Conversion rates up, values down in Canadian wholesale used-car market

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The Canadian wholesale used-vehicle market had its ups and down last week.

Canadian Black Book’s weekly Market Insights report for the week ending Aug. 2 showed auction conversion rates rising from the depths of a year-to-date low, while vehicle values took a significant tumble.

At the auctions, the average monitored sale rate came in at 32.1%, which might not sound impressive but is a step up from the previous week’s 23.5% reading. The rates ranged from a low of 15.8% to a high of 62.5%.

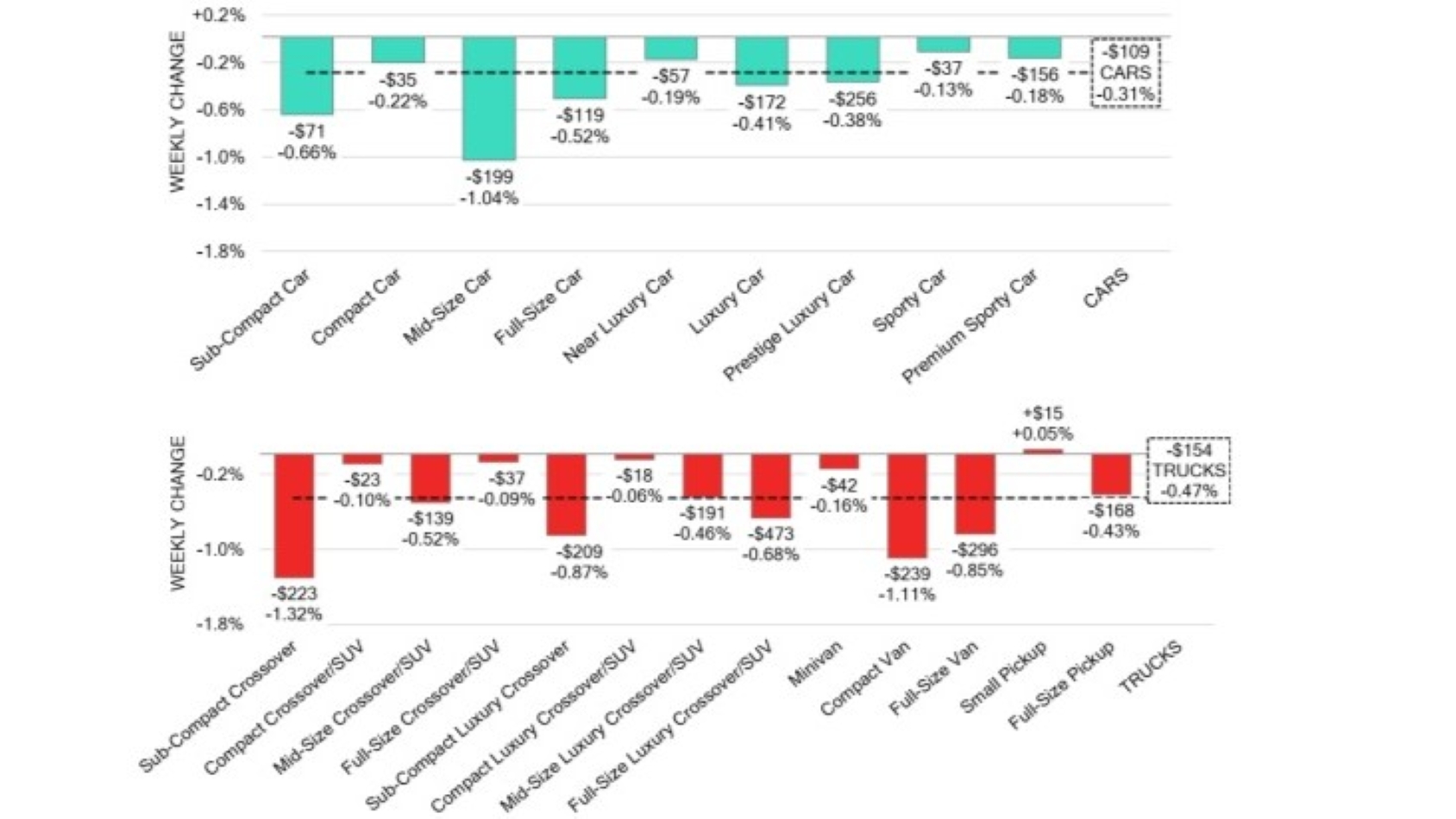

Meanwhile, depreciation accelerated, with the overall market down 0.40% following the previous week’s 0.18% drop. Just one segment poked its head into positive territory — barely — with small pickups gaining $15 (up 0.05%), while 13 of the 22 total segments lost more than $100 in value. That group was led by full-size luxury crossover/SUVs, which sank $473 (0.68%), while sub-compact crossovers (1.32%, $223), compact vans (1.11%, $239) and mid-size cars (1.04%, $1.99) were down more than 1% for the week.

Truck/SUV segments as a group were down 0.47% and cars were down 0.31%.

The 14-day moving average of used-vehicle retail listing prices inched up $100 to $37,700, based on some 220,000 used vehicles listed for sale on Canadian dealer lots, the report said.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

August began in the U.S. market with moderating depreciation, down 0.37% — still above the pre-pandemic average of 0.25% — after a July that surpassed typical seasonal levels with auction conversion rates remaining steady nationwide.