Canadian wholesale used-car value decline picks up speed

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The decline in Canadian wholesale used-car prices is picking up speed.

Canadian Black Book’s weekly Market Insights report showed a drop of 0.35% for the week ending June 7, almost double the 0.18% decrease of the previous week and the largest fall since a decline of 0.48% during the week of Jan. 11.

It’s also nearly three times the pre-COVID 2017-19 average of 0.12%.

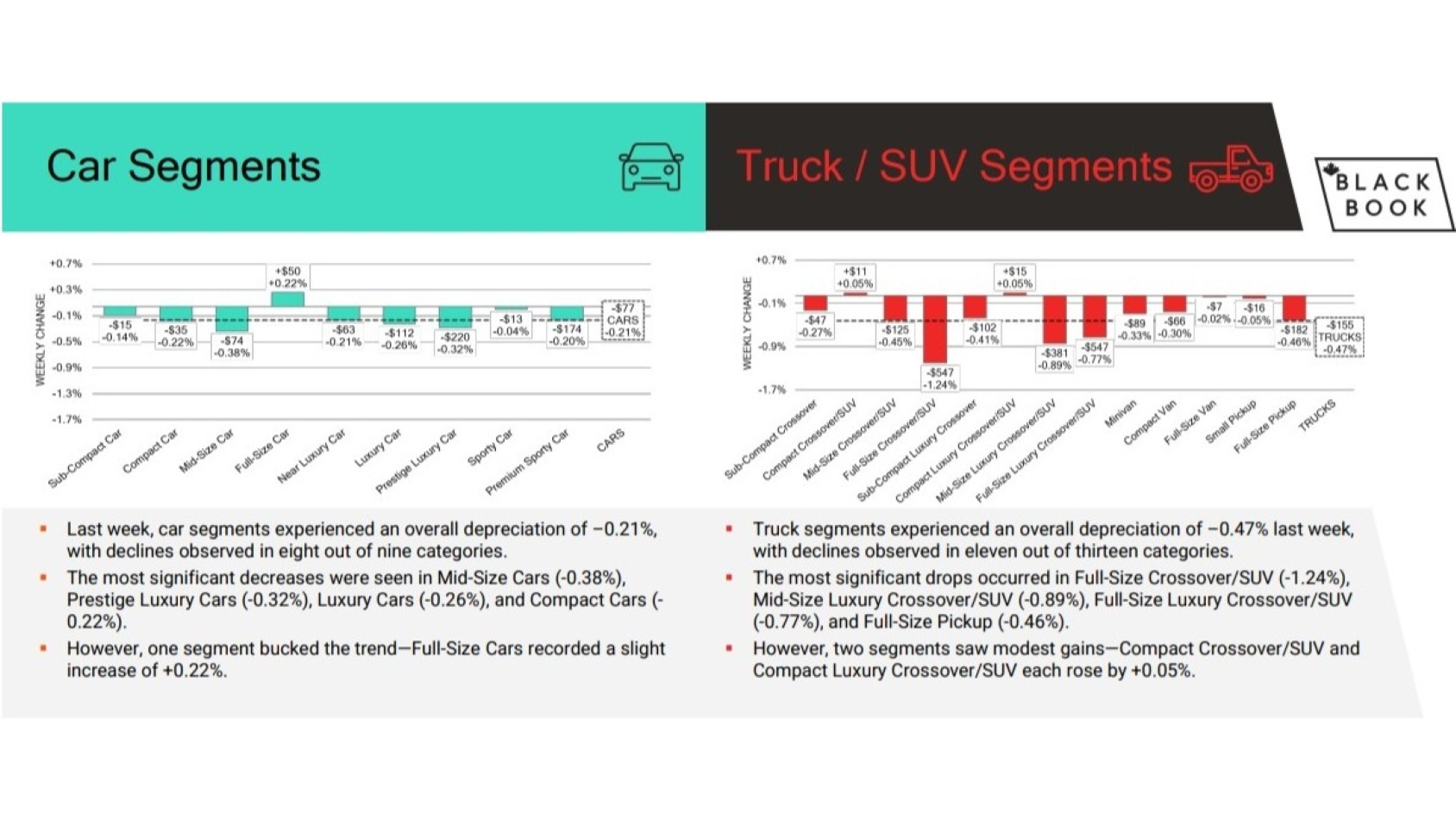

Truck/SUV values sank 0.47%, with full-size crossover/SUVs taking the biggest dive at 1.24% and matching full-size luxury crossover/SUVs (0.77%) for the largest dollar loss at $547. Midsize luxury crossover/SUVs (0.89%, $381), full-size pickups (0.46%, $182) and midsize crossover/SUVs (0.45%, $125) also dropped more than $100 in value.

Car segments were down 21%, with midsize cars (0.38%, $74), prestige luxury cars (0.32%, $220) and luxury cars (0.26%, $112) showing the largest percentage decreases. Full-size cars were the only segment to gain value, up 0.22% ($50).

Used-vehicle retail prices also declined for the week, with the 14-day moving average listing price down $100 to $38,200. Auction sale rates, which hit their lowest level of the year the previous week, fell again, averaging 31.9% with a low of 16.5% and a high of 50.8%.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

That’s a stark contrast to the U.S. market, where sales rates rose to 60%, though CBB analysts noted that increase was accompanied by accelerated depreciation. The overall market fell 0.54%, almost double the typical seasonal decline of 0.28%.