CBB Index’s January rise a ‘reprieve’ as expected slower year begins

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

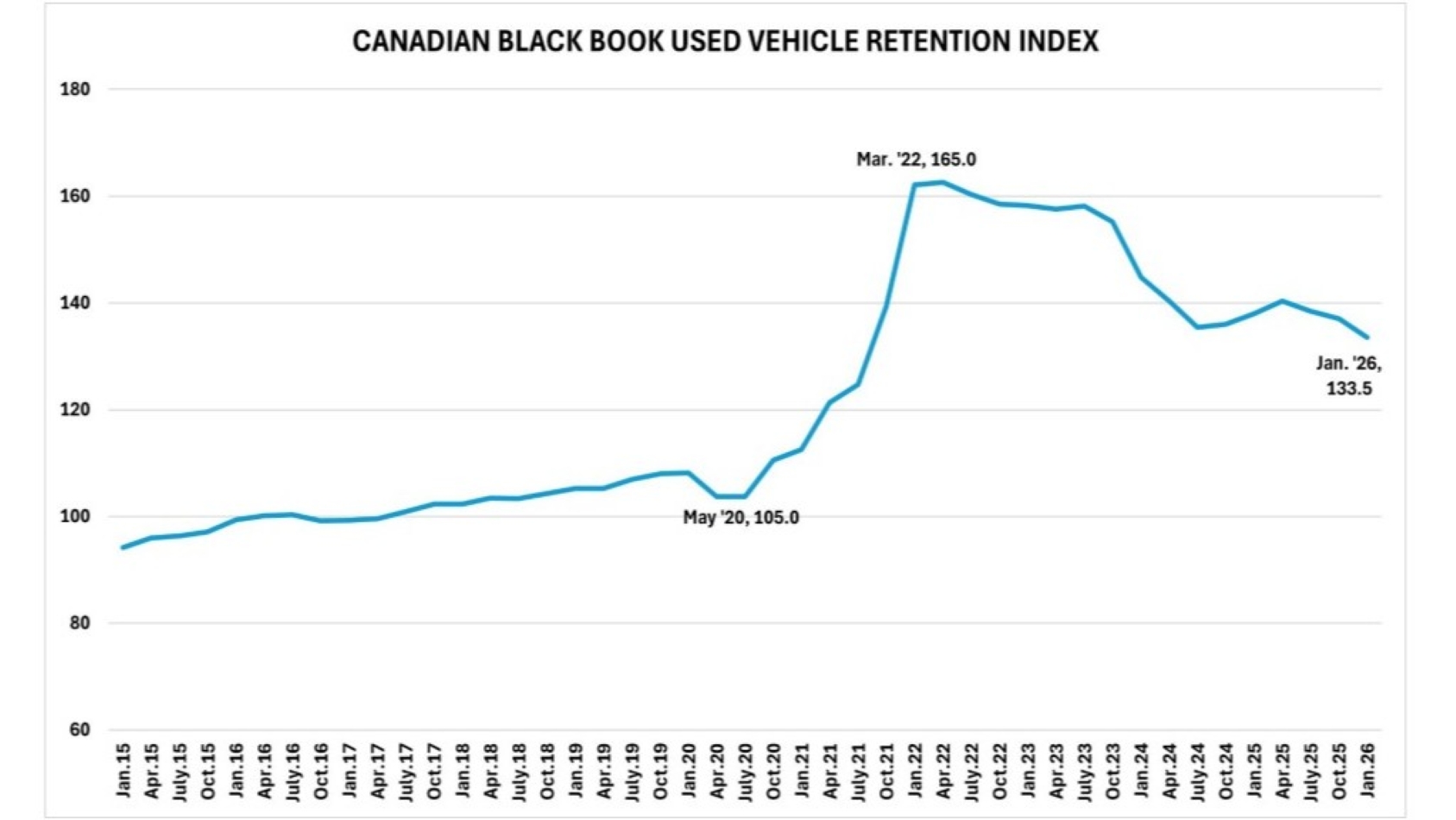

A month after a market correction led to its largest drop in a year and a half, Canadian Black Book’s Used Vehicle Retention Index went the other way in January.

The index inched upward 0.4 points to 133.5 points to open 2026, a rise that followed a 2.8-point fall in December that offset the early 2025 jump in wholesale prices sparked by concern over tariffs.

As a result of last year’s tariff bump, the January index, while up month-over-month, was down 3.2% from January 2025.

CBB senior manager of industry insights and residual value strategy Daniel Ross said despite the slight rise, the market is still expected to slow this year.

“Week-over-week wholesale changes proved less negative at the start of the year, providing some reprieve for our monthly index,” he explained. “While the overall negative Q1 trajectory remains, the acceleration in U.S. market values this month is supporting value retention in Canada, offsetting the general lack of consumer demand expected in 2026.”

The Canadian Black Book Used Vehicle Retention Index is calculated using CBB’s published wholesale average value on two to six-year-old used vehicles, as a percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The end of January illustrated the “less negative” start Ross noted. According to CBB’s Market Insights report with Canadian wholesale values declining 0.32% for the week ending Jan. 31 — less than the 0.35% average of pre-COVID years 2017-2019.

The report found retail prices also decreased for the week, with a 14-day moving average of $36,800. Auction sale rates averaged 53.8%.