No sale at Canadian auctions as conversion rate plummets

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Auto auction sale conversions have become a rare thing in Canada.

In its weekly Market Insights report, Canadian Black Book reported a miniscule average monitored auction sale rate of 23.5% during the week ending July 26 — by far the lowest of the year.

Even more remarkable, the highest recorded rate was a mere 27%, just barely above the low of 20%.

“There has been continuous fluctuation in sale rates across various auction lanes,” CBB analysts said, “that can be attributed several factors including, economic uneasiness, political variants and sellers holding strong on floor prices.”

Even so, the report said, there continues to be demand for inventory and high-quality vehicles at auctions in Canada and the U.S.

Canadian used-vehicle values fell 0.18% for the week, a slower pace than the 0.32% drop the previous week.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

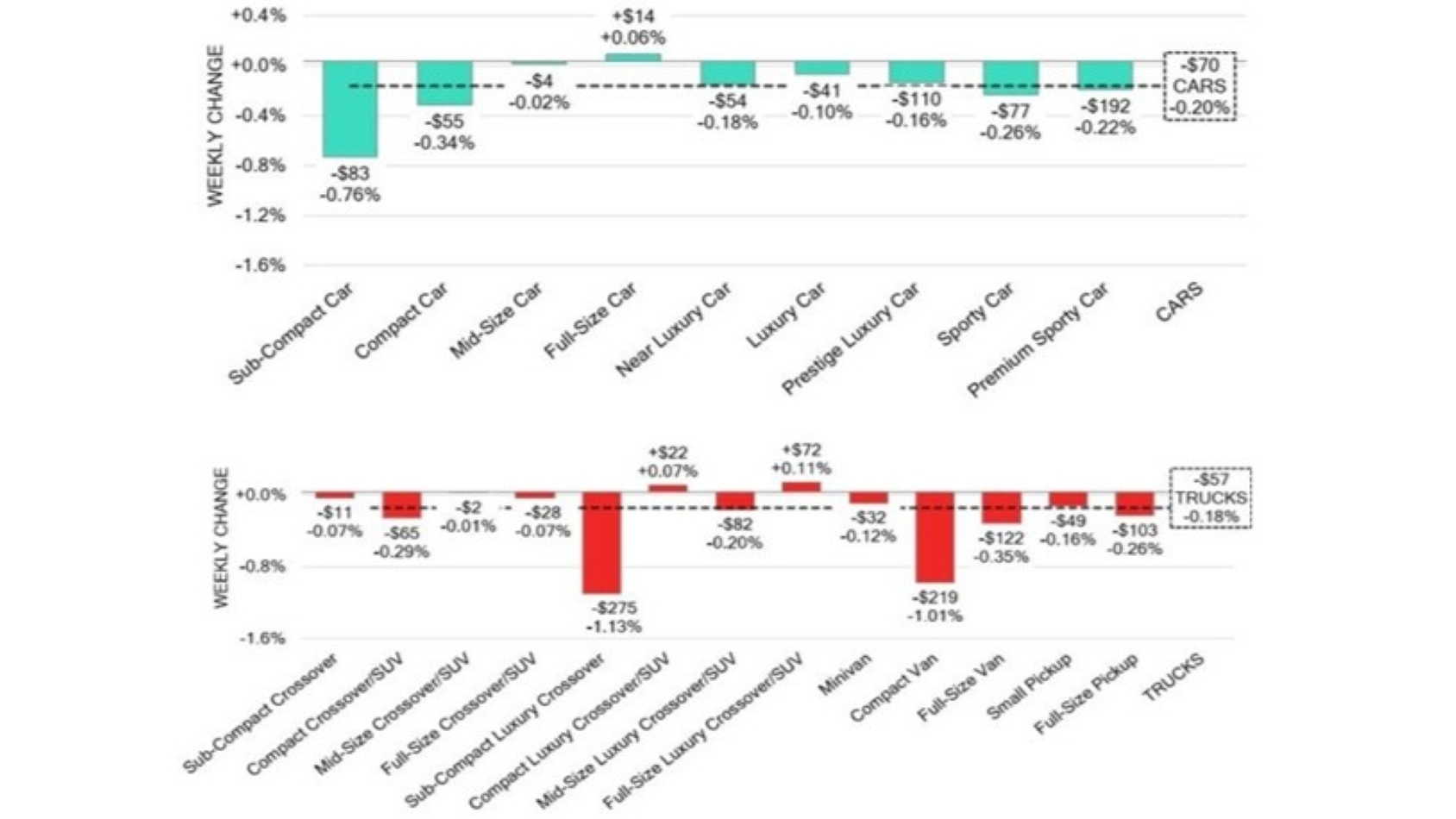

Just three segments gained value — full-size luxury crossover/SUVs ($72, 0.11%), compact luxury crossover/SUVs ($22, 0.07%) and full-size cars ($14, 0.06%) — while six lost more than $100, led by sub-compact luxury crossovers ($275, 1.13%) and compact van ($219, 1.01%) among truck/SUV segments and premium sporty cars ($192, 0.22%) among cars.

Car segments overall were down 0.20% and trucks dropped (0.18%).

Retail prices have remained quite stable throughout July, with the 14-day moving average at $37,600 for the second consecutive week following four weeks at $37,500.

In the U.S., used-vehicle wholesale values fell 0.55% for the week, which analysts said was well above the typical pre-pandemic seasonal depreciation rate of 0.25%. But, they added, the market showed “encouraging signs of strength” including strong auction sales rates nationwide.