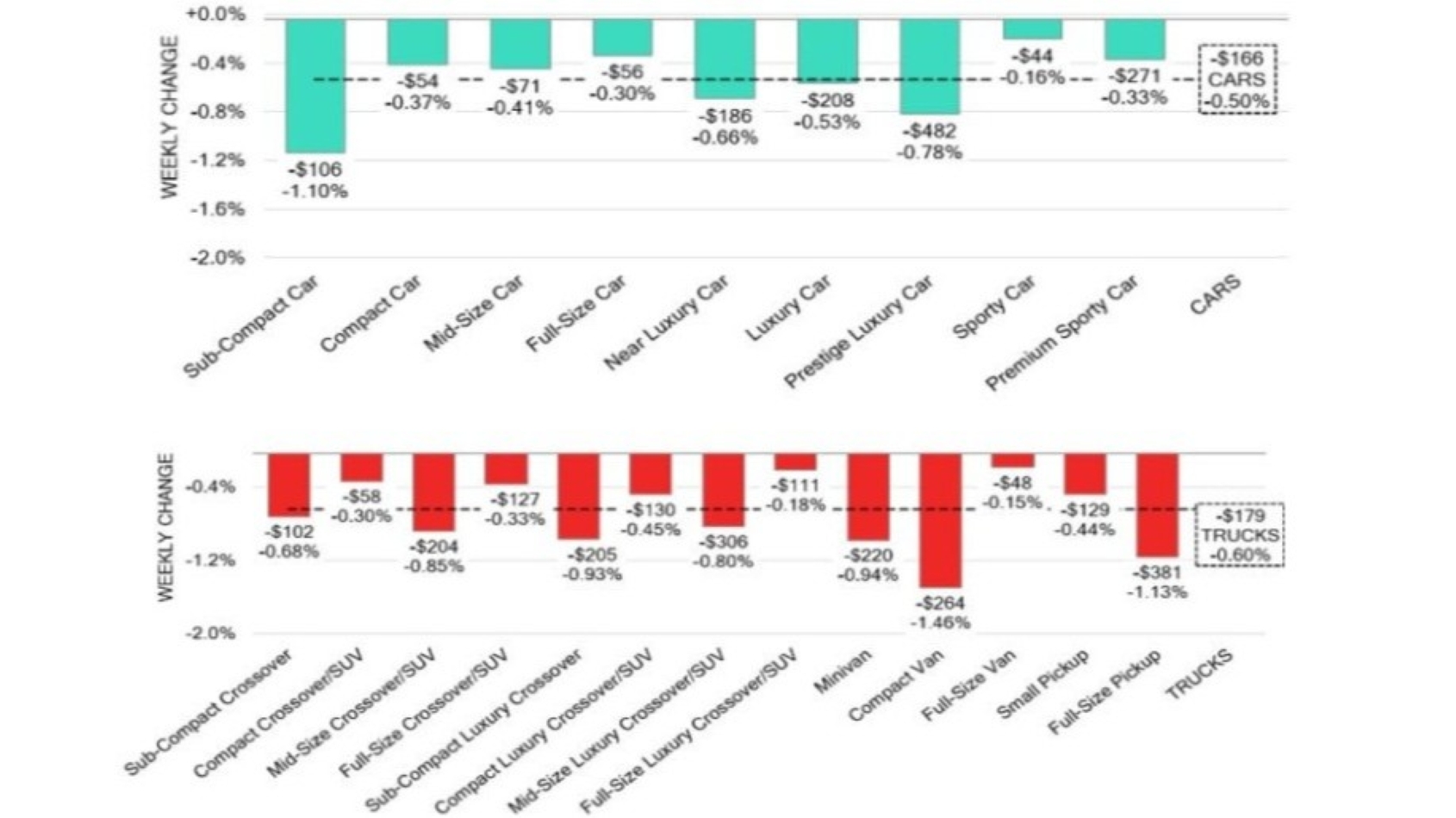

The Canadian wholesale used-car market’s downward slide continued in the week ending Jan. 17.

Canadian Black Book’s Market Insights report showed values down 0.55% for the week, the fifth time in six weeks the market has sunk by 0.50% or more.

Just as the previous week, all 22 vehicle segments lost value, and 16 of them were down by more than $100. That even includes subcompact cars, which dropped $106 and was among three segments posting a decrease of more than 1% — the others were compact vans (1.46%, $264) and prestige luxury cars (0.78%), which had the largest dollar fall at $482.

Full-size pickups ($381, 1.13%) and midsize luxury crossovers/SUVs ($306, 0.80%) joined prestige luxury cars in losing more than $300.

Canadian auctions backed last week’s encouraging sale rate with an average of 51.6%, the highest since a 54.3% mark the week of April 19.

CBB analysts reported a rise in wholesale supply to start 2026, but noted upstream channels continue get first pick of the inventory. Buyer demand for high-quality vehicles at auctions remains high in both Canada and the U.S.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Used-vehicle retail prices remained steady during the week, with a 14-day moving average listing price of $36,700.

The U.S. market is gaining momentum, analysts said, with depreciation slowing and auction conversion rates topping 60%, indicating stronger demand and even an early spring market in the making.