Canadian wholesale market ‘turns the corner’ as tariff frenzy cools

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The Canadian wholesale used-vehicle market’s tariff-fueled rise continued in May — but it might have hit a turning point as the month closed.

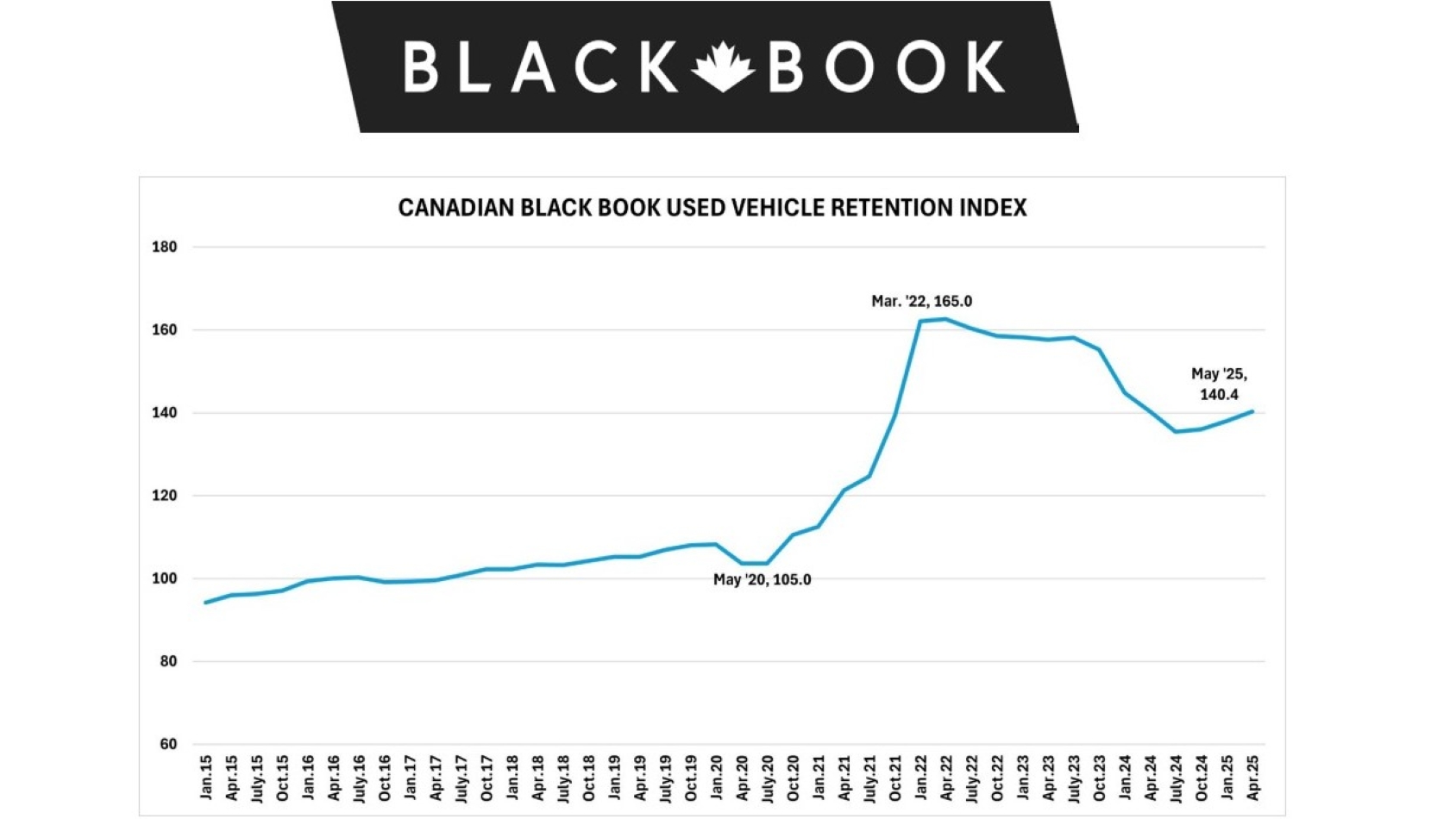

While Canadian Black Book’s Used Vehicle Retention Index inched upward by 0.1 points for the month to 140.4, a 2% increase over the May 2024 index of 137.6, CBB senior manager and head of Canadian vehicle valuations David Robins said May ended with a hint of normalcy.

“As the month neared completion,” he said, “wholesale values turned the corner and were decreasing at typical rates for this time of year.”

The index measures the wholesale average value of 2-6-year-old used vehicles as a percentage of original typically equipped MSRP and weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

The index has been rising slowly but steadily since last July, other than a 2.3-point spike in January, when U.S. President Donald Trump took office with threats of tariffs on Canadian imports.

Auction sale rates hit lowest level of 2025

The cooling of the tariff frenzy can also be seen in Canadian auction rates, which sank to their lowest level this year, according to CBB’s weekly Market Insights report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The monitored auction sale rate averaged 37.4% for the week ending June 3, ranging from a low of 23.5% to 69.3%. The report noted supply has remained high compared to previous weeks.

Canadian wholesale values began June with a week-over-week decline of 0.18%, following a drop of 0.23% in the last full week of May.

Trucks and SUVs led that charge, down 0.21% overall with just two of the 13 segments gaining value — and midsize crossover/SUVs (0.06%, $25) and small pickups (0.04%, $12) combing for an increase of a mere $37.

Meanwhile, subcompact luxury crossovers (0.80%, $199), compact vans (0.58%, $129) and full-size vans (0.43%, $153) fell by more than $100.

Among cars, full-size cars (0.40%, $93) were the only segment with an increase over the previous week. Subcompact cars (0.64%, $71) recorded the largest percentage loss, while premium sporty cars (0.15%, $132) had the largest dollar drop.

The average used-vehicle retail listing price rose to $38,300, up $200 for the week.

The U.S. market also backed off from the tariff pattern during the week, showing what analysts called “a significant milestone” — a 0.25% decline that’s typical for this time of year and in line with the pre-pandemic seasonal average of 0.22%.