Canadian wholesale market’s December fall indicates ‘need for market correction’

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Canadian used-vehicle wholesale values took a tumble last month — and it was a long time coming.

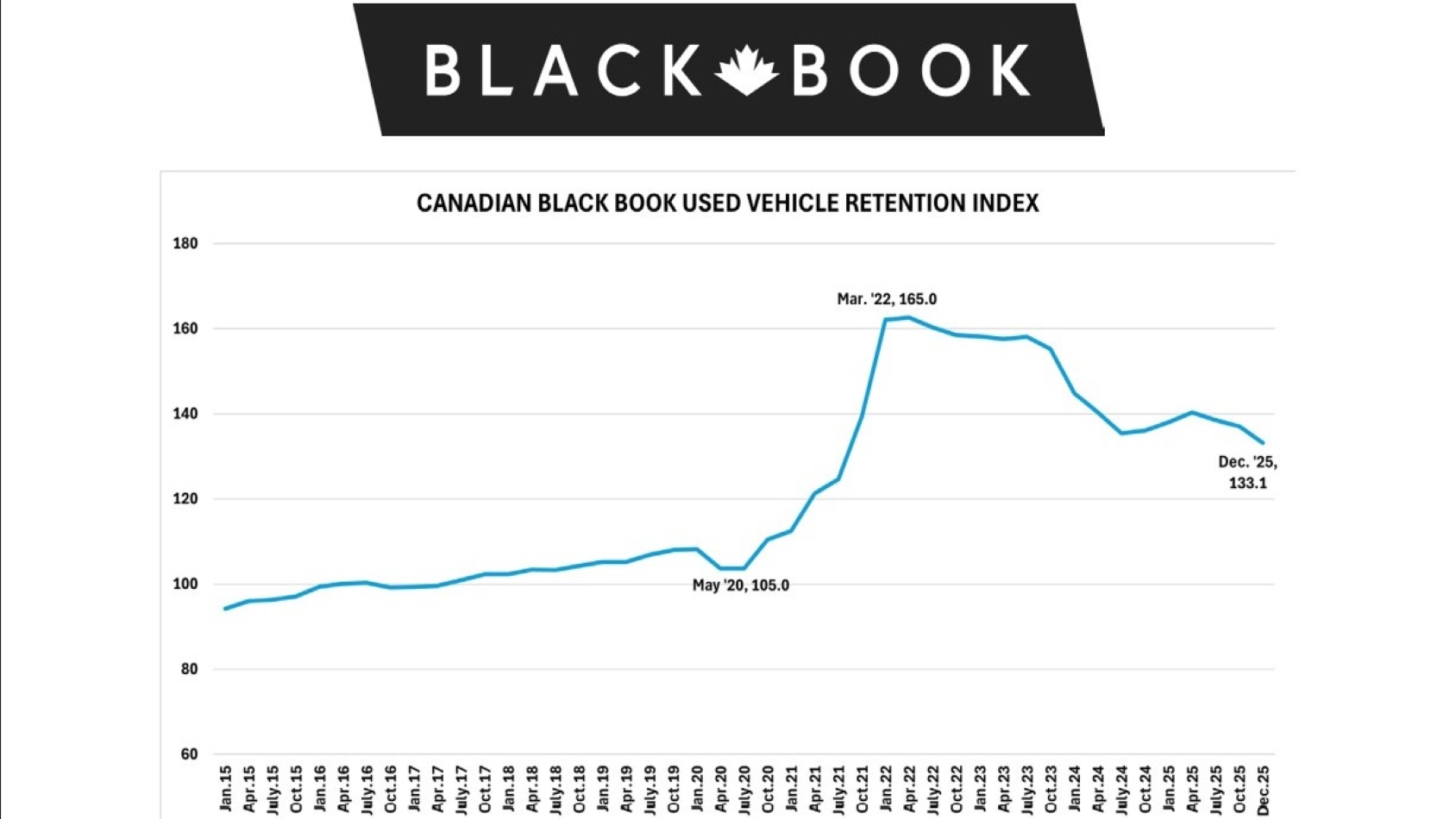

Canadian Black Book’s Used Vehicle Retention Index for December dropped 2.8 points, from 135.9 in November to 133.1, the most precipitous month-to-month fall since a three-point decrease to 140.3 in April 2024.

Year-over-year, the index was down 1.9%.

Canadian Black Book senior manager of industry insights and residual value strategy Daniel Ross said the December drop was not a surprise, and in fact, should have happened earlier.

“Anticipated negative values registered on our index in the past month,” he said. “December was the largest month-over-month decrease in 2025 and a true sign of the need for a market correction originally initiated way back in 2024 but forced to stall last year.”

The correction, during which the index fell steadily throughout 2024, was stopped in its tracks as values were driven up by talk of U.S. tariffs on Canadian vehicles early in the year and their implementation beginning in April.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Looking ahead, Ross expects a calmer year in 2026.

“With trade policy again a focus of our market this year,” he said, “OEMs and dealers alike are seeing less demand in the marketplace. Expectations are for a slowing but less volatile new- and used-car market.”

Still, changes in the tariff landscape might be on the horizon, as the U.S. Supreme Court could rule on the legality of President Donald Trump’s tariffs and the current Canada-U.S.-Mexico Agreement, which Trump has threatened to abandon, is under review.

The Canadian Black Book Used Vehicle Retention Index is calculated using CBB’s published wholesale average value on two to six-year-old used vehicles, as a percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

Wholesale values drop as 2026 opens

The market correction was in plain sight as the new year opened, with wholesale prices sinking 0.54% for the week ending Jan. 6, according to CBB’s weekly Market Insights report.

Just one vehicle segment gained value during the week — full-sized cars, which were up 0.32% ($51) — while 13 of the 22 segments lost $100 or more and six were down by more than $200, led by premium sporty cars ($494, 0.67%), compact vans ($384, 2.43%), prestige luxury cars ($360, 0.69%) and sub-compact luxury crossovers ($282, 1.44%).

Used-vehicle supply, which had been tight throughout 2025, has stabilized and returned to regular levels, the report said, but upstream channels continue to get priority sale access to inventory, and buyer demand remains high for high-quality vehicles at auctions on both sides of the Canada-U.S. border.

Retail listing prices were down slightly, with the 14-day moving average, based on more than 200,000 used vehicles listed for sale on Canadian dealer lots, fell to $36,520.

In the U.S., 2025 closed with solid conversion rates and typical seasonal declines, CBB said, along with “encouraging signs” for a strong 2026 as large independents remained active in bidding and buying.