CBB reports note tariff impacts on Canadian used-car market

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The 25% U.S. tariff on imported vehicles and Canadian reprisals weren’t in place in March.

But the threat of those tariffs and the expectations of consumers, automakers and dealers were already making a tangible impact on the Canadian used-car market — an impact noted in the latest reports from Canadian Black Book.

To begin with, CBB’s monthly Used Vehicle Retention Index rose 0.9 points to 139.8, continuing an upward trend that took off in January, when U.S. President Trump took office promising tariffs.

The index measures the wholesale average value of 2-6-year-old used vehicles as a percentage of original typically equipped MSRP and weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

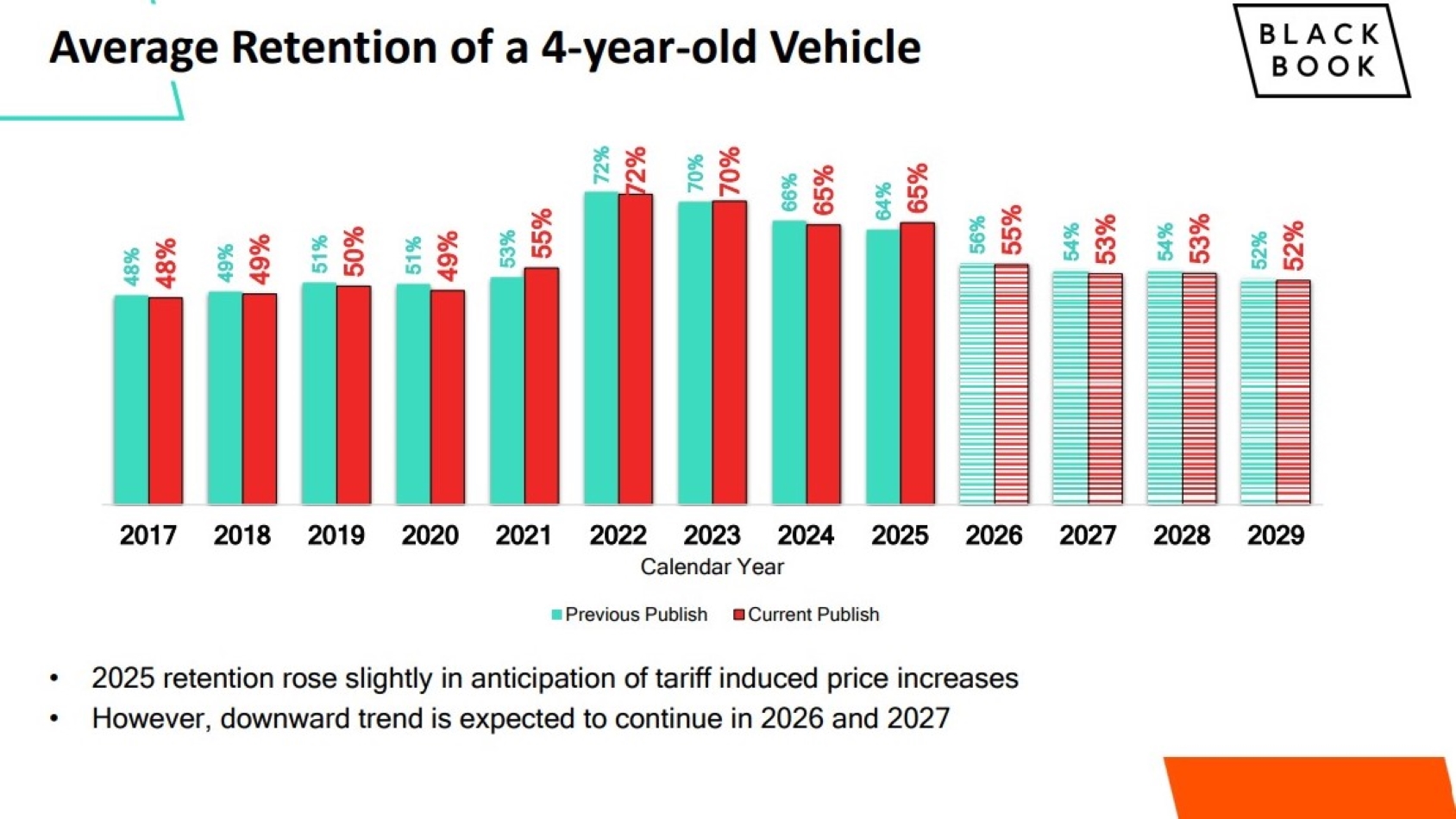

CBB’s Residual Value Newsletter for May showed 2025 showed the average retention for 4-year-old vehicles has up slightly from previous projections at 65% of MSRP in anticipation of tariff-induced price increases, though a major decrease is still expected to follow in the next several years.

Meanwhile, used-car supply is tightening from the aftereffects of the COVID pandemic, CBB reported, though at the same time exporters are pulling back from the Canadian market, which could counteract that effect somewhat.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

That report also noted the negative effect of tariff uncertainty on the Canadian economy and businesses, with slower economic growth, increasing unemployment and potentially higher inflation weighing on Canadian consumers.

CBB analysts said those factors could cause consumers postpone large purchases such as vehicles which could also help reverse the trend of dwindling used inventory.

“The market seems to be holding its breath pending the outcome of negotiations between the U.S. and its largest trading partners (European Union, Mexico, Canada and China),” the report said.

The full report can be downloaded here.

Through all of that, used wholesale values held steady for the week ending April 26, with no change in the overall market from the previous week.

Truck/SUV segments gained .12% for the week, led by full-size pickups, which jumped 0.54% ($213). Full-size crossover/SUVs (up 0.41%, $178), minivans (0.39%, $106) and small pickups (0.34%, $105) were also up by more than $100.

Car segments were down 0.15%, with just three segments — midsize cars (up 0.08%, $15), subcompact cars (0.03%, $3) and sporty cars (0.03%, $10) — on the positive side and none of those even making it to a 0.10% increase. Prestige luxury cars fell the most, dropping 0.30% ($205).

Auction sales rates took a big tumble from the previous week’s 54.3%, averaging just 38.6% with a range from 25.4% to 59.9%. Used retail prices ticked slightly upward with the 14-day moving average listing price rising to $37,900 following two weeks of big leaps.

U.S. wholesale values continue to climb at higher-than-typical levels at a time of year when their “spring bounce” begins to slow, CBB analysts said. The overall market shot up 0.63% for the week, same as the previous week. With tariffs in place on imported vehicles, the market remains strong, and expectations of rising prices and reduced inventories for new vehicles are likely to further boost demand for used cars.