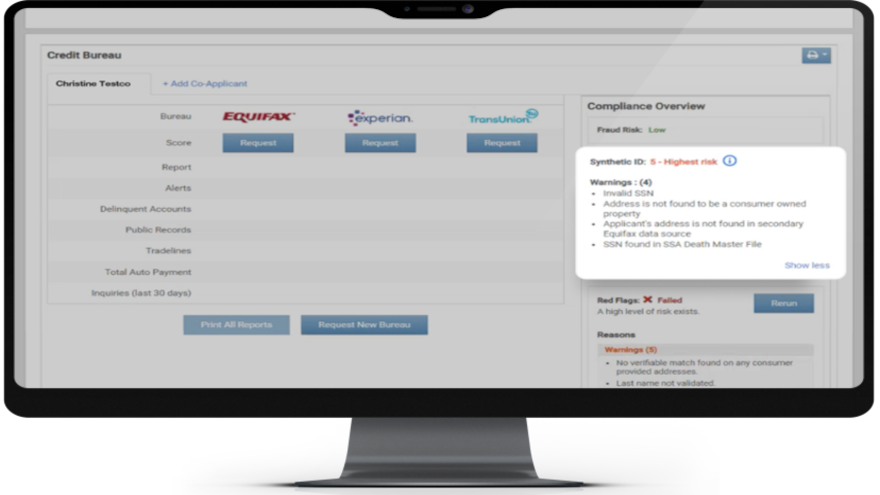

Cox Automotive enhances Dealertrack Synthetic ID fraud alert with Equifax technology

Image courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Two of the larger industry service providers — Cox Automotive and Equifax — now are working together to tackle what might be the most difficult challenge — eradicating fraud.

News about an enhancement of the Dealertrack compliance solution through the addition of a new synthetic ID fraud indicator already is being welcomed by dealerships. David Giovine is finance director at Subaru of Cherry Hill in New Jersey.

“Based on our location in the Tri-State Area, our dealership regularly does business with customers from New Jersey, Pennsylvania, Delaware, and New York, and many of our customers have dual residences in many other states as well, which can complicate ID verification,” Giovine said in a news release from Cox Automotive about the collaboration with Equifax, which is geared to help protect dealers against fraudulent transactions earlier in the F&I process.

“Since it’s not out of the ordinary for our customers to have out of state credentials, Synthetic ID Fraud Alert is an extremely valuable tool that we utilize to not only protect our dealership as well as our customers, but also to ensure our business is protected when we are working with customers across so many locations,” Giovine went on to say.

The new Synthetic ID Fraud Alert integrates with technology from Equifax, using patent-pending machine-learning algorithms, coupled with proprietary data sources, to detect synthetic identity behaviors, with the end goal being additional peace of mind for dealers.

According to Point Predictive’s 2023 Auto Fraud Trends Report, fraud grew to $8.1 billion, with a substantial increase in the use of synthetic identities. That report noted installment contracts and vehicle leases are the third most common type of fraud reported over the past five years.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experts said fraud is becoming more advanced with the use of synthetic ID. This type of fraud involves combining fake information with real data to create a credit profile.

“As automotive fraud exposure continues to grow, synthetic ID fraud is increasingly impacting the industry, so there has never been a more pressing need for advanced tools to protect dealers from associated risks,” stated Kait Gavin, vice president of operations, titling and F&I solutions at Cox Automotive.

“Cox Automotive Dealertrack recognizes the importance of giving retailers insights into identity verification (IDV) so they may circumvent increasing instances of ever more sophisticated fraud. With this new Synthetic ID Fraud Alert, dealers can rely on advanced technology to implement IDV best practices in their transactions online or instore to safeguard their business,” Gavin continued.

As dealers expand online and omnichannel workflows, Cox Automotive and Equifax said it becomes increasingly difficult to identify potential fraud risks.

They highlighted that dealers who adopt Synthetic ID Fraud Alert can alleviate that risk and help protect their businesses from the financial losses caused by these fraudulent activities.

With the new offering, dealers can receive an alert when a customer may be using synthetic ID and get a risk level assessment score when pulling credit. It’s all designed to assist dealers to:

—Better address fraud risk and establish a more secure end-to-end process for deals.

—Reinforce early validation of a consumer before progressing them through the financing process by adding an additional layer of security for fraud detection.

—Help protect their dealership from potential chargeback from finance companies, which can be up to $15,000 per incident in potential losses, according to a study by the Federal Reserve

—Gain peace of mind in an era of increasingly sophisticated fraud.

More information about Dealertrack’s compliance tools can be found via this website.

Dealers also can download the complimentary 2024 Dealertrack compliance guide via this website.