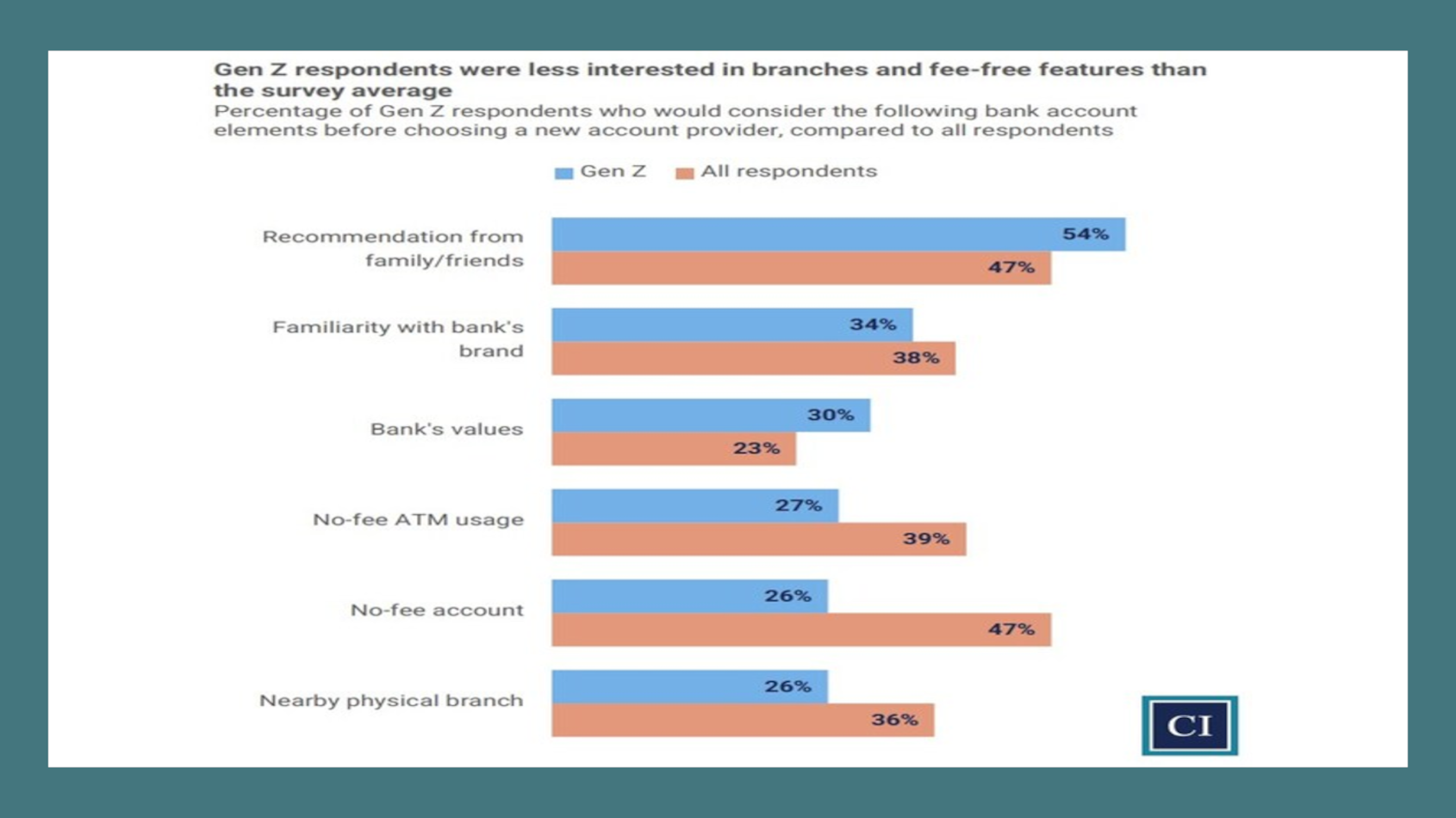

Corporate Insight research reinforces how differently boomers & Gen Z see banks

Graphic courtesy of Corporate Insight.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Corporate Insight (CI) recently released its latest Fintech Monitor report examining how and why customers choose fintechs or incumbents for their banking needs. The report also offered new insights on preferences across generations, income levels and banking relationships.

The report examined a first quarter survey of 972 bank account holders, including those with fintech accounts only, incumbent bank accounts only, and those with both types of accounts, offering valuable insights for financial institutions looking to enhance customer retention and acquisition strategies.

Key findings from the research included:

—Generational differences drive banking decisions: While older respondents prioritize no-fee accounts, physical branch access, and customer service quality, younger generations take a more holistic approach. Gen Z respondents are significantly influenced by recommendations from friends and family, as well as a bank’s values, showing a stronger emphasis on social factors.

—Younger generations are less satisfied with their banks: While 81% of boomer and Gen X respondents expressed high satisfaction with their bank’s digital interface design, only 40% of Gen Z respondents felt the same. This pattern of lower satisfaction scores from Gen Z repeats for other aspects, including customer service quality and spending tools.

—Customer loyalty remains strong at incumbents: 80% of incumbent-only respondents have not considered changing banks, with boomer respondents showing the highest loyalty (91%). When asked why they stay, 70% of incumbent-only respondents gave the most popular reason for staying: “I like my bank.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“This research reveals a clear generational divide in banking preferences, with older consumers prioritizing traditional elements like physical branches and security, while younger generations place greater emphasis on social factors and recommendations,” CI senior analyst Will Jack said. “This has profound implications for both incumbent banks and fintechs as they compete for customers in today’s rapidly evolving financial landscape.

“This report shows that financial institutions need tailored strategies for different demographic segments,” Jack continued. “While traditional banks maintain strong customer loyalty, especially among older generations, they must enhance their digital capabilities to compete with fintechs that excel in these areas.

“Conversely, fintechs should consider how they might address the branch access and customer service features that continue to resonate with many consumers,” Jack added.

CI subscribers can obtain the entire report at corporateinsight.com.