Decline in Canadian wholesale used-car values continues

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Canadian wholesale used-vehicle values continued their downward trend last week.

The market dropped 0.29% for the week ending Sept. 6, picking up speed from a 0.16% decline the previous week, according to Canadian Black Book’s weekly Market Insights report.

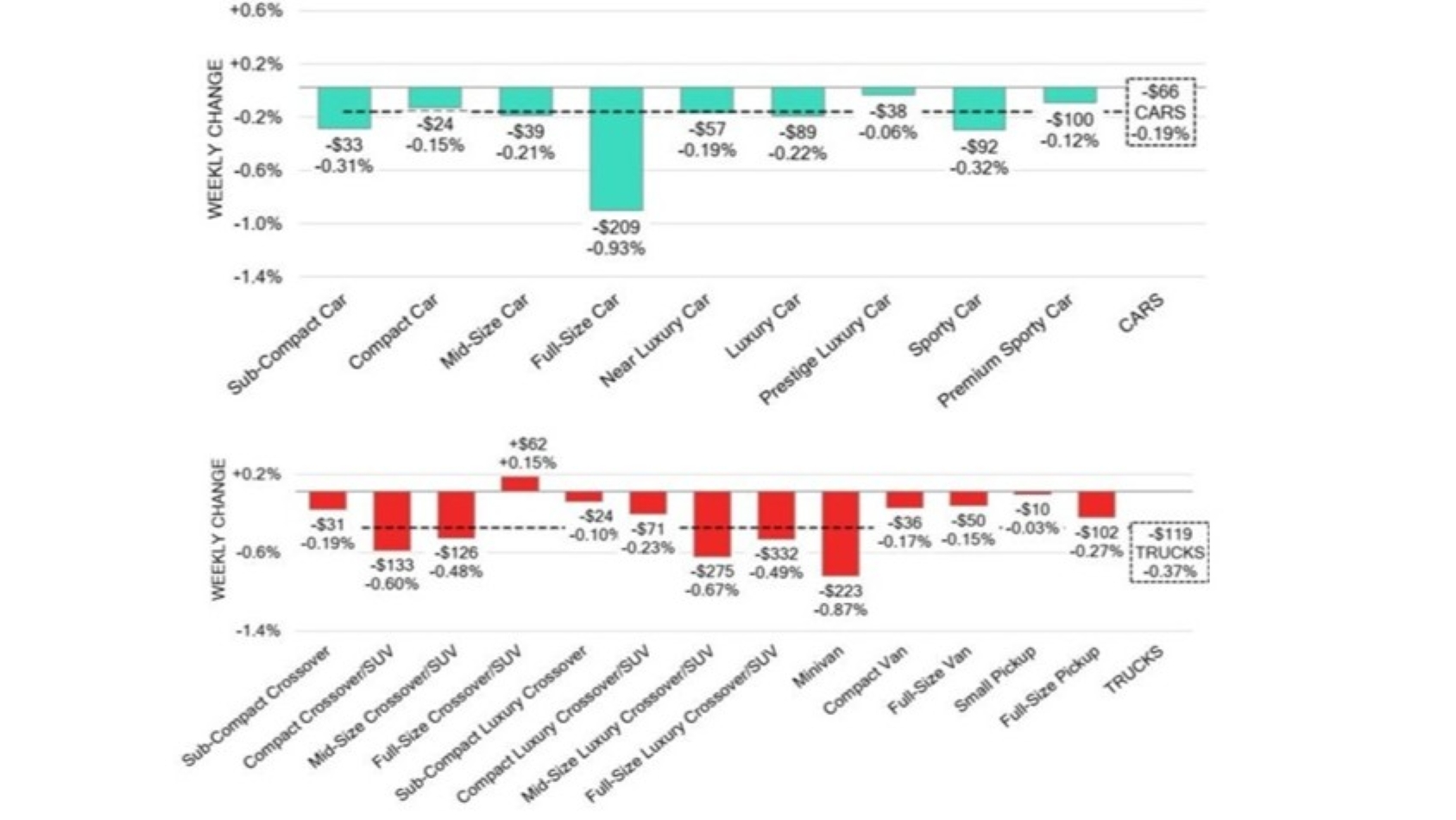

Just one vehicle segment got above break even for the week — full-size crossovers/SUVs, which were up 0.15% ($62) — but that was more than offset among trucks/SUVs, which were down 0.37% collectively. Minivans led that decline, losing 0.87% of their value ($223), followed by mid-size luxury crossovers (0.67%, $275), compact crossovers/SUVs (0.60%, $133) and full-size luxury crossover/SUV (0.49%), which had the largest dollar drop among all segments at $332.

Car values sank 0.19%, with full-size cars taking the biggest dive at 0.93% ($209).

Auction conversion rates tumbled as well, with an average monitored sale rate of 31.2%, ranging from 16.9% to 50.9%. That’s down from 33.2% the previous week and a high of 42.9% in mid-August. CBB analysts said sale rates have been affected by economic uneasiness, political variants and sellers holding strong on floor prices.

Supply has been stable, but CBB said upstream channels are still getting early access to frontline-ready vehicles, and demand for inventory and high-quality vehicles remains high at auctions on both sides of the border.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The report said August retail sales were down year-over-year, the first such decline since February. The estimated 160,000 units sold represented a 2.9% decrease from 2024, with one less selling day.

The 14-day moving average of used-vehicle retail listing prices was $37,700, up slightly from the previous week.

In the U.S. market, the average auction conversion rate was 61% — almost twice the Canadian rate — but that represented a decline from the previous week. Depreciation was in line with late-summer norms, with values down 0.21%.