Canadian wholesale values continue downward trend

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

After a hot start to the year — thanks to the threat of tariffs — Canadian wholesale used-vehicle values have been heading steadily downward.

Canadian Black Book’s Used Vehicle Retention Index fell in August for the third consecutive month, coming in at 138.1, down from 138.5 in July and 139.1 in June. The index began 2025 with five months of increases as demand spiked before the effects of U.S. tariffs and Canadian responses were felt.

Since then, the trend has reversed.

“Economic pressures continue to push vehicle retention downward as demand decreases,” CBB senior manager and head of Canadian vehicle valuations David Robins said. “Interest rates have remained steady on both sides of the border, leading to a more cautious position by both vehicle exporters and domestic purchasers.”

While the index’s direction is downward, CBB noted the current reading is still up 1.5% from August 2024, when the index was at 136.0.

The Canadian Black Book Used Vehicle Retention Index is calculated using CBB’s published wholesale average value on 2 to 6-year-old used vehicles, as a percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage, and condition.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The index’s decrease was mirrored by data in CBB’s Residual Values Newsletter for September, which showed the drop in the average wholesale value of 2-to-6-year-old used vehicles picking up pace in July “as wholesale buyers pull back,” down 0.97% for the month.

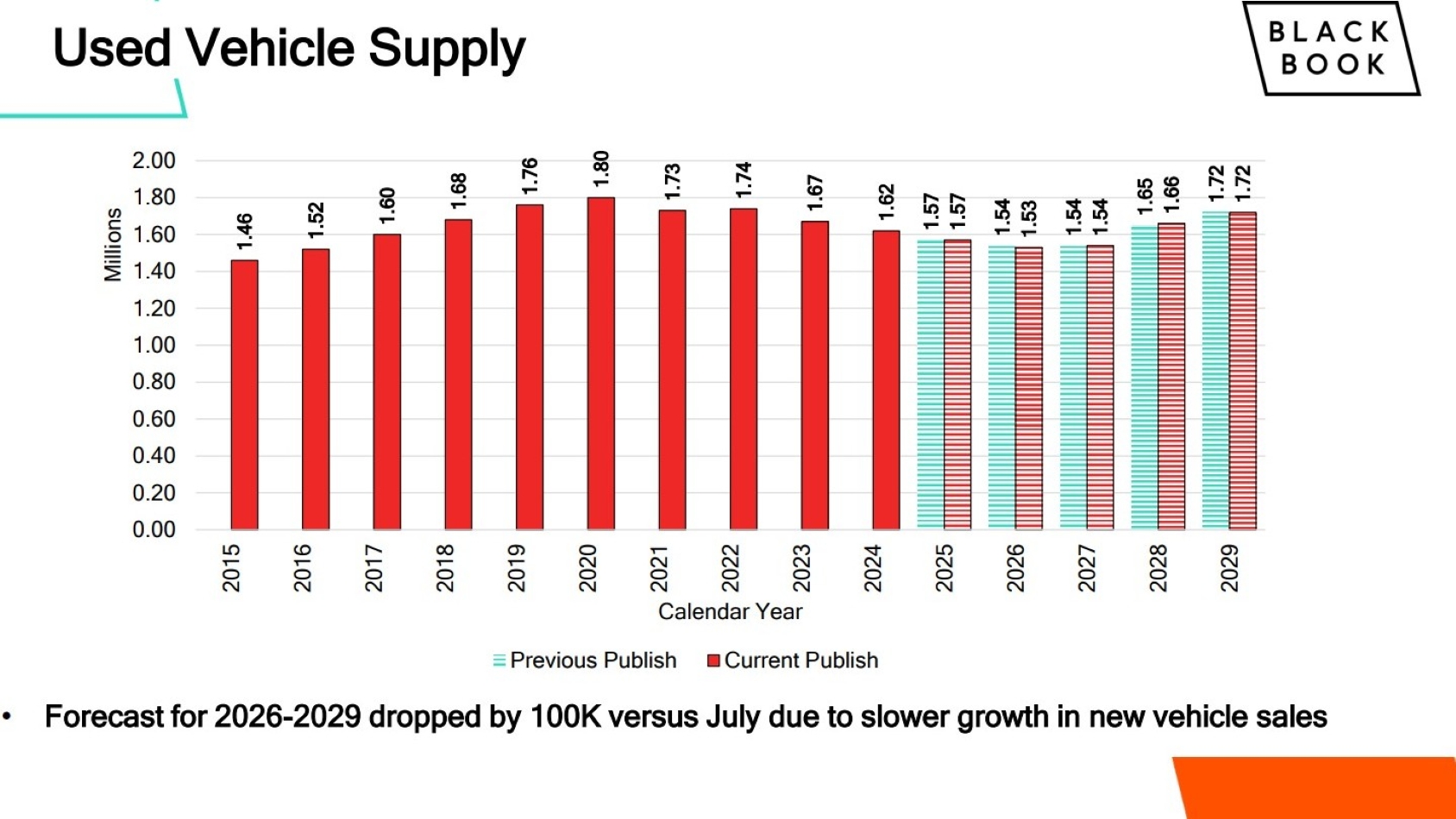

The decrease in demand also showed up in CBB’s projections for future used-vehicle inventory. While the newsletter still shows an expected supply of 1.57 million units for this year, it lowered the estimates for 2026 and ’27 to 1.53 million and 1.54 million, citing “slower growth in new-vehicle sales.”

In addition, CBB lowered its projection for 4-year-old vehicle retention values in 2025 for the second time in three months, dropping it to 63% of MSRP “as the overall market continues its decline,” according to the newsletter. The projection had originally been raised to 65% in May in anticipation of tariff-induced price increases.

As before, the current newsletter noted the downward trend is expected to continue through 2029.

The full newsletter can be downloaded here.