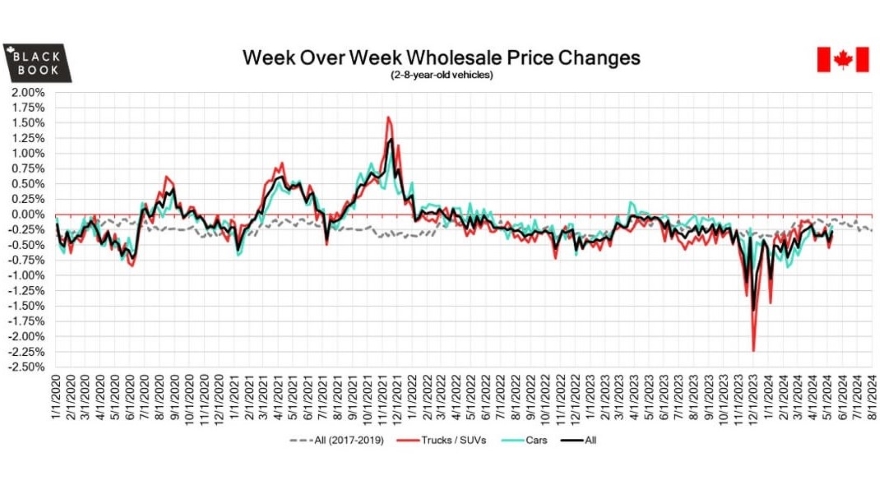

Canadian wholesale values continue downward trend

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The downward slide of Canadian wholesale vehicle prices continues but the pace slowed, according to Canadian Black Book’s weekly Market Insights report for the week ending May 11.

Overall, values declined 0.28% — significantly less than the 0.44% tumble the previous week — led by the truck/SUV segment, which was down 0.35%. Full-size pickups had the largest fall, sinking by $341 for a 0.95% drop, as all truck/SUV segments were down.

The car segment dropped 0.20%, with compact cars down 0.72% and followed by mid-size cars down 0.62%. Two car segments posted gains — full-size cars (0.43%) and prestige luxury cars (0.03%).

“Most segments saw a change in average value of more than $120 this week, as the truck segments fell more than the car segments,” CBB analysts said in the report. “Conversion rates were less than last week, but some observed sell rates were still as low as 14% while the high end was up to 59%, and the average being between 25% and 45%.

“We also saw less sellers dropping floors last week, which has been contributing to more lanes with lower sell rates.”

As in previous weeks, CBB analysts reported supply is building with stable demand for vehicles at auction in both Canada and the U.S., and upstream channels continue to tap supply before it can become available to wholesale markets.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The average retail listing price for used vehicles was slightly down week-over-week, with the 14-day moving average at $33,900.

CBB described the current U.S. market as “stable, flat and unchanging as we observe a slow and consistent dip after what looks to be the end of the spring market period.”

While the market segment for 2-to-8-year-old cars remained unchanged, both newer used vehicles (0.03%) and the oldest model years (0.10%) were up slightly. The truck market, across all age categories, experienced slow declines.