Study finds Canadian auto lenders must exceed dealer expectations to succeed

Image courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

To succeed in an increasingly uncertain and volatile market faced with rising costs for vehicles and financing, Canada’s auto lenders need to go the extra mile.

That’s the conclusion of J.D. Power’s 2025 Canada Dealer Financing Satisfaction Study, an analysis of 5,974 finance provider evaluations from new-vehicle dealerships in Canada, conducted in February.

“In the current economic climate, just meeting dealers’ expectations is no longer the catalyst for growth,” J.D. Power senior director of automotive finance intelligence Patrick Roosenberg said. “How a lender’s sales rep engages with dealers in terms of responsiveness, ability to solve issues and communicate consistently has a significant effect on satisfaction, which eventually manifests itself in generating new business opportunities.”

The study found 63% of dealers said they “definitely will” increase business in the next 12 months if sales reps’ facilitation of contract and problem resolutions exceed expectations, but just 42% agreed when expectations are only met.

In addition, top-performing lenders with high satisfaction scores are more likely to get additional business from dealers during the next 12 months than those in the middle of the pack — 61%-50% for captive finance companies and 56%-42% for non-captive providers.

The survey also showed 62% of dealers prefer an on-site visit for a sales meeting, but resolving problems is a different story, with 71% favoring phone communication — and 77% expecting reps to respond in 30 minutes or less.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

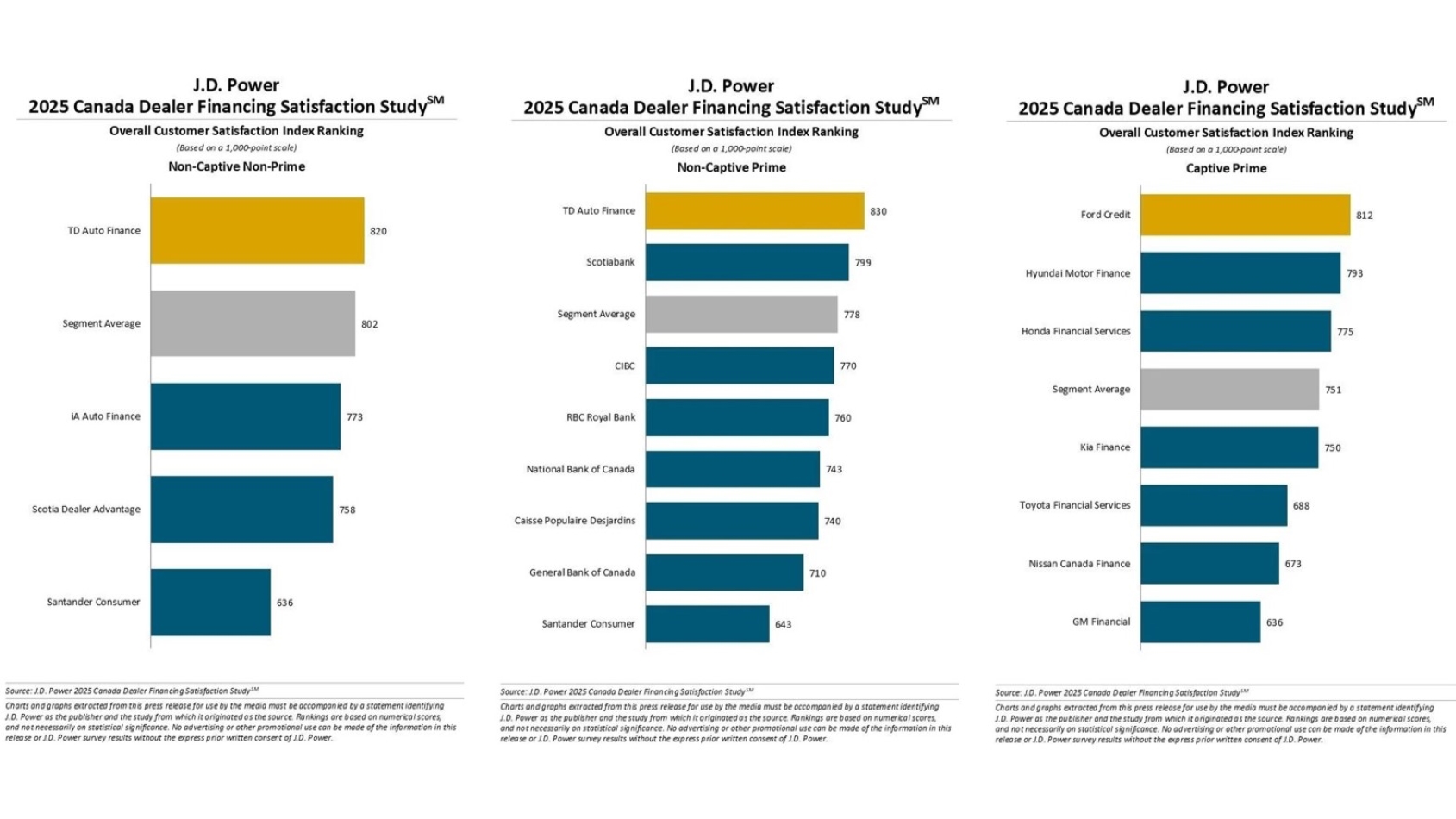

The study ranked auto finance providers’ customer satisfaction with a score on a 1,000-point scale and TD Auto Finance was a clear winner. The subsidiary of Toronto-Dominion Bank ranked No. 1 in the non-captive prime segment with a score of 830, well ahead of second-place Scotiabank (799) and the highest of any company in any sector.

TDAF also scored 820 to take the top spot on the non-captive non-prime list for the eighth consecutive year as it swept both non-captive categories for the second straight year. Ford Credit (812) led the captive prime segment.

The scores measure satisfaction using four factors: finance provider offerings, funding process, credit staff relationships and sales representative relationship. In a news release, TDAF said it ranked first in all of those areas.

“At TDAF, our clients are at the center of everything we do,” senior vice president and head of TD Auto Finance Canada Michael McGhee said. “I am exceptionally proud of this team and the results we have achieved together. Achieving our eighth consecutive J.D. Power award is remarkable, and I want to offer a wholehearted and sincere thank you to all our clients for their trust.”